Late last week, Hungarian Prime Minister Viktor Orbán met with US President Donald Trump in Washington. According to participants and observers, the meeting was quite friendly. It is no secret that the two leaders have long held some affection for each other.

Although they discussed a number of issues at the meeting, one topic stood out above all others. Orbán clearly lobbied the White House for an exemption for Hungary from US sanctions on two Russian oil companies - Lukoil and Rosneft.

The Trump administration banned US companies from doing business with them in late October. And since it cannot order foreign entities to do so, the mechanism mentions that the US may extend its sanctions to those companies in third countries that continue to do business with Lukoil and Rosneft. Or to those that mediate the exchange of payments for oil supplies, in particular, banks.

This means that, even if individual oil refiners were not afraid of the sanctions restrictions and continued to trade, European money houses, in particular, are unlikely to be willing to continue to transfer money to the accounts of Russian suppliers. Indeed, if they were targeted by US sanctions and cut off from their financial system and the dollar, it would be devastating for them.

Orbán succeeded. And Slovakia with him

The Hungarian refiner MOL, however, does not have to worry about sanctions anymore. In fact, Prime Minister Orbán managed to convince Trump that his landlocked country is not having an easy time with its oil supplies and that there are no viable alternatives at the moment.

This was evidenced by Donald Trump's statement shortly after the meeting, when he said that it was 'very difficult for Orbán to get oil and gas from other areas' other than Russia.

