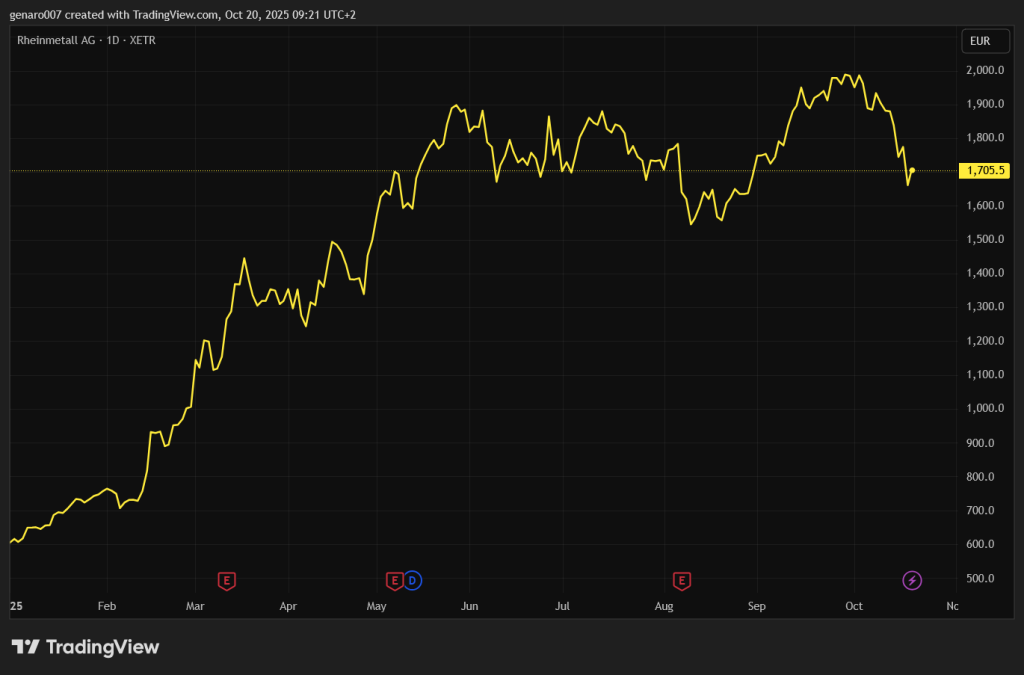

For the world, this is a promise of relief, but for investors in European defense companies, it is a threat. A cessation of fighting would immediately affect their contracts. The German company Rheinmetall was hit hardest, with its shares falling more than 10 percent after the announcement.

We may have reached the peak of interest in defense companies, and it would not be surprising if investors began to take profits in this sector.

Are we witnessing a repeat of the crisis faced by American regional banks?

In the middle of the week, the American stock market discovered a new problem, which was brought to light by Jamie Dimon, CEO of JPMorgan, the largest American investment bank. He compared the situation to cockroaches: “If you see one, there are probably more.”

This statement was a reaction to the write-off of losses amounting to $170 million in connection with the bankruptcy of Tricolor. This company specialized in leasing used cars, but it became increasingly apparent that it had systematically underestimated the default risks of its customers. In other words, it lent money to people with an increasing risk of default.

Such situations are not surprising, as monetary policy has tightened since 2022. This process initially hit the US Treasury market hard and then regional banks in 2023. The rise in Treasury yields, combined with a high proportion of unsecured deposits, proved fatal.

Among the most notable victims were Silicon Valley Bank, Signature Bank, and First Republic. Their balance sheets were full of long-term bonds that had been purchased during periods of low interest rates and whose value declined rapidly as yields rose quickly.

As investors and depositors began to take a closer look at the situation, a classic run on the bank ensued, turning book losses into an actual collapse.

Rising interest rates affected not only investment companies, but also businesses and ordinary Americans. For example, credit card interest rates rose from 14 percent in 2020 to 22 percent currently.

Surprisingly, the problems with non-performing loans are only now becoming apparent. Jamie Dimon's words had an almost magical effect—shortly after he made his statement, two American regional banks reported further difficulties.

Zions Bancorporation and Western Alliance Bancorporation have been in the spotlight for all the wrong reasons in recent weeks. Zions announced that it had written off $50 million in loans to two troubled borrowers.

Although this amount does not threaten the existence of a bank with assets of more than $8 billion, the market reacted nervously and the bank's shares fell by more than 13 percent. In addition, the institution is facing a lawsuit in connection with unpaid revolving loans of more than $60 million secured by mortgage loans.

Western Alliance suffered a similar fate. The Arizona-based bank is trying to recover around $100 million that has disappeared into dubious credit structures.

After this information was released, the bank's share price immediately fell as investors wondered whether this was an isolated problem or a sign of general vulnerability in the credit market. This is the crucial question for the entire banking sector: Is this an isolated case or a systemic failure?

Past cases suggest that such situations are either due to fraud or to loans with a high risk of default. The crucial question is therefore: How are these companies' control mechanisms designed?

