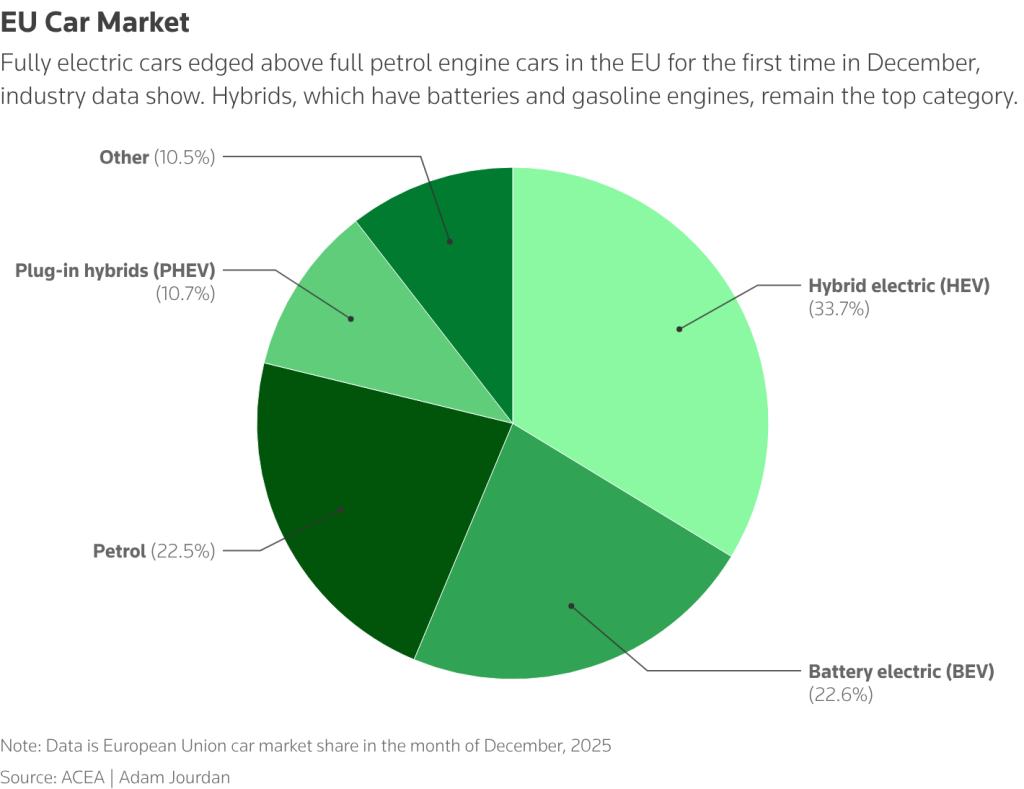

Registrations of purely electric cars reached a share of 22.6 percent in the European Union in December, narrowly surpassing gasoline vehicles with a share of 22.5 percent. This is according to data from the European Automobile Manufacturers' Association (ACEA), which uses registrations as an indicator of sales.

However, hybrids continue to hold the largest share of the market. Gasoline-electric hybrid vehicles, including plug-in hybrids, accounted for up to 44 percent of all new registrations in the EU.

According to analyst Matthias Schmidt, the decline in sales of pure gasoline cars is partly due to their reclassification as so-called mild hybrids. Although these still use a combustion engine, they formally fall into the hybrid category and only reduce emissions to a limited extent.

"It will take about five more years before purely electric cars actually overtake combustion engine vehicles across the region. Nevertheless, this is an important start," said Schmidt.

Pressure from Chinese brands

In the broader European market, which also includes the UK and Norway, car sales grew year-on-year for the sixth consecutive month in December last year. The battle for customers is intensifying with Chinese brands such as BYD, Changan, and Geely increasing pressure on traditional manufacturers, including Volkswagen and BMW.

In December, the European Union also presented a plan to back down from a de facto ban on the sale of cars with combustion engines after 2035. This was in response to pressure from car manufacturers facing strong Chinese competition, US tariffs, and problems with the profitability of electric car production.

Despite political concessions, experts expect the share of electric cars to continue to grow. Chris Heron, secretary general of E-Mobility Europe, points out that European brands are already coming up with more affordable electric models and several countries are introducing new incentives.

"We see that consumers are embracing these changes. We are confident that sales in Europe will continue to grow in 2026," Heron said.

Car sales are growing, Tesla is losing ground

Total sales of new cars in the EU, the UK, and European Free Trade Association countries rose 7.6 percent year-on-year in December to 1.2 million vehicles. For the whole of 2025, they increased by 2.4 percent to 13.3 million cars, the highest in five years, although still below pre-pandemic levels.

In the EU alone, sales rose by 5.8 percent in December to almost one million vehicles. Registrations of battery electric vehicles rose by as much as 51 percent year-on-year, plug-in hybrids by 36.7 percent, and hybrids by 5.8 percent. Together, they accounted for up to 67 percent of all new registrations.

Among manufacturers, the Volkswagen and Stellantis groups performed particularly well in December, with registrations up 10.2 percent and 4.5 percent, respectively. In contrast, Tesla saw a decline of more than 20 percent, while China's BYD increased registrations by nearly 230 percent.

(reuters, mja)