In the US, the shutdown, i.e., the closure of most government agencies, is now in its ninth day. This situation will soon affect 1.3 million US Army employees, who are at risk of not being paid as long as Republicans and Democrats fail to reach an agreement. An army without salaries is certainly not a good situation for the United States.

So far, however, the markets are stubbornly ignoring this risk and continuing to grow. The reason for this, as always, is anticipation: everyone knows that the markets will grow when the shutdown ends. By buying stocks, they are already anticipating this growth. No one knows when this will happen. The only consequence of this general attitude is that the markets have no time to fall due to the shutdown. Some analysts are already noting that they often lack rationality.

Tsunami in Japan

In August last year, Japan shocked the stock market world with the so-called carry trade. Investors who had borrowed money cheaply in yen and bet on higher-yielding assets abroad were forced to close their positions massively within a few days. The climax came on August 5, when Tokyo's TOPIX slumped 12 percent and volatility exploded on all continents.

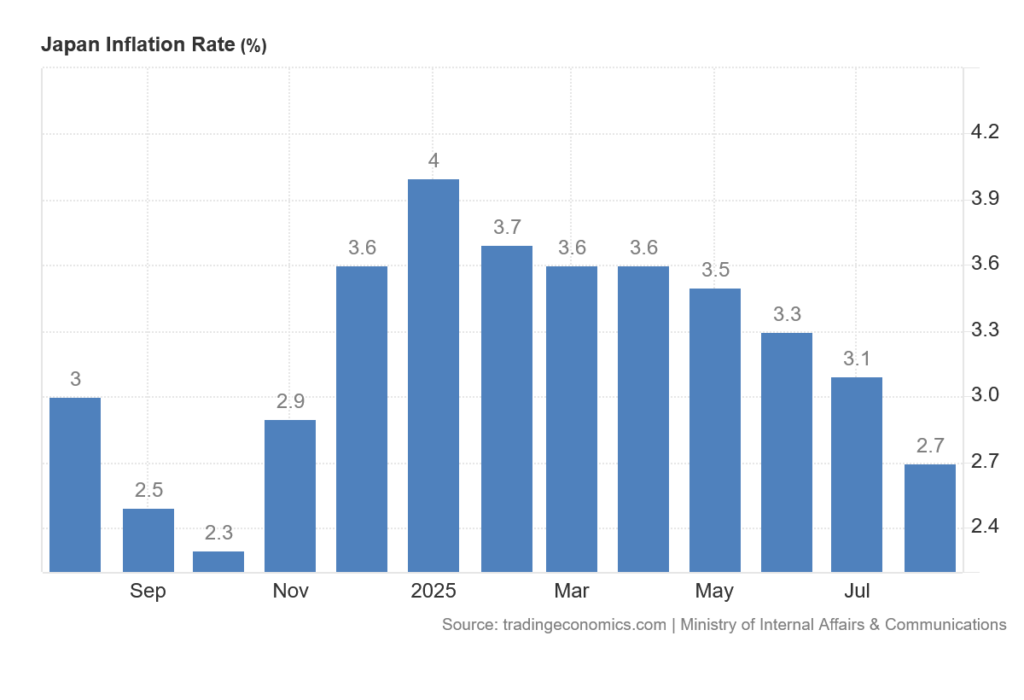

The world—and with it Japan—was reminded that Japanese monetary policy stands on the shaky legs of zero interest rates. The Bank of Japan decided to change course, at least rhetorically, and prepared for further interest rate hikes. The Land of the Rising Sun is suffering from uncharacteristic inflation, which will be between 2.7 and 4 percent in 2025. At first glance, this may not seem like high inflation, but given the highly inflationary demographic context, such growth is actually significant.

Japan is a very interesting country precisely because of its aging population and high level of debt. In a sense, it is an economic testing ground for problems that the Western world will face in ten or more years.

The economic crisis also triggered a political crisis. This brought Sanae Takaičiová into office as the first female prime minister in Japanese history. The Japanese prime minister is set to be officially inaugurated on October 15. However, she has already caused a literal tidal wave on the Japanese markets.

Her name caused the Japanese Nikkei index to rise by four percent in a single day and then fall only slightly. The only one who was not happy about her name was the Japanese bond market: yields on long-term Japanese bonds reached record levels. Why?

