Markets became uncertain during the week, particularly due to comments by the Fed governor that the US stock market was highly valued. Fortunately, however, Friday's inflation figures were in line with expectations.

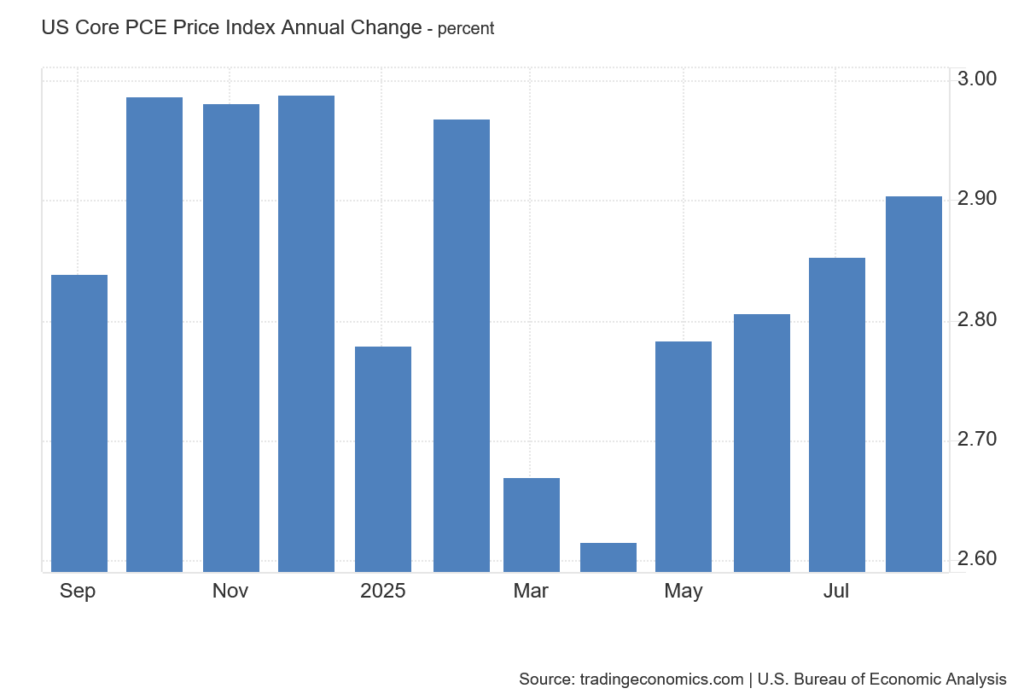

PCE inflation rose 0.3 percent in August compared to the previous month. Year-on-year, it reached 2.7 percent, slightly more than in the previous month. Core PCE inflation remained stable at 2.9 percent.

As usual, the markets interpreted these figures rather optimistically. It's similar to a glass half full of water: optimists see the glass as half full, which in this case means that inflation is rising in line with expectations and does not deviate from experts' estimates. Pessimists, on the other hand, see the glass as half empty, i.e., prices in the US continue to rise and the inflation target remains a distant prospect.

Current interest rates are not restrictive enough to bring core inflation back down to two percent. Trump's tariffs are undoubtedly behind this.

The good news is that retailers are not raising prices sharply. In many cases, they have stocked up on goods that were not yet subject to tariffs and are raising prices gradually in line with competition in the respective sector.

The question remains whether the price increases will end in the foreseeable future or drag on for a year or more. In that case, a further reduction in interest rates would be significantly jeopardized. Even though the markets celebrated the release of the inflation figures with a rise, we must not be deceived. Inflation in the US remains high.

New tariffs on the horizon

US President Trump is also keeping the markets in uncertainty, as he announced the introduction of further tariffs last week. Even the possibility that the US Supreme Court could overturn these tariffs in the near future is no obstacle for him.

Trump stated: “Starting October 1, 2025, we will impose a 50 percent tariff on all kitchen and bathroom cabinets and related products. In addition, we will impose a 30 percent tariff on upholstered furniture. The reason for this is the massive ‘flooding’ of the United States with these products.”

The purpose of these measures is difficult to assess, as it is well known that these products have been mass-produced in China for decades. There are virtually no American manufacturers of furnishings.

Building new factories and recruiting qualified employees is a lengthy process. These measures will only further drive up the already high real estate prices in the US. Developers have no choice but to purchase such furniture abroad, which also means paying tariffs.

Trump added to this measure by introducing a 100% tax on pharmaceutical products for companies that do not have production facilities in the US. In doing so, he is making it clear that he does not intend to back down from his idea of tariffs. He undoubtedly has many ideas. The question remains whether his American voters and supporters will also turn away from him if inflation does not subside.

Will the price of copper continue to rise?

