The pressure for Republicans and Democrats to reach an agreement will be proportional to the mounting losses. Wall Street has so far ignored this danger. The reason for this could be that the specter of a Chinese-American trade war is looming on the horizon once again.

The panic was eased over the weekend by President Donald Trump, who noted that neither president (of the US nor China) was interested in damaging their countries' economies.

At the beginning of this week, the markets were optimistic. Trump announced a peace agreement between Hamas and Israel, which is always good news for the markets. The conflict in the Middle East automatically increases tensions on the oil market. Let's hope the ceasefire lasts as long as possible.

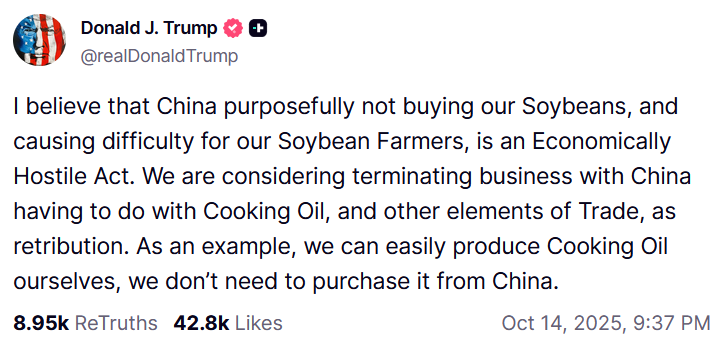

Trump warns China

It seemed as if Trump would enjoy his aura as a peacemaker for at least a week and let the markets celebrate. However, that did not happen. During his meeting in Israel and Egypt, he found time to reignite tensions between the US and China by reminding everyone that China is deliberately not buying soybeans from American farmers.

This unsettled the markets again, albeit not as much as on Friday, when the escalation of tensions between China and the US came as a surprise. The markets are now better prepared for such news. It is very likely that Trump will turn his attention to China after his meeting with Putin and the peace agreement between Israel and Hamas.

The second reason why the markets' reaction was not as strong is the agricultural sector itself. This is important for Donald Trump from a political point of view, as the agricultural states form his voter base. From an economic point of view, however, it is not a key area.

The decisive battles in Sino-US relations will be fought in the technology and industrial sectors. In the coming days or weeks, the markets will be eagerly awaiting important news from China or the White House. If this does not happen, the markets will probably forget about this threat again. Diplomats from both countries will then be able to work undisturbed on the final version of a major agreement between these world powers.

How have financial institutions performed?

Due to the shutdown, we currently have no macroeconomic data on the US economy, so investors have had to focus more on the start of the reporting season. This is traditionally opened by US banks. Their results can serve as a litmus test for the state of the entire economy.

When banks are doing well, the economy is usually doing well too. However, if they run into problems, this can be a harbinger of trouble ahead. Another reason to watch the results of American banks, even if you don't have them in your portfolio, is their analytical forecasts.

Most American banks benefit from activity in the financial markets and, when they publish their results, inform the public and their customers about the economic outlook for the coming months. So how did American banks perform?