The losses incurred by US banks do not yet pose a threat to liquidity, but this does not mean that there will not be further defaults in the coming weeks or months. If the number of defaults rises, this could lead to further insolvencies among regional US banks.

The adjective “regional” can be misleading, as many people understand it to mean a small bank with few branches. Zions Bank, for example, despite its share price decline, has a market capitalization of $7.3 billion, making it one of the 300 largest banks in the world, right next to the Czech Komerční banka.

Even the collapse of such a “regional” bank could shake the US banking system.

The danger of student loans

Another potential problem is unpaid debt, especially student loans. The US job market is facing problems as artificial intelligence is replacing junior positions, which are typically filled by young people after graduation.

If these graduates remain unemployed for a long time, they will not be able to repay their student loans. This problem could pose another risk to financial stability, not only for banks but for the entire economy.

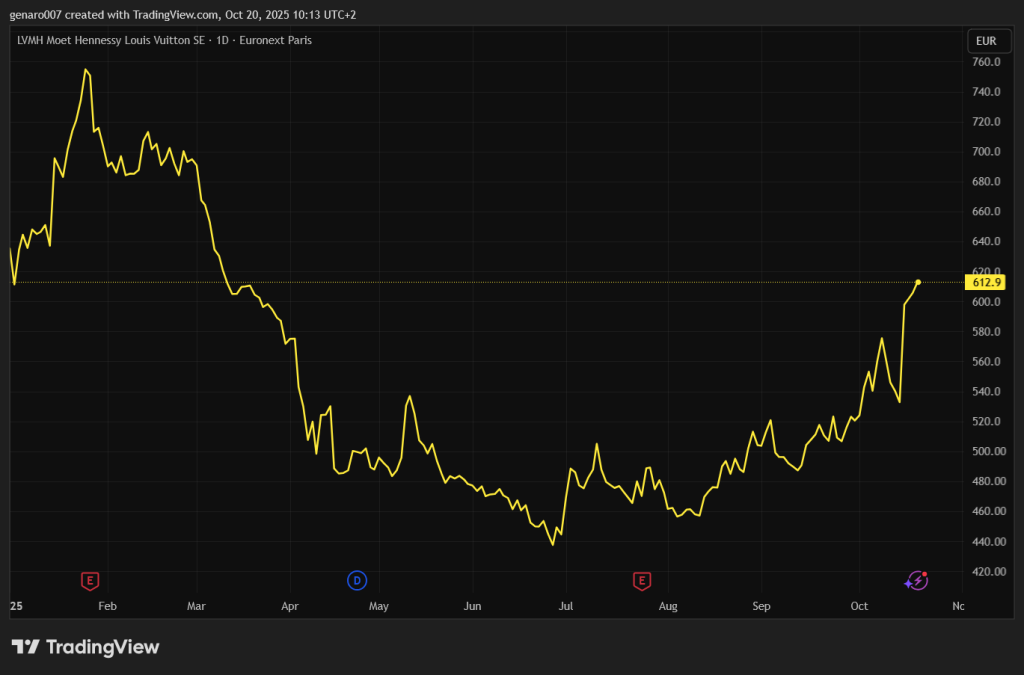

Upturn in the luxury sector

The luxury goods sector is crucial for Europe, especially France and Italy, but has been in crisis for two years. The main reason for this was the decline in interest in luxury goods in China, where the Communist Party has emphasized that a conspicuous preference for luxury is incompatible with communist doctrine.

Another blow to this sector was the tariffs imposed by the United States. These two factors led investors to shy away from the luxury goods sector. However, the situation could now be changing.

LVMH recorded organic revenue growth of one percent year-on-year in the third quarter of 2025, marking a return to growth after two quarters of declines. This result exceeded analysts' expectations, with revenue reaching $18.3 billion.

The Sephora division was the strongest performer, with growth of over seven percent. The wine and spirits division also recovered from the impact of Chinese and American tariffs and was able to halt the decline in sales.

The markets reacted euphorically and LVMH shares rose by more than 11 percent, representing one of the largest single-day increases in the company's history. The entire luxury goods sector contributed to the rise in LVMH shares, with Kering and Burberry gaining 4.8 percent and 3.4 percent, respectively.

Conclusion: What to watch out for next week?

Due to the ongoing US government shutdown, no data will be released by the US Bureau of Statistics this week. Investors will therefore focus primarily on the reporting season, which promises to be interesting.

On Tuesday, Netflix will present its results. These results are important because they reflect households' willingness to spend money on non-essential services. In times of rising inflation, debt, and consumer pressure, Netflix is a litmus test for the state of the US economy.

Tesla will publish its results on Wednesday, with investors' attention focused on the press conference with Elon Musk. Everyone will be eager to see whether Musk announces a specific date for the launch of the robot taxi or chooses an evasive strategy and presents a completely different topic. The results of these companies can significantly influence market sentiment.