However, this week could be different, as investors face a particularly busy schedule. The first hurdle was the US Federal Reserve meeting on Wednesday evening. The reactions to this confirmed that, despite the apparent calm, both central bankers and investors have doubts about the direction in which the macroeconomic and political situation is heading.

One word suffices

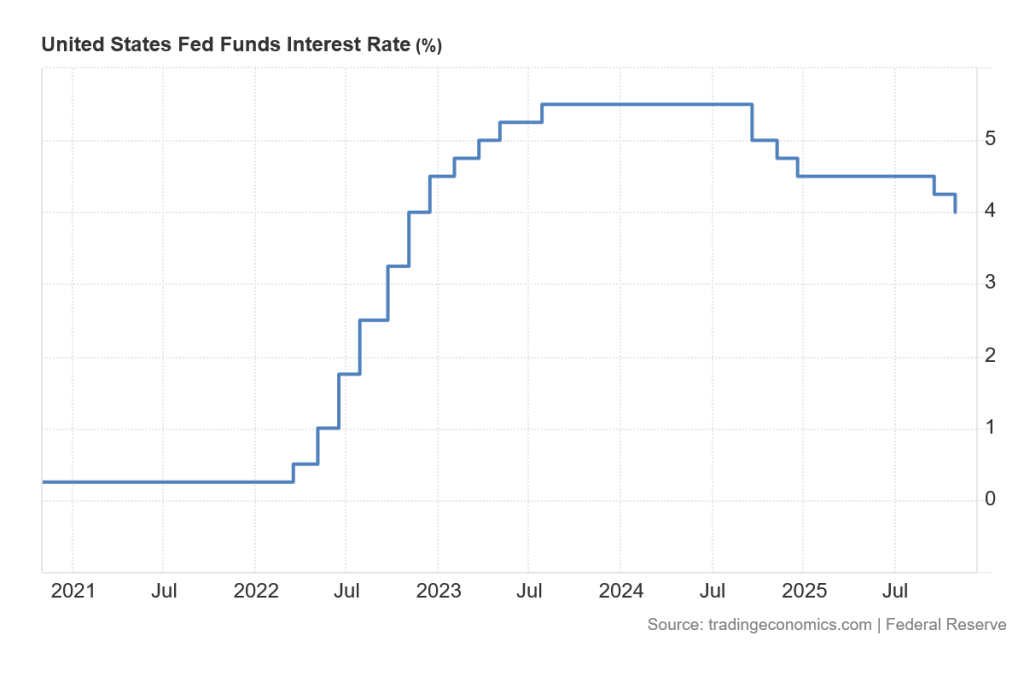

Overall, there were no major surprises. As expected, the Fed cut interest rates by 25 basis points, which everyone had anticipated. The second point that was closely watched was the issue of quantitative tightening.

This is a process whereby the central bank reduces the amount of money in circulation in order to tighten monetary policy. The Fed began this process on June 1, 2022, and has since reduced its balance sheet from $9 trillion to its current level of $6.6 trillion.

At Wednesday's meeting, Jerome Powell announced that the quantitative tightening process will end on December 1, 2025. This is very important news, especially for high-risk assets such as stocks and cryptocurrencies. A higher volume of assets on the Fed's balance sheet means more liquidity in the system, which typically promotes the growth of these assets.

Another piece of good news for the markets was that the Fed acted as expected. Most investors had anticipated this move. However, that was where the good news ended.

The markets reacted negatively to Powell's comments on the future development of interest rates. He stated that the December cut was “by no means a foregone conclusion.” This surprised the markets, as everyone had assumed that the Fed would stick to its optimistic September forecast. According to this forecast, interest rates were to be cut twice more by the end of this year. The last cut is now in jeopardy. However, this is not an attempt by Powell to harm Donald Trump, but a response to macroeconomic reality.

The Fed is cutting interest rates without having reached its inflation target of two percent. Worse still, the latest data shows that inflation in the US is heading toward three percent. Trump's tariffs are to blame. The key question is whether their effect is only a temporary boost to inflation or whether they will fuel inflation in the long term. No one knows, and that is precisely why Powell is proceeding cautiously.