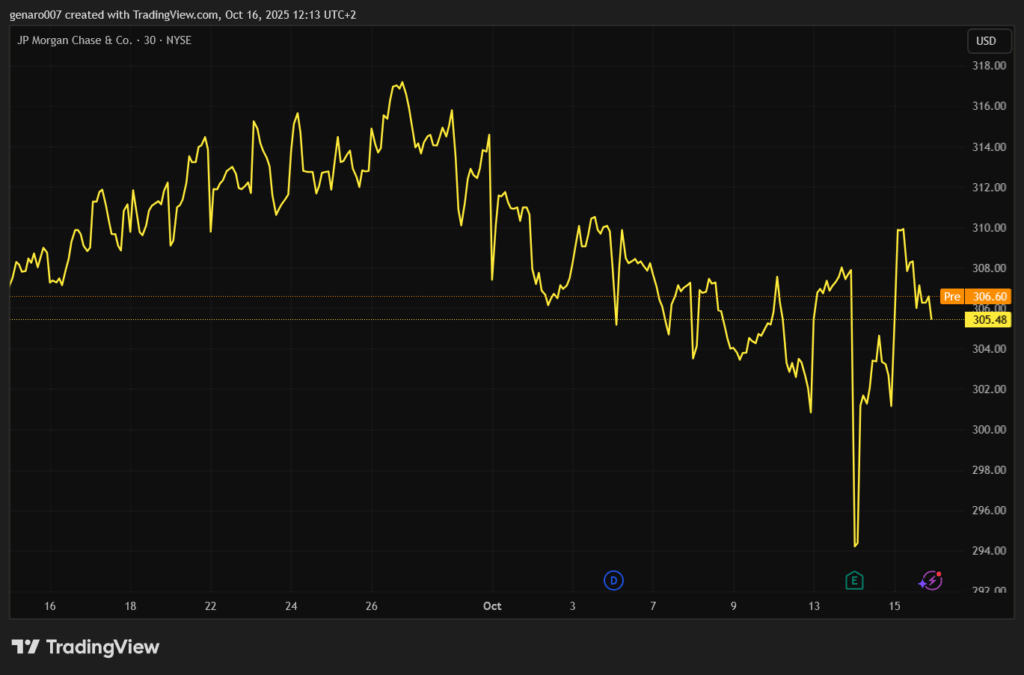

JP Morgan failed to impress despite excellent results

The largest US bank is JPMorgan. Its economic results were excellent: earnings per share reached $5.07 compared to the expected $4.84, and revenue for the third quarter of 2025 amounted to $47.12 billion compared to the expected $45.4 billion.

These results are attributed to Donald Trump's policy of easing capital requirements and stress tests for US banks. This allows banks to invest more of their capital.

JPMorgan's results were bolstered by its investment banking division, which exceeded expectations by $700 million. After the shock of April 2 (Liberation Day), stock markets are rising sharply, and for experienced investment bank traders, there is nothing easier than capitalizing on this wave of growth.

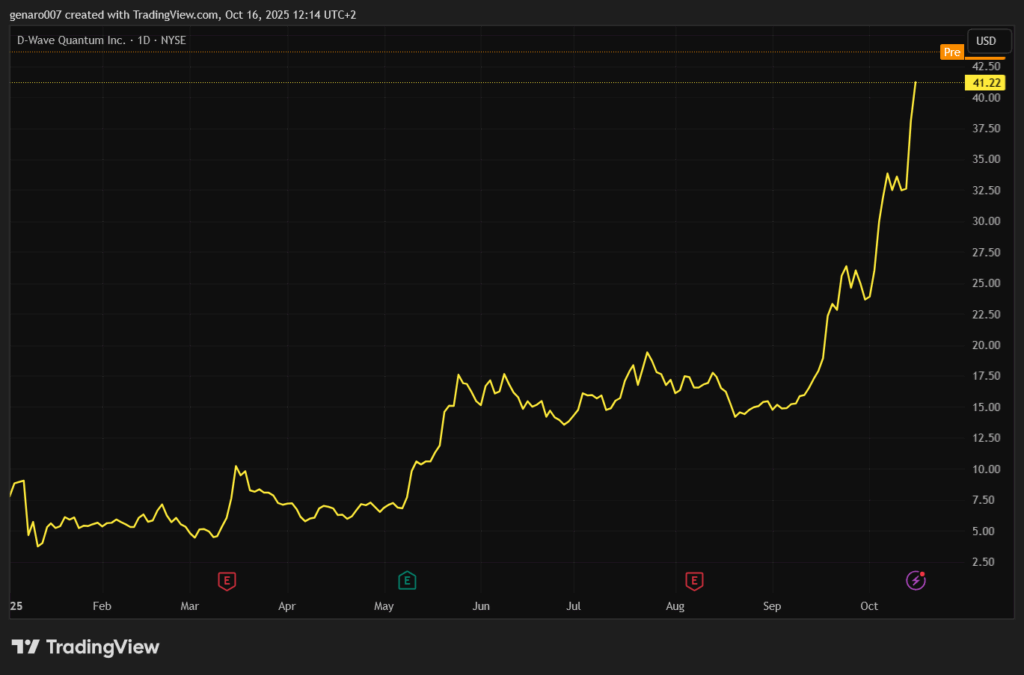

The quantum computer business

Investors were very interested in the statement by JPMorgan CEO Jamie Dimon, who announced a plan to invest another $10 billion in companies that are critical to US national security, such as defense, pharmaceuticals, precious metals, and quantum computers. Shares of companies involved in quantum computing responded to this news with a rise of more than 20 percent.