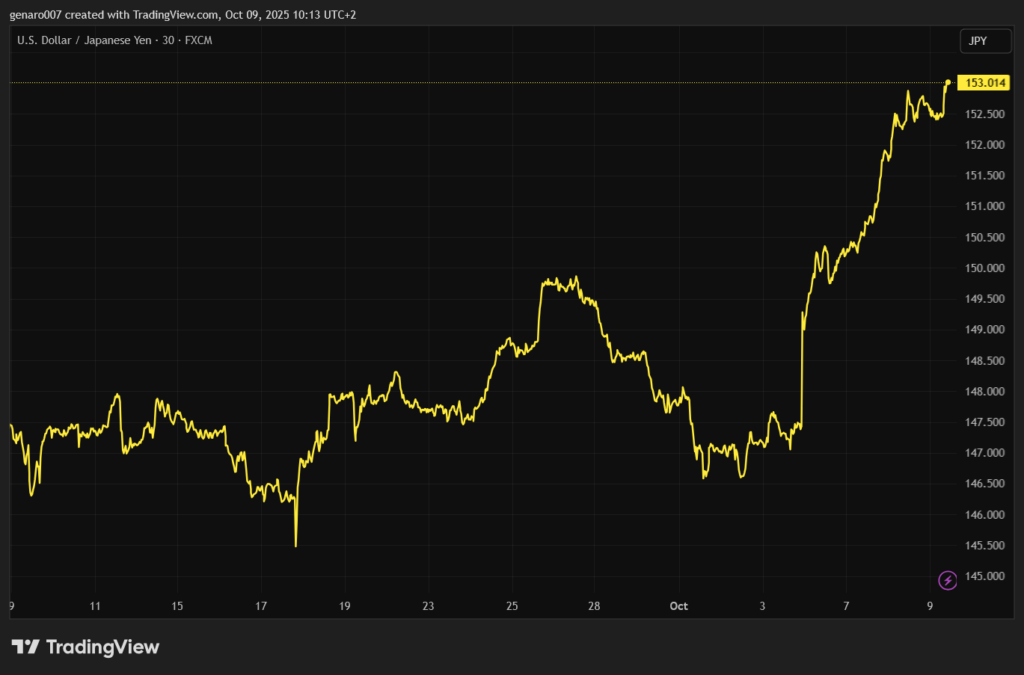

The Japanese prime minister is fundamentally changing Japan's monetary policy. She wants to return to zero interest rates and massive government investment to support the economy. Translated for non-economists: Japan wants to stimulate growth again with large investments. Austerity measures will only come once the economy has picked up again.

Another goal of this strategy is to keep the Japanese yen at a low level. This plan would sound good if Japan had a debt level similar to that of Germany. However, this is not the case—Japan's debt is enormous. The higher debt has frightened Japanese creditors, who automatically demanded higher interest rates.

It will be very interesting to see what Donald Trump has to say about the new prime minister. A weak Japanese yen can irritate him like a red rag. If Sanae Takaičiová continues this aggressive policy, which weakens the yen, Trump could reconsider his tariff agreement with Japan and impose further tariffs on the grounds that Japan is subsidizing its exports with the weak yen.

The situation in Japan will be very interesting, and investors should not overlook it. If Japanese yields continue to rise, we could see renewed high volatility that would spread across the globe.

Slow descent into debt hell

While the Japanese prime minister at least has a plan for how to resolve the situation, this is not the case in France. The new government under Prime Minister Lecornu lasted only 14 hours. Even the fact that Lecornu had spent a record amount of time putting it together did not change this.

The name of the new prime minister is to be announced within two days. Rumor has it that this time someone from the left wing could get a chance. However, this could mean an even greater economic disaster, as the left has so far insisted on only joining the government if the pension reform is withdrawn. A repeal would mean an increase in the government deficit of another three billion euros.

France has no approved budget for 2026. With no time left for a revised plan to reduce debt, this budget is expected to be the same as the previous one – i.e., without any significant systemic solutions or savings. France will thus continue to increase its debt.

Even the recent downgrade of French government debt by the rating agency Fitch was not enough for French politicians. The lack of a solution to the national debt could lead to a very poor future rating of French government debt.