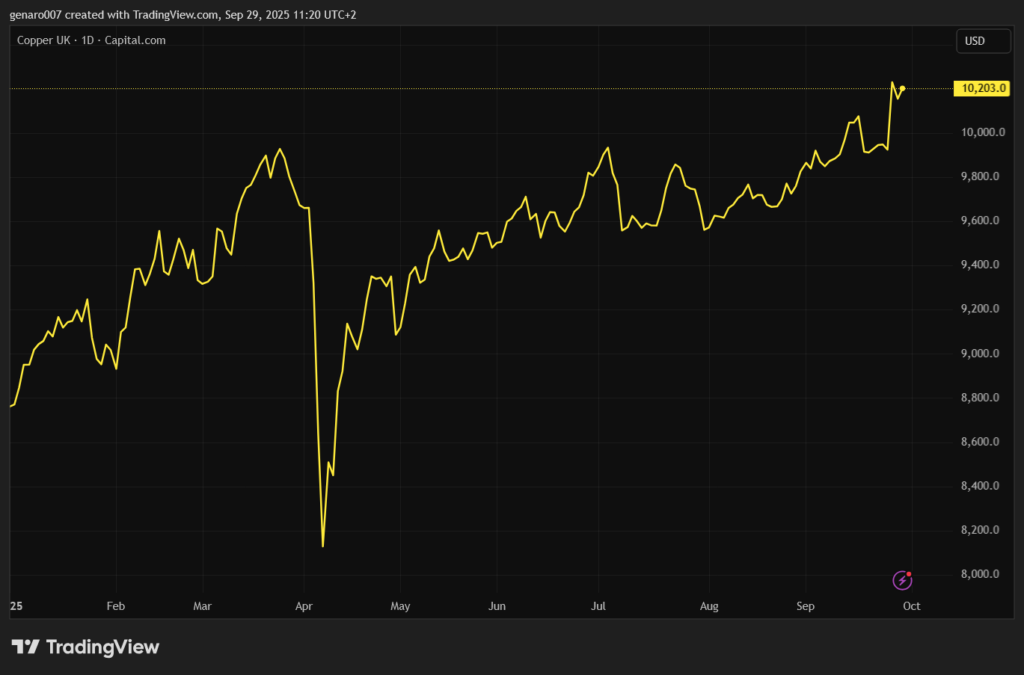

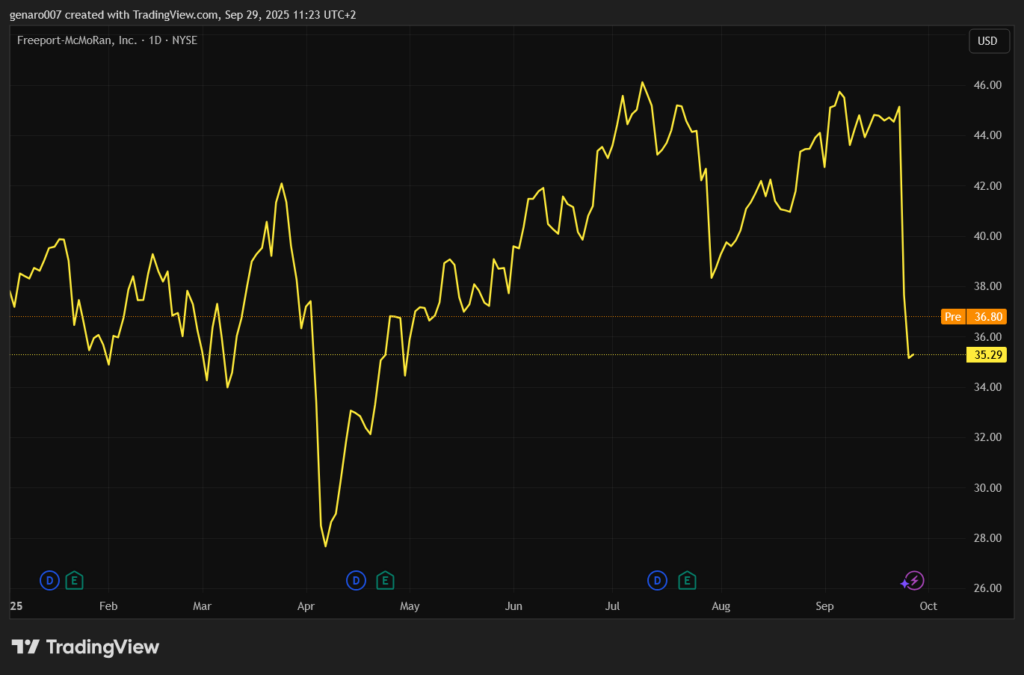

As if that weren't enough, there was another strong inflationary impulse. Flooding hit the world's second-largest copper mine, Grasberg in Indonesia. According to mining company Freeport-McMoRan, which operates the mine, more than 800,000 tons of mud entered the mine. This must first be removed before mining can continue.

A partial resumption of mining is expected in the fourth quarter of 2025, but the mine is not expected to return to full capacity until the middle of next year.

The price of copper rose in response to this news, as this production loss will lead to increased demand from Freeport-McMoRan's customers, who will not receive their copper on time. In contrast, Freeport-McMoRan's share price fell, while the shares of its competitors rose.

Copper is a strategic raw material that remains somewhat outside the main focus of investors. It is estimated that current copper reserves will last for around 40 years, which is significantly less than oil reserves, for example.

In addition, demand for this metal will rise sharply in the coming years, as it is needed in virtually all industries, especially in electromobility and renewable energy sources. In contrast, no such increase in demand is expected for oil in the coming decades.

Investing in copper can therefore be very sensible in the long term. However, there is a risk of a global economic recession. In the event of an economic slowdown, the price of copper would likely fall. For central banks, a rise in the price of copper due to a decline in supply is not good news, as this type of inflation would be very difficult to curb.

Will US labor market data unsettle Wall Street?

This week will be very turbulent on the markets as important data from the US labor market is expected. On Tuesday, the JOLTS figures will be published, i.e., the total number of job vacancies in the US. On Friday, the non-farm payrolls will be announced, i.e., the number of new jobs created in September.

The markets will be watching closely to see if, as usual, there will be a revision of the data from previous months. The situation on the labor market was the main reason why the Fed decided to cut interest rates.

If the US labor market continues to weaken, more and more investors may have to face the unpleasant truth. US GDP grew by 3.8 percent in the last quarter, which, according to economics textbooks, should lead to massive job creation.

However, the data suggests the opposite. One possible explanation for this is that artificial intelligence is beginning to disrupt the American labor market. If this hypothesis is correct, the question arises as to what the US Federal Reserve can do in such a case. Its options are very limited.