It was neither the ongoing shutdown nor the political crisis in France that triggered the sell-off. Donald Trump was to blame for the crisis with his social media account.

Chinese regulation of precious metals: trigger for the conflict

On Thursday, China announced stricter monitoring of the mining of precious metals, which are strategic raw materials for cars, cell phones, and weapons. Despite its own deposits, China controls the majority of global production thanks to mining in Africa and South America.

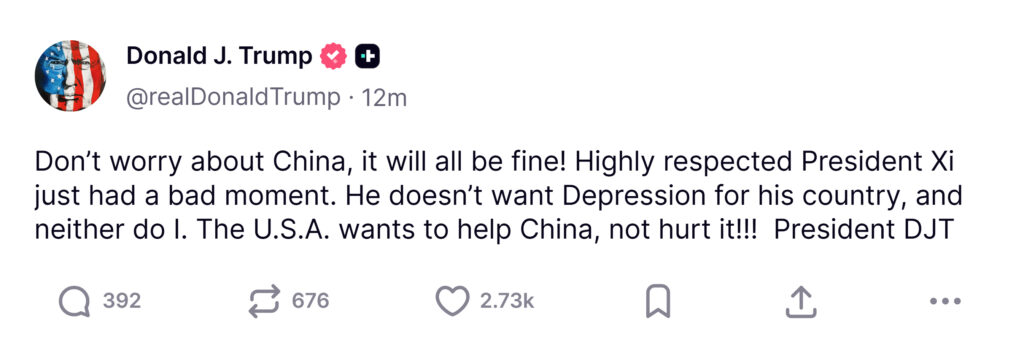

It was precisely this vision that angered Donald Trump, who viewed efforts to regulate precious metals as a direct attack on US interests. This was also reflected in a post by the American president on his social network, which could be equated with a declaration of war.

From November 1, Chinese goods were to be subject to an additional 100 percent tariff. In practical terms, this means a halt to trade between these two countries.

Panic on the markets: technology and Chinese stocks at the forefront

And that is exactly how the US stock market reacted, literally collapsing. Shares that had previously driven the market upwards, namely technology shares, followed by Chinese shares traded on US markets, such as Alibaba and JD.com, plummeted.

It was classic, textbook panic. But this came as no surprise. No final agreement was reached between China and the US. The countries are using a provisional agreement for the time being. With negotiations tense, it was to be expected that one of the parties would not resist the temptation to exert further pressure during these negotiations. That is exactly what happened. China's original intention was simply to remind the West that it has considerable leverage over them in the form of precious metals.

Donald Trump is striving to become independent from China in this area. Since the world has been slow to act in this area, it will be a long road. Incidentally, it is precisely the issue of rare metals that explains Trump's interest in Greenland.

The Trump administration has not only bought shares in Intel, but also five percent of Lithium Americas. Of course, these measures are not enough to free the US from its dependence on China.

Chinese surveillance as an act of war?

And it is precisely this increased surveillance of precious metals by China that the White House has interpreted as a declaration of war. If the country of the dragon were to halt its exports to the US, this would not only be an economic move, but above all a military one. The American arms industry would then no longer be able to supply sophisticated weapons to its allies, particularly Ukraine and Israel. At a time when an American warship is cruising off the coast of Venezuela, this move could be interpreted as China's support for the Maduro regime, with which the Asian country is allied on paper.

Trump viewed China's regulation of precious metals as an attack on the US, and his social media post announcing 100% tariffs on Chinese goods starting November 1 virtually brought trade between the countries to a standstill.

The American stock market plummeted, especially technology and Chinese stocks (Alibaba, JD.com). The panic was not surprising. China and the US do not have a final agreement, only a preliminary one, and the tense negotiations led to the expected pressure from China on precious metals.

A storm in a teacup?

However, according to the latest reports, it appears to be a storm in a teacup. Trump announced on Sunday that we do not need to worry about China. It was a misunderstanding, as neither president wants to harm their country. The markets can breathe a sigh of relief. We can thank Trump for his good timing with this news. Letting the balloon rise on Friday evening allowed room for negotiations without affecting market events.

If the situation does not escalate again, we will probably start this week in the green and the crisis will be over. However, the whole story will not end with a happy ending. Especially for those who panicked and sold their stocks or cryptocurrencies on Friday. These people will certainly not forget this. Donald Trump has certainly lost a few hundred of his supporters who had invested in the stock market.

