The iPhone maker predicted strong sales growth last week, driven by demand for the iPhone 17 models. CEO Tim Cook told investors he expects memory chip prices to rise sharply, but declined to answer analysts' questions about whether Apple would raise prices in response.

"There are various levers we can pull, and who knows how successful they will be, but there are only a few options," Cook said after the earnings release.

He did not comment on whether the global chip shortage offers Apple an opportunity to increase its market share with iPhones and Macs by maintaining prices at the expense of competitors who may have greater supply constraints.

Analysts predict that despite the shortage, Apple has well-established relationships with long-standing suppliers such as Samsung Electronics, SK Hynix, and Micron to secure enough memory chips to manufacture iPhones, unlike smaller phone manufacturers.

The rapid build-out of artificial intelligence infrastructure by tech companies such as Meta, Google, and Microsoft has absorbed a large portion of the memory chip supply, driving up prices as manufacturers prioritize higher-margin data center components over consumer devices. Memory chips, or DRAM (dynamic random-access memory), are crucial for smartphones because they enable energy-intensive applications to run smoothly.

Market decline expected

Apple's decision is likely to have far-reaching consequences.

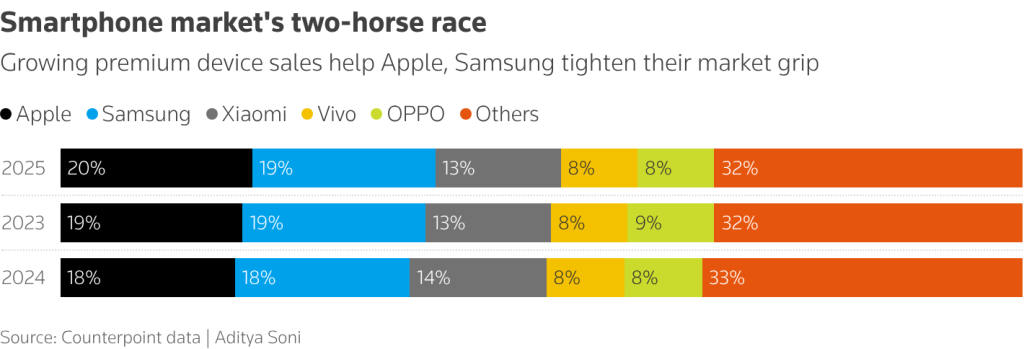

According to some estimates, the company led the global smartphone market last year with nearly 10 percent growth in shipments.

If Apple maintains its prices while smaller competitors raise theirs, as analysts expect, iPhones will look more attractive. If Apple raises prices, it will give competitors room to follow suit.

"This is now the biggest question for the industry," said Nabila Popal, head of research at IDC, one of the most cited IT analytics firms in the world. "It's a double-edged sword because if Apple doesn't raise prices, it will help increase market share, but it will also worry investors."

According to IDC data, the shortage of memory chips faced by market competitors is expected to lead to the first year-on-year decline in the global smartphone market since 2023.

What global manufacturers are counting on

Qualcomm, the world's largest smartphone chipmaker and a major supplier to high-end Android phones, fueled those concerns on Wednesday with a forecast that fell short of Wall Street estimates due to a shortage of memory chips among its mobile phone-making customers.

Chief Financial Officer Akash Palkhiwala said key customers in China do not have enough memory chips to manufacture phones, despite strong demand from clients.

"We have seen several manufacturers that supply components or finished products to other brands, particularly in China, take steps to reduce their mobile phone production plans and inventory in distribution channels," Palkhiwala said.

During Qualcomm's conference call, analysts again pointed to Apple. "They appear to continue to capture a disproportionate share of available DRAM (dynamic random access memory)," said Ben Reitzes of Melius Research.

One experienced smartphone industry executive, who requested anonymity because he was discussing sensitive supply issues, commented that Android phone makers are watching carefully to see if Apple raises prices. Some investors in the company believe that will happen.

Samsung's actions could also influence the situation. Analysts believe that the South Korean company's phone division may be able to absorb memory price increases because it sources memory chips from another Samsung unit.

"We are watching Apple and Samsung," said eMarketer analyst Gadjo Sevilla. "If they raise prices, they will raise the ceiling, and other manufacturers will likely have to adjust their prices as well."

(Stephen Nellis, Aditya Soni, Reuters)