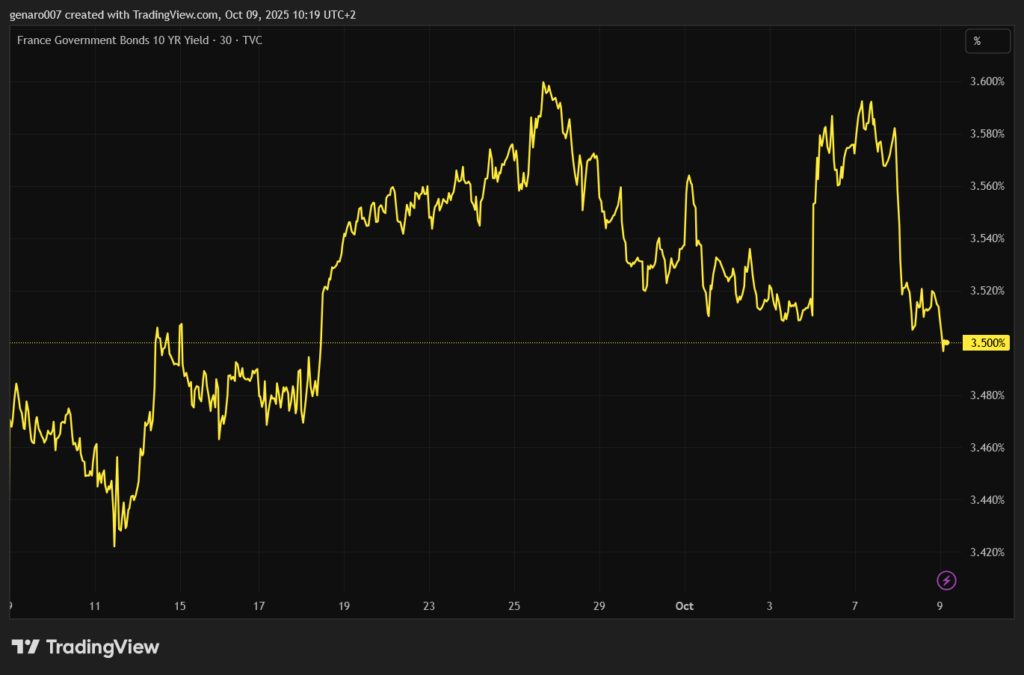

The markets' reaction to the fall of the government was consistent with this. The French stock market lost two percent immediately after the announcement. The Paris stock exchange was dragged down most heavily by French banks, led by Société Générale and BNP Paribas. This is because all French banks are heavily exposed to French government bonds.

Yields on ten-year bonds rose to as high as 3.6 percent. This week, French government bonds were already trading at a higher yield than Italian bonds. The spread between French and German bonds is being watched very closely. If the difference exceeds one percentage point, there is speculation that the ECB would have to intervene to prevent a major crisis on the European bond market.

For Emmanuel Macron, who is known as the Mozart of the financial world, this is already a very bitter pill to swallow. His government and his economic skills have put France in a position where speculation about ECB intervention is rife. The outlook remains pessimistic.

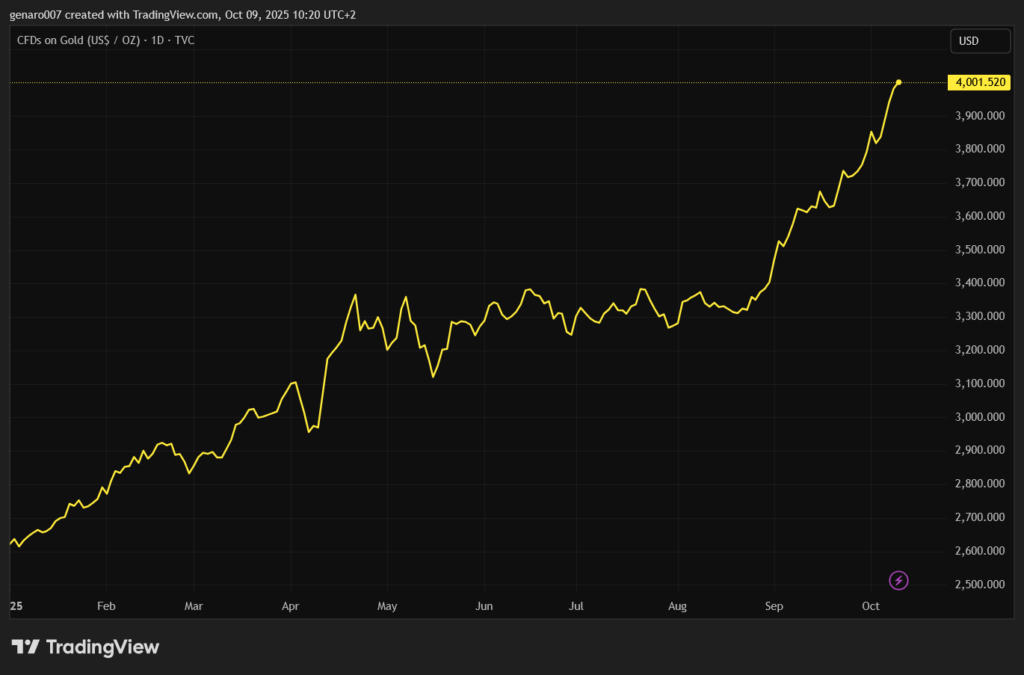

Gold above four thousand dollars

The current overview shows us that the political crisis is a major cause of the current situation. Politicians have neither ideas nor a vision for how to solve the problems. Perhaps it would be helpful to admit that the system needs to be changed. From this perspective, the situation is very uncertain. It is therefore not surprising that gold reached another psychological milestone during the week, with the price of gold rising above four thousand dollars per troy ounce.

Gold is primarily insurance against poorly managed currencies. Central banks are coming under increasing political pressure—and that is not a good sign. In this situation, it is therefore logical to hedge. No wonder investors are willing to pay a high price for this insurance today.