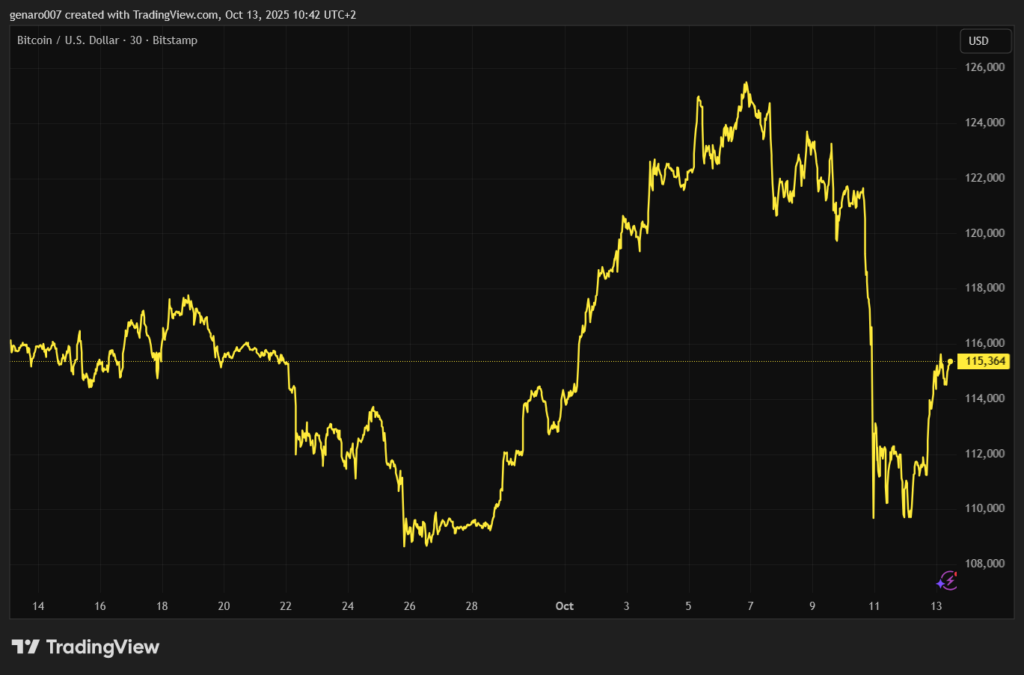

Manipulation of Bitcoin

But that wasn't all. Bitcoin was the hardest hit. After the announcement of the introduction of tariffs, the cryptocurrency market literally collapsed. The price of Bitcoin fell by more than seven percent in a very short time. This sharp drop wiped out all stop-loss orders and other preset orders.

No one had expected this financial instrument, which had established itself in the portfolios of banking institutions over the past year, to experience such a sharp decline. The situation was even worse for altcoins, with some losing double-digit values within a very short time.

But that's not the end of the story. It turned out that half an hour before the announcement, bets on a fall in the price of Bitcoin had risen significantly. A brave investor had shorted Bitcoin. According to estimates, this operation earned him around $190 million. That's a tidy sum.

It is virtually impossible to prove whether it was someone close to the American president. At the same time, however, this cannot be refuted either. Trump's political opponents naturally used this to accuse him of allowing his confidants to exploit the situation for their own gain. But even an apolitical investor cannot overlook this fact. If such situations were to repeat themselves in the future, the cryptocurrency market would lose confidence. And that would be a major blow that would be difficult to repair.

What to watch this week

Donald Trump seems to have calmed the markets, so we may be in for a less volatile week. However, investors will be vigilant throughout the week as the reporting season begins again in the US. As usual, it starts with the major American banks.

Investors will be particularly interested in the banks' general comments and forecasts on the macroeconomic situation. Do they continue to expect high inflation or significant problems in the American labor market?

Are American banks planning layoffs? Last week, the first companies reported their third-quarter results. The airline group Delta and the beverage manufacturer PepsiCo. Both companies surprised the market positively.

They confirmed that they are coping well with the introduction of tariffs. If all other American companies achieve similar results, we may be able to start a pleasing final spurt until the end of the year. Provided Trump does not decide to unleash an economic war. With him, you can never be sure.