This is a situation in which the federal government temporarily restricts or suspends its activities because Congress has not passed any funding bills.

This is not an entirely unusual phenomenon—there have been more than seven shutdowns in the US since 1987, most recently in 2018 and 2019. Donald Trump therefore already has experience of how to deal with such a situation.

A shutdown is not a hopeless situation, but rather a political game in which everyone knows that they will ultimately have to reach an agreement. Among the government employees who are forced to take unpaid leave are voters from both political camps, which is why an agreement will be reached sooner or later.

The blockage of public finances is based on the same principle: Democrats are pushing for higher healthcare spending, while Republicans want lower taxes. Ultimately, however, they always reach an agreement, and this is precisely the scenario that the financial markets are currently anticipating. Market reactions to the shutdown have been minimal, apart from analyses and headlines in the leading American business media.

The whole affair is a reminder of the uncomfortable truth that the US economy is not in good shape. This is nothing new for the markets, as they operate in a mode where bad economic news paradoxically promotes growth because it forces the US Federal Reserve to lower interest rates. So if the shutdown worsens the economic situation, it is unlikely to bother the markets.

During the last shutdown, for example, the US S&P 500 index rose by more than 10 percent, mainly due to Apple shares. Now, a similar scenario could repeat itself, for example with Nvidia shares, if an agreement were reached on the delivery of its chips to China.

How will the markets function without economic statistics?

However, there is one problem: among the government employees who have not been going to work since Wednesday evening are the staff of the US Bureau of Labor Statistics. Given that both central banks and investors have been primarily guided by data over the past year and a half, the lack of current statistics could be problematic.

On Friday, October 3, most investors expect the release of important data on the American labor market, known as the non-farm payrolls. However, this data will most likely not be available. The absence of a single piece of information may not be serious, but if the shutdown drags on, it could lead to more serious problems.

The US Federal Reserve will also not have all the necessary statistics, which is unfortunate given that the US labor market is currently in a difficult situation.

This week, the ADP report was published, which tracks changes in the US private sector. Fortunately, this report is published by a private company, so it is not affected by the shutdown.

The data comes from internal company sources, but the results were not positive: in September 2025, there was a decline of 32,000 jobs in the private sector, while experts had expected an increase of at least 50,000 new jobs. These figures suggest that something serious is happening in the American labor market.

It is often said that artificial intelligence is primarily responsible for the rise in unemployment. Statistics show that young people entering the labor market are having great difficulty finding jobs.

Artificial intelligence puts pressure on junior positions in particular, which is understandable as companies use AI to automate these functions. However, this strategy can be detrimental in the long term, as today's juniors are tomorrow's seniors. If companies stop hiring junior employees due to the use of artificial intelligence, there could be a shortage of qualified senior employees in the future.

However, the market is not yet experiencing any issues with this – quite the contrary. The deterioration in the labor market means that the Fed is likely to continue cutting interest rates, making money cheaper. Cheaper money primarily benefits riskier investments, especially Bitcoin, which reacted very positively and approached the $118,000 mark.

This level represents an important resistance level, which, if broken by the end of this year, could trigger an expected wave of growth.

Agreement between Pfizer and the White House

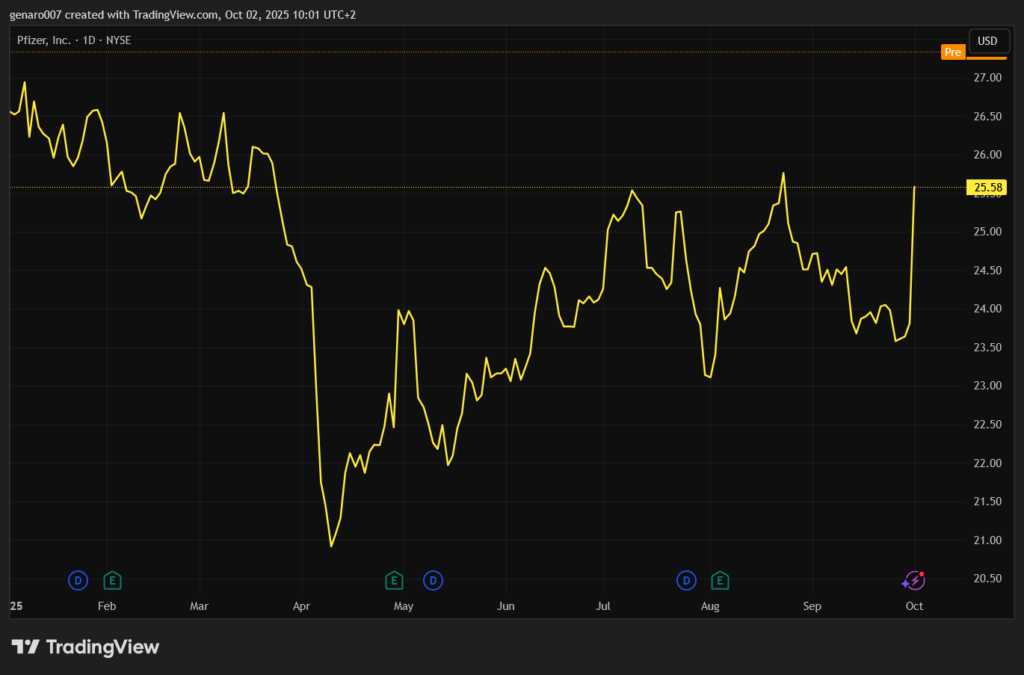

The appointment of Robert F. Kennedy Jr. as Secretary of Health led to a decline in the stock market prices of large pharmaceutical companies. The Trump administration, whose campaign was partly based on fighting these pharmaceutical giants, had tense relations with them. This made the announcement of an agreement between Pfizer and the White House all the more surprising.

Pfizer has committed to aligning the prices of drugs available under the Medicaid program in the US market and other developed countries. Part of the agreement is also the creation of the TrumpRx platform, which will offer American citizens drugs at significant discounts. This platform is intended to bypass the distribution channels that artificially inflate prices. Pfizer's management also promised to invest $70 billion in American drug research and production.

In exchange for these concessions, Pfizer received a three-year exemption from the proposed tariffs on drug imports. Pfizer shares responded to this news with a significant rise. Pfizer was not the only beneficiary of the agreement—shares in other pharmaceutical companies, including European companies such as Sanofi and Roche, also rose. This agreement shows that cooperation between the White House and pharmaceutical companies is possible. With this agreement, Donald Trump is consolidating his position with his voters.

Gold, Bitcoin, and US bonds

As no new macroeconomic data is likely to be released due to the shutdown, investors will mainly be keeping an eye on financial assets that reflect market sentiment.

The performance of Bitcoin in October will be decisive. After an unspectacular September, the cryptocurrency community is expecting an “Uptober 2025.” If these forecasts come true and the price of Bitcoin exceeds the $118,000 mark, the optimism could also spread to the stock markets.

Contrasting with this wave of optimism is the performance of the gold price, which reached the $3,900 mark during the week. The rising gold price signals that investors are willing to pay for protection against market turbulence.

Yields on US government bonds reveal the depth of the government crisis associated with the shutdown. If yields begin to rise, this could indicate that the shutdown poses risks that no one has yet fully recognized. Conversely, stable yields would show that this is primarily a political issue with no significant economic impact.