Building a global image also through industrial products is part of China's national strategy. The invasion of Chinese electric vehicles is therefore taking place in virtual space rather faster than in reality.

In the first nine months of 2025, Chinese EVs had a market share of roughly 12 percent of the Western European EV market. The share of Chinese brands (including combustion versions) in sales of all cars reached five percent, almost double In Europe, they have overtaken Ford and caught up with Mercedes. V October their share was up to 7.4 per cent, putting the Chinese brand group ahead of Korea's Kia.

The Chinese carmakers can't be denied a number of trump cards: vertical integration, factories designed from the outset to produce EVs, and in a large scale, a raw material base and advanced technologies, especially for batteries.

Advantages and pitfalls

Industrial policy in China is centrally planned, which brings with it certain pitfalls. Beneath the veneer of success lies a rather primitive tactic of pitchforking capital. We have seen it many times before with China. The construction industry and the steel industry have been flooded with capital at the behest of the party and have produced an incredible boom. Today, however, they are suffering from great overcapacity, and a lot of capital has been sunk without yielding adequate returns.

Will we see a similar story with Chinese electric cars? The scenario so far is similar. Piles of capital with the aim of producing, not earning. Today, there are 129 brands of EVs and plug-in hybrids in China. But after several years of meteoric growth, things are quietly starting to creak.

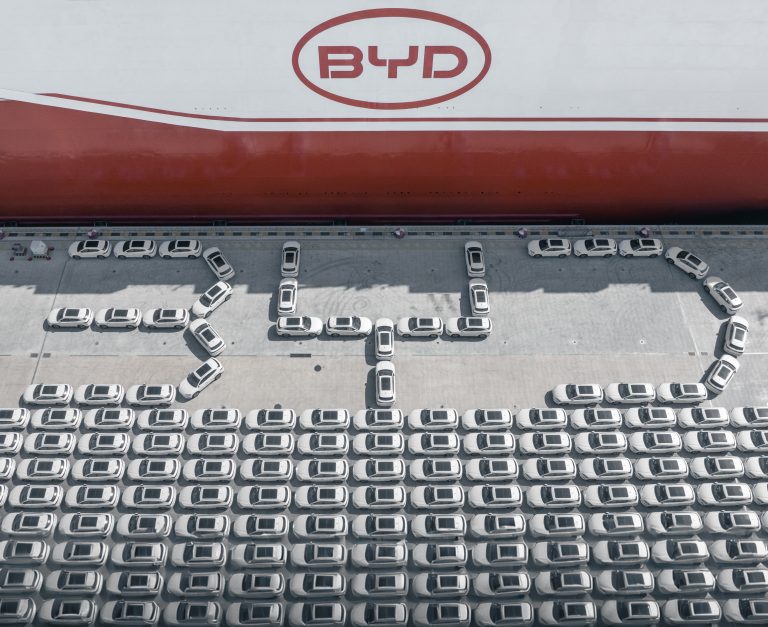

BYD is losing its lead

While BYD's flagship brand posted solid sales of $100 billion in the first nine months of this year, it also registered negative free cash flow of more than $10 billion. This means that despite strong sales, the company is in need of significant external financing.

In the third quarter of this year, the carmaker's profits fell by a third and even quarterly sales fell for the first time in five years, albeit by just three per cent. In October, deliveries of its cars fell by twelve per cent, and in September the brand already lost the title of best-selling electric car in China when it was overtaken by SAIC.

Extremely fierce domestic competition is constantly pushing down prices and margins, which can hardly be replaced by exports. Especially when nervous competitors are ring-fencing their lucrative domestic markets with tariffs. The most lucrative market in the US is virtually closed because of 100 per cent tariffs.

Chinese manufacturers are therefore increasingly pinning their hopes on projects abroad at the expense of domestic investment. These amounted to around $90 billion in 2022, $41 billion a year later and just $15 billion in 2024.

At the same time, there is a paradoxical situation - China is afraid of technology leakage to competitors in its foreign investments. That is why for two years now delayed the planned construction of a BYD factory in Mexico. It will also be delayed The launch of full operation in Hungary.

It is clear that the Chinese electric vehicle sector will have to undergo a major consolidation, at the end of which a fraction of today's number of brands will remain. A number of these will certainly be top global players.

It will depend on the Communist Party to what extent it will allow the cleansing and to what extent it will feed the sector with resources to maintain overcapacity. However, the first phase of China's seemingly unstoppable growth appears to be near an end. Economic realities will also force Chinese manufacturers to think about their next steps. Indeed, expansion into global markets will be expensive.