According to him, the tariffs contribute about half a percentage point to inflation. This means that even without them, inflation would not reach the two percent target. In other words, the Fed has no leeway to ease monetary policy too quickly.

The main reason for the easing so far has been the weakening labor market, but due to the ongoing government shutdown, we currently have no up-to-date data on unemployment. Although unemployment is rising slowly, the trend has not been dramatic so far.

Most commentators have noted that Powell indirectly acknowledged a stagflation scenario, i.e., a situation in which the economy slows down but inflation remains above target. So far, however, it does not look like deep stagflation. The most likely solution therefore remains to do nothing and wait until the situation on the markets has stabilized. However, this is precisely where another problem arises.

Division within the Fed

The Fed meeting revealed the central bankers' disagreement, which is not something that happens very often in history. Normally, the leadership of a central bank tries to present a united front, but this was not the case this time. Trump's nominee Stephen Miran, who was appointed to the Fed in September and supports Trump's aggressive interest rate cuts, played a role in this. As in September, Miran voted for a 50 basis point cut.

What was new, however, was that Jeffrey Schmid voted to keep interest rates at their current level. In other words, there is one member of the Fed who believes that the risks of inflation are so serious that the bank should stop cutting interest rates. This is further evidence of the complexity of the situation.

Even central bankers disagree on how things will develop, and it is precisely this disagreement that is a source of uncertainty. The Fed meeting did not reassure investors, but rather sowed doubt.

Technology test: Alphabet, Microsoft, and Meta

The second major test for the market was the release of results from three companies in the elite Magnificent Seven group after the market closed. Here, too, investors were surprised.

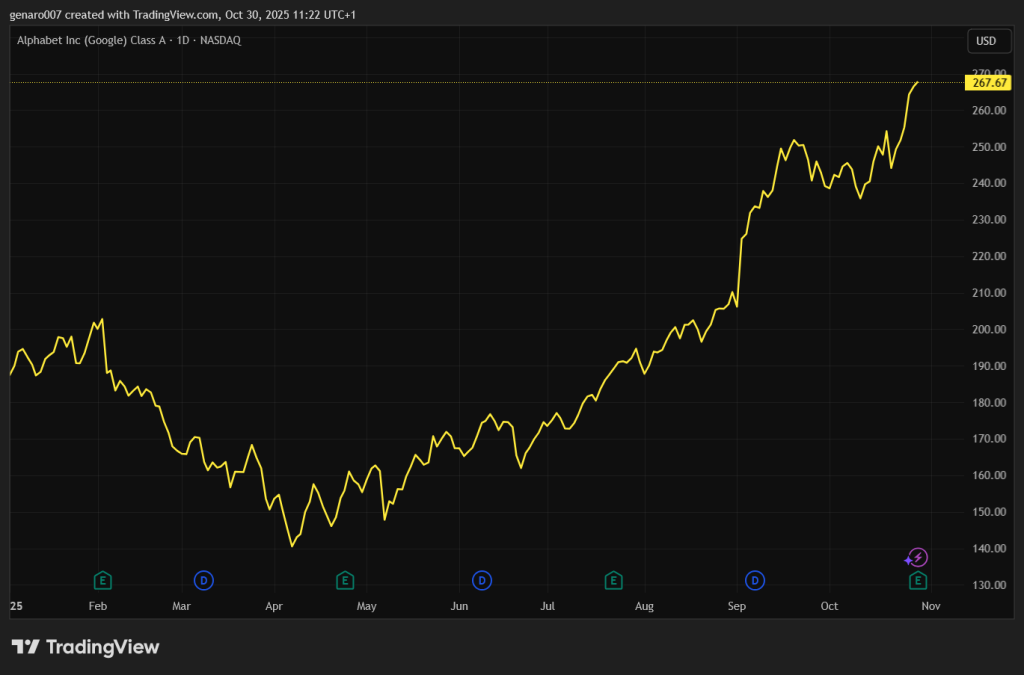

Let's start with the positive news. Alphabet (Google) presented results that significantly exceeded analysts' expectations. Earnings per share were $2.87 compared to the expected $2.26, and revenue reached $102.3 billion, representing solid growth of 16 percent over the previous year. The operating margin reached 30.5 percent and would have been even higher without the $3.5 billion fine imposed by the European Union.

