The shutdown in the US has already lasted a month. It is very likely to be the longest in history – the previous record was 35 days. Now there are only two days left to break this grim record.

Some American billionaires have even taken the initiative to start buying food for distribution. More than 40 million Americans have been without government-subsidized food stamps since Saturday. This program has also been suspended due to the suspension of funding for government employees.

Interestingly, the US government spends eight billion dollars a month on this program. The Pentagon, for example, also finances the salaries of important government officials who are close to Donald Trump.

However, the markets are stubbornly ignoring this fact, knowing that it will be a good sign once the shutdown is lifted. But they may have miscalculated. After all, no one expected such a long shutdown.

There is absolute uncertainty everywhere

If we add to this the fact that a US court could rule on the lifting of tariffs as early as this week, we find ourselves in a phase of absolute uncertainty. Even the Fed has not presented a clear vision and stated in its statement that an interest rate cut in December is not certain.

The meeting between the American president and his Chinese counterpart has merely led to a one-year postponement of the trade war. Fundamental issues such as Taiwan and the problem of intellectual property were not addressed at all during the meeting.

The whole thing seemed rather awkward. Donald Trump constantly talked about how well everything was going and was generous with his compliments to the Chinese president. However, the latter remained stony-faced and—as is his wont—very reserved. A stark contrast.

Despite the agreed truce, both presidents immediately took quite contrasting steps.

Donald Trump gave the green light for nuclear tests. After President Xi Jinping's return, the Chinese government announced a tightening of tax regulations for gold trading – specifically, it plans to remove or restrict tax exemptions that previously favored small traders and investors.

This decision significantly increases pressure on the price of gold. It is a very interesting decision by the Chinese Politburo, as it is well known that the Chinese central bank is continuously increasing its gold reserves. The situation surrounding gold as a safe haven is also far from clear. The markets therefore have only one certainty, and that is artificial intelligence.

The dominance of Nvidia and artificial intelligence as the only certainties

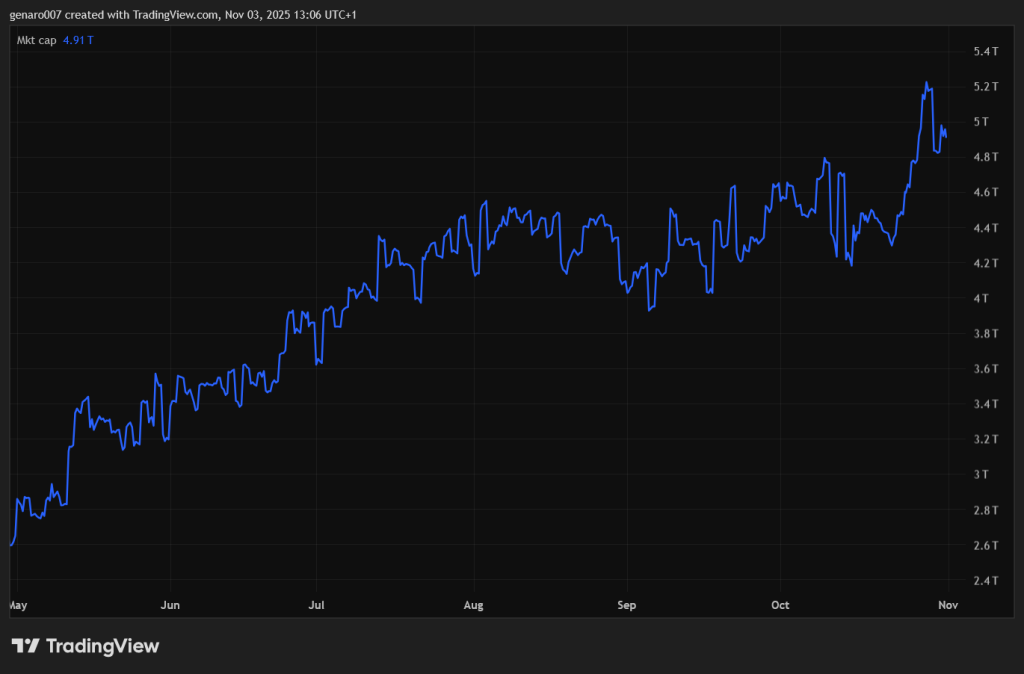

The dominance of artificial intelligence was confirmed this week by Nvidia, which became the first company in history to exceed a market capitalization of five trillion dollars. The company didn't even have to publish its results to reach this historic milestone.

Recently, Nvidia has made clear its intention to transform the entire company. It will no longer be just a chip manufacturer, but will slowly but surely expand its activities everywhere. Just recently, it announced a collaboration with Palantir and bought shares in Nokia, where it is primarily interested in patents and the development of the 6G network, which will be connected to artificial intelligence.

As if that weren't enough, Nvidia has also agreed to work more closely with Uber, to which it will supply chips for self-driving taxis powered by artificial intelligence.

However, it wasn't just grand plans and completed partnerships that caused Nvidia's share price to rise. The company's results also contributed significantly to this. The first important point is that the current reporting season for the third quarter is one of the best in Wall Street history.

More than 85 percent of published reports exceeded analysts' estimates. However, market expectations are very high. Any hesitation is severely punished. We saw this with Meta's shares, for example. Similarly, failure to meet expectations – despite very good results – can lead to price stagnation.

We saw this in the case of Microsoft, whose results were unexpectedly good but disappointed investors' expectations for the next quarter. The outlook only confirmed the median forecast.

Investment in artificial intelligence at an all-time high

In contrast, investors welcomed the strong figures from Apple, Amazon, and Google. All of the results from these five major companies had one thing in common: high investment in artificial intelligence.

Investments for 2025 will be very generous. Microsoft plans to invest $80 billion, Meta $70 to $72 billion, and Alphabet $91 to $93 billion. Amazon is the most ambitious, with planned investments of up to $100 billion in AI.

Apple is the most modest of all these companies, with investments of $12.3 billion. However, this relatively low expenditure is offset by its efforts to connect AI to all its devices. And since Apple is successful in sales, no one doubts that the company will at least use AI to integrate it into its devices and services.

And the best is yet to come. All companies agree that they will continue to increase their investments until 2026. So Nvidia does not have to fear a decline in demand. The investment bubble surrounding AI will therefore most likely continue to inflate next year.

The only certainty in an uncertain world is therefore the rising demand for chips and, with it, for precious metals and energy needed to power the growing data centers.

What to watch next week?

The biggest focus for investors tracking monetary policy this week will undoubtedly be the Bank of England meeting. The UK is in a particular macroeconomic slump, with inflation stubbornly stuck at 3.8 percent and economic growth barely moving forward.

The country is thus becoming a kind of living laboratory for studying the slow onset of stagflation, a phenomenon that investors in Western economies know more from textbooks than from practical experience. The central bank's decision will therefore not only be a technical commentary on monetary policy, but also a test of whether the right decisions can be made in an environment of high prices and weak growth.

Investors will certainly not complain of boredom. This week is all about the reporting season, and the flow of data will more than fill analysts' screens.

On Monday, Palantir, Realty Income, and ON Semiconductor will publish their results, followed by AMD, Shopify, Pfizer, McDonald's, Fortinet, Sempra Energy, Siemens Healthineers, BMW, AstraZeneca, Rheinmetall, Airbnb, and Constellation Energy later in the week.

If the stock market is a barometer of investor sentiment, then we can expect a week in which the mercury will certainly not stand still.