Just because they are not implemented does not mean they are not realistic. Losses reduce equity, credit rating and the willingness of banks to lend. In the event of a sudden need for liquidity and the need to sell even assets with these unrealised losses, they become realised losses. They can then lead to survival problems, as Silicon Valley bank illustrated in 2023.

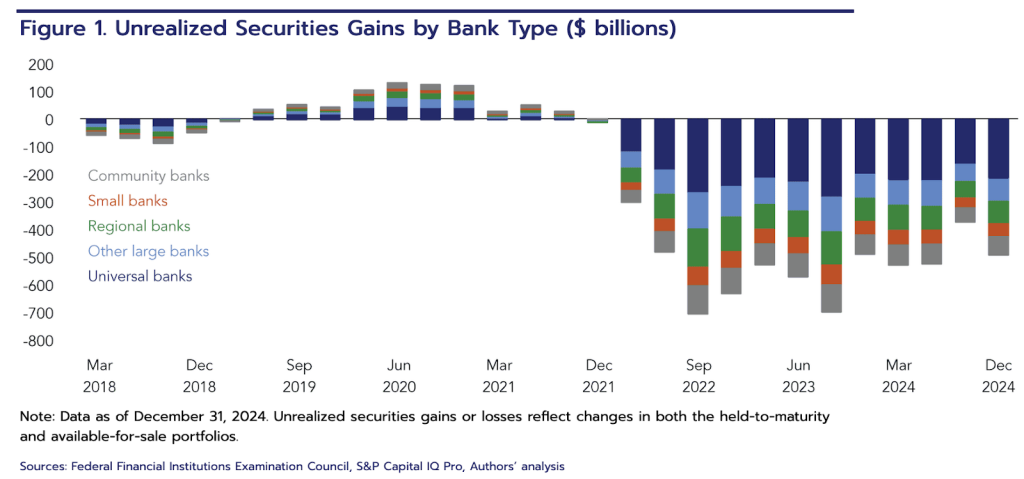

By the end of 2024 unrealized losses in U.S. banks on securitized debt alone (ignoring losses on conventional loans), that is, state and federal bonds, mortgage-backed securities, of nearly $481 billion, more than 8.6 percent of their cost. That's a full fifth of the aggregate equity of U.S. banks.

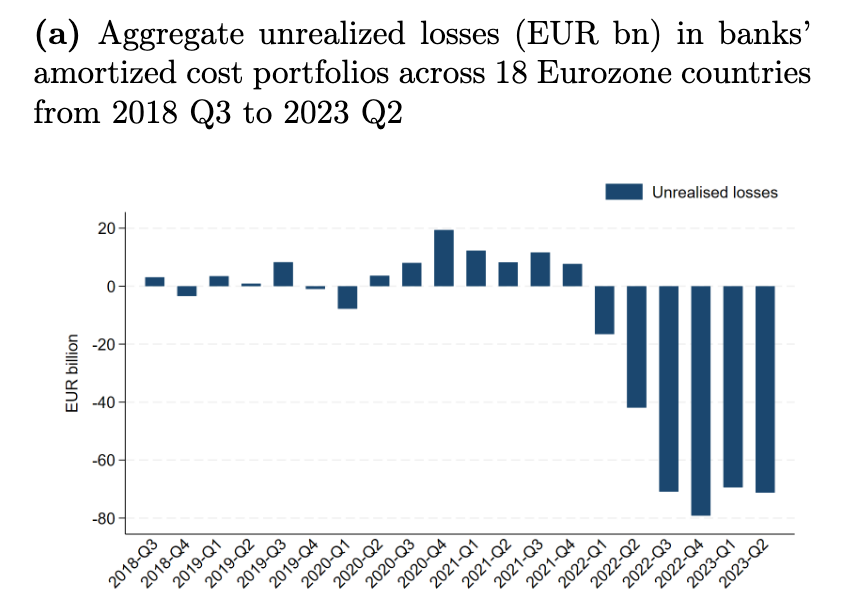

In the euro area, unrealized losses on the balance sheets of financial institutions are less. Financial institutions here hold a smaller portion of bond portfolios at purchase price rather than market value (the so-called Held to Maturity portfolio) and have been more active in shedding the risk of rising interest rates than U.S. ones.

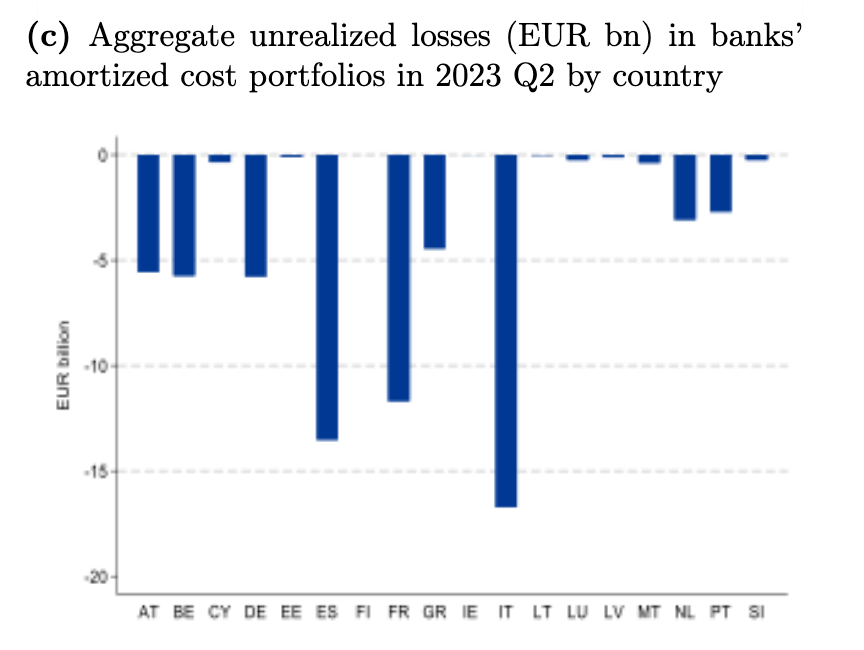

Aggregate unrealised losses for 18 euro area countries amounted to around €70 billion in mid-2023, with most of them on the balance sheets of Italian banks. This is followed by Spain and then France.