Shares of D-Wave, for example, which have risen more than 365 percent, showed only a slight movement on the chart. JPMorgan thus contributed to the bubble surrounding quantum computers. While it can be argued that companies in the artificial intelligence sector are generating significant profits and their value cannot theoretically fall to zero, the situation is different for quantum computers.

The aforementioned company D-Wave, for example, has quarterly sales of around three million dollars, yet it has a market capitalization of 15.3 billion dollars. More significant advances in quantum computing are not expected until around 2030. It is paradoxical that Jamie Dimon warned against excessive valuations in the field of artificial intelligence, but is willing to invest in a sector with even higher valuations.

Although JPMorgan's results were excellent, investors sold off their shares and the share price lost more than 4.5 percent. The reason for this was the increase in loan defaults, which rose by nine percent year-on-year. This is not dramatic in itself, but the bank's management pointed to the risks of larger companies collapsing, which could lead to significant losses.

There were two major bankruptcies last month. Tricolor, a company that sold used cars and provided loans for them, caused JPMorgan a loss of $170 million. And the bankruptcy of First Brands, a manufacturer of auto parts and accessories, hit Swiss bank UBS hard. These two companies could be just the first signs of larger economic problems. If similar bankruptcies become more frequent, banks could suffer significant losses.

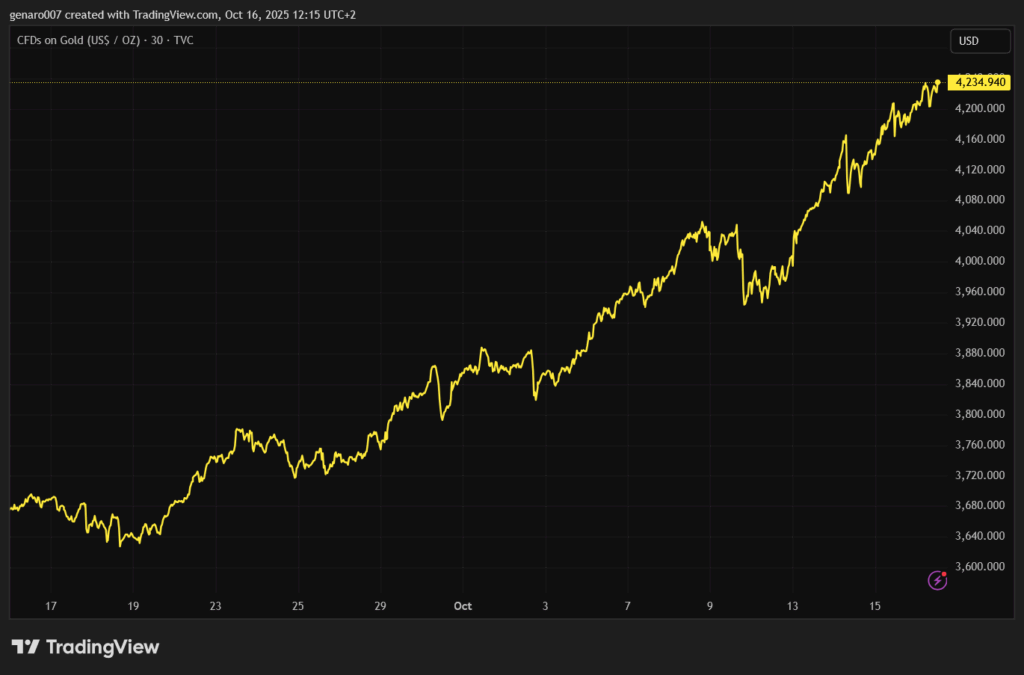

Gold above $4,200

The current reporting season has not changed the fact that gold continues to rise. It has crossed another psychological barrier of $4,200. The rise in the price of gold is worrying because investors are not buying gold to get rich, but to preserve their wealth. It is a form of insurance, not a speculative investment.

The large number of investors willing to pay high costs for this insurance signals growing caution, even though stock market indices are approaching record highs.