The ANO movement is currently leading in all polls ahead of the Czech parliamentary elections. However, it remains unclear who will join Andrej Babiš in government if his movement forms it, warns Oxford Economics. And according to the company's analysts, this is precisely what the development of the Czech economy will depend on over the next four years.

In its latest analysis, Oxford Economics assumes that the ANO movement will form a coalition with one of the center-right parties of the previous government. This would be the most favorable scenario for the markets, as it would slow down the ANO's planned loosening of fiscal policy.

Its program envisages a loosening of public finances by around CZK 95 billion (EUR 3.7 billion), which corresponds to 1.2 percent of GDP. Such a stimulus would boost economic growth in the short term, but mainly through current expenditure and tax relief. This is not what the Czech economy needs at present, as GDP is already set to grow at a rate in the top third of EU countries this year. Potential coalition partners should therefore curb the fiscal loosening, at least in part.

However, the analysis also considers other scenarios.

The negative scenario assumes that Babiš's movement will form a government majority with “fringe parties” (the Stačilo movement, the SPD, and possibly the Motorists). According to Oxford Economics, this would trigger a negative reaction from the markets: fears of waste, higher inflation, and a weakening of institutional quality.

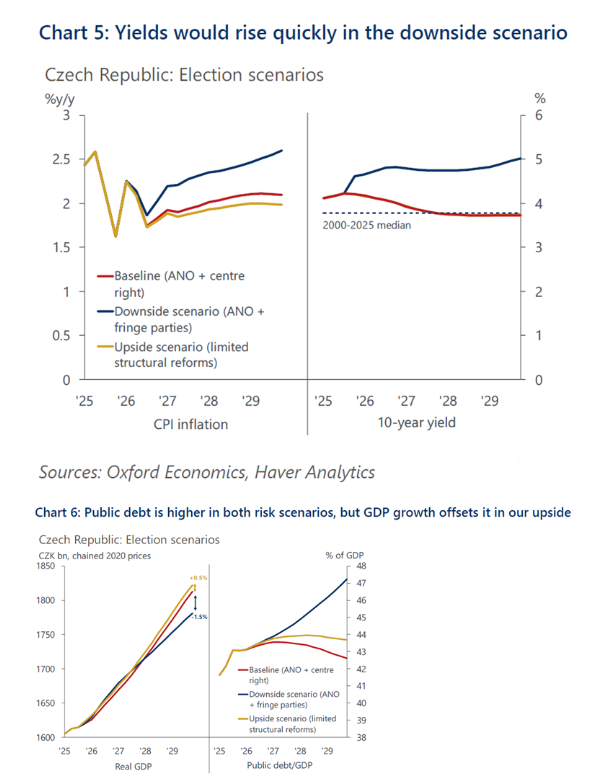

The result would be that GDP would be 1.5 percent lower by the end of the legislative period, the debt ratio would rise by three percentage points, and the yield on ten-year bonds would rise to up to 5.2 percent. The cost of servicing the debt would rise to CZK 180 billion (EUR 7.4 billion), and by 2029, debt would approach the 47 percent of GDP limit. Furthermore, this course would lead to the debt brake being exceeded as early as 2034.

A positive scenario, which analysts consider unlikely, would occur if ANO and its center-right partners were to push through partial reforms, restructure the tax system, and increase the labor supply and infrastructure investment—specifically by CZK 120 billion (EUR 4.9 billion) above the baseline level. In that case, GDP would rise by half a percent above the baseline scenario by 2029, investment would be 2 percent higher, and around 50,000 people would enter the labor market. These factors would strengthen the economy's potential and reduce the price level by 0.3 percent.

Regardless of the composition of the government, the new Czech cabinet will take over the economy in relatively good shape. Inflation has returned to the 2 percent target, wages are rising solidly, and household purchasing power has already exceeded pre-pandemic levels. Interest rates have fallen significantly since their peak in 2023, unemployment is among the lowest in the EU, and the current government's fiscal consolidation—albeit imperfect—together with pension reform has put public finances on a more sustainable path.

However, this picture may not appear entirely objective. In the short term, the Czech economy is threatened by US tariffs, weak foreign demand, and a continuing decline in investment. Private household consumption could gradually weaken as the labor market eases. In the medium term, public finances and declining growth potential remain the biggest challenges.

Oxford Economics therefore warns that the biggest risk is not so much the specific government coalition as the waste of time. The current favorable macroeconomic environment offers an opportunity for reforms of the labor market, the energy sector, the healthcare system, and the tax system. If the new government does not take advantage of this leeway, analysts say the growth potential of the Czech economy will continue to decline.

The text was originally published on the website lukaskovanda.cz.