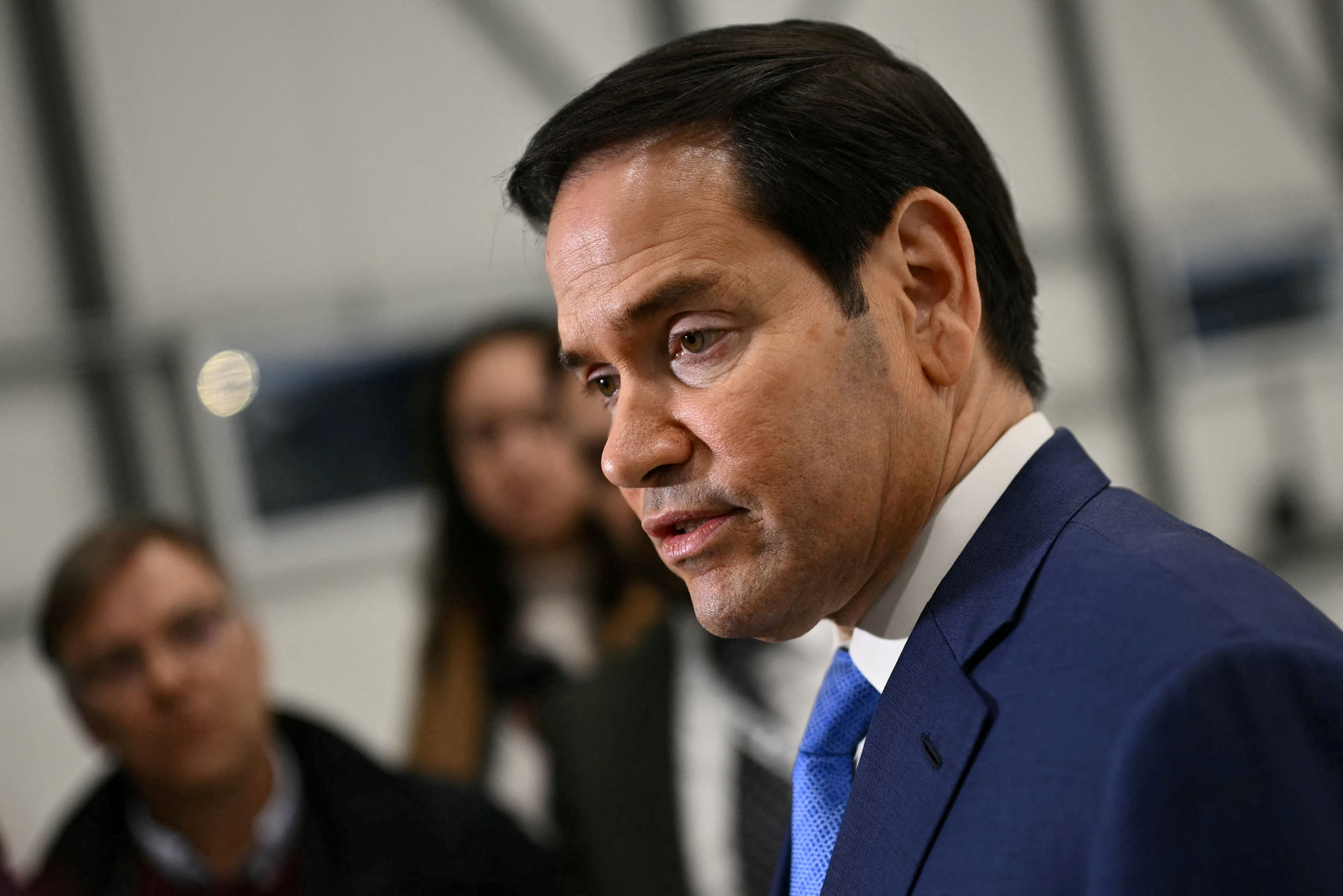

The Hungarian Prime Minister subsequently told a press conference that he had managed to negotiate a full and indefinite exemption from sanctions for oil supplies from the two Russian companies. However, a White House official later told the media that Donald Trump had exempted Hungary from the sanctions for one year. This information was later confirmed by US diplomatic chief Marco Rubio.

Although Slovakia is not directly mentioned in the exception, the fact is that Slovnaft refinery does not take any supplies from Rosneft and although oil from Lukoil also goes to Slovakia, Slovnaft does not trade with the other Russian company.

Lukoil's oil is owned at the Belarusian-Ukrainian border by the MOL group, which then transports the oil through Ukraine under its own name before distributing it to its subsidiary in Slovakia in return for payment. So if Viktor Orbán succeeds in his negotiations with Donald Trump and negotiates an exemption from US sanctions, the crisis should automatically be averted for Slovnaft as well. At least for the one year communicated by the Americans.

Let us add that, according to the information available from last year, the annual volume of oil supplied by Lukoil totals approximately four to five million tonnes, of which roughly two million go to Slovakia. Given that Slovnaft processes around 4.5 million tonnes of black gold annually, this is roughly 40 per cent of its needs, which is extremely difficult to replace from month to month.

MOL and Slovnaft will now have at least a year to find alternative routes and suppliers, otherwise they will have to apply for an extension of the exemption or look for ways to elegantly circumvent the mechanism. For example, increase purchases from the other Russian company that supplies oil to the region and is not on the US sanctions list - Tatneft.

Or, before purchasing, to launder the oil through another Russian intermediary. MOL could, for example, try to increase supplies from Tatneft, which would not need to produce more, but would only need to buy oil from Lukoil before the Hungarian concern takes it over.

2027 will be the final year

However, whatever form the mechanism for circumventing sanctions takes, unless the political status quo in Europe changes significantly, from the beginning of 2028 both Hungary and Slovakia will most likely have to switch to oil supplies from alternative non-Russian suppliers.

The EU wants to completely ban the import of Russian energy carriers as part of the REPowerEU programme, which will not only affect Lukoil but also the remaining potential Russian suppliers. The plan has not yet been approved by the member states, but a qualified majority would be sufficient to unblock it. It is expected to pass comfortably later this year.

For Slovakia and Hungary, this poses a problem. Although on paper there is a clear alternative in the form of the Adria pipeline, which starts in the Croatian port town of Omisajl and has sufficient capacity to replace the eastern route from Russia (via Druzhba), in practice it is somewhat worse.

Both Slovnaft and MOL have long pointed out that the pipeline is currently unable to operate in the long term under the high pressure that would be needed to use it to its full potential - to deliver around 14 million tonnes of oil per year to Hungary.

Most recently, tests were carried out in September, after which Slovnaft reported that the pipeline was unable to operate at sufficient capacity for more than two hours. The Croatian partner also cited power outages and the report on the testing process seemed rather bizarre.

It should be added that the Croatian operator, Janaf, is charging unusually high transport fees, which, according to earlier industry accounts, are up to five times higher than current ones.