Shares responded to the results with a six percent rise. Investors particularly appreciated the fact that cloud services continue to be the growth engine, with revenue growth of 34 percent. In addition, Alphabet increased its planned investment in artificial intelligence to $92 billion for 2025, with a further increase in 2026. The AI boom is therefore far from over.

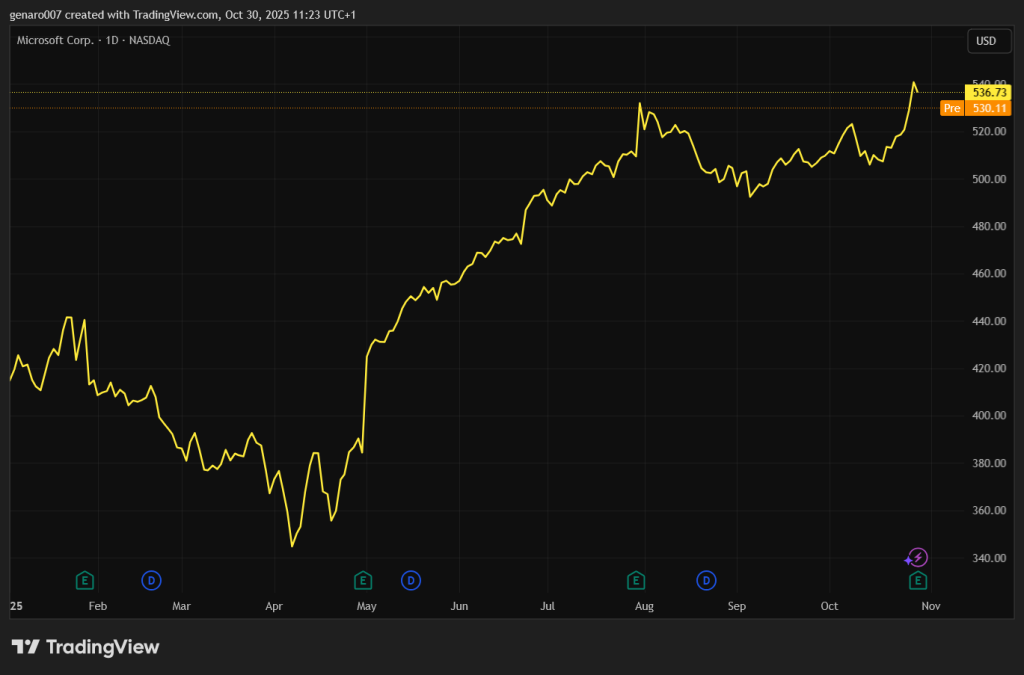

Microsoft also exceeded expectations. Earnings per share were $4.13 compared to the expected $3.67, and revenue was $77.7 billion, more than $2 billion higher than market expectations.

As with Google, the cloud segment was the main driver here, particularly the Azure division, which recorded revenue growth of 40 percent compared to the previous year. Nevertheless, Microsoft shares fell 4 percent after the results were announced, as Azure is only expected to grow by 37 percent in the next quarter.

Investors experienced the greatest disappointment in the case of Meta. Earnings per share were only $1.05, while analysts had expected $6.68. However, revenue exceeded expectations, reaching $51.2 billion compared to the estimated $49 billion. The reason for the sharp decline in profits is massive investments in artificial intelligence. Mark Zuckerberg does not see this as a problem, however; on the contrary, he wants to increase these investments further. Meta is expected to invest $71 billion this year, with the pace of spending set to accelerate even further by 2026.

The difference between Meta and companies such as Amazon or Microsoft is that Meta does not rent computing capacity but builds its own infrastructure. This may be an advantage in the long term, but in the short term it means high costs and higher risk. The markets reacted immediately to this weakness, and Meta's shares fell by more than 8 percent.

Everything could be different by the end of the week

The reporting season will continue over the next few days. Apple and Amazon will announce their results. The European Central Bank will also meet to decide on interest rates in the eurozone. In addition, there are reports that the meeting between Donald Trump and the Chinese president went well.

So it will all depend on which of these events the markets choose as the main topic of the week. In any case, it is clear that beneath the surface of the record figures,

uncertainty is spreading and that this year's invincible markets may be facing their first real test.