As recently as the middle of last week, everyone believed artificial intelligence was a bubble because Michael Burry bet big money on Palantir and Nvidia's stock drops. But the very next day, there was no more talk of a crisis. On the contrary, the markets welcomed the US Supreme Court's restrained stance on the presidential tariffs.

During the hearing, the justices expressed scepticism about the extent of the president's power to impose new tariffs without congressional approval, and warned that not everything could be justified by reference to "compelling national urgency".

Although the formal elimination of the tariffs has not yet occurred, investors viewed the court's decision as a signal of greater legal scrutiny over trade policy. Trump will thus no longer have a completely free hand. A little restraint in Trump's U-turns would be appreciated by the markets in that it would bring stability to the market, which is lacking there.

It is also important for the markets that the current form of tariffs would more or less stabilise inflation. For now, it appears that traders cannot afford to raise prices. The imposition of tariffs has thus mostly been resolved by importers by reducing their margins. And if tariffs don't go up, prices won't go up. Then the Fed will be able to cut rates.

The logic of low rates never fails the markets. This time was no different. Moreover, the entry into the new week could be very strong as there is speculation that there may be an end to the shutdown.

Republicans and Democrats are thus finally coming to some sort of agreement. If this information proves to be true, we could be in for a euphoric week when everyone forgets about the problems that are still lingering, such as the US debt, the high valuation of US technology stocks or the slowing US labour market. At the same time, there is no guarantee that this good mood will last into the next day.

Will Elon be the first trillionaire?

Elon Musk had a lot to be happy about last week. Tesla shareholders approved a new record bonus. Three-quarters of shareholders were in favour of a one trillion dollar bonus. If Musk were to actually receive this award, it would become the largest corporate reward in history. There is, of course, a catch. Or, more accurately, several hooks.

The plan is broken down into 12 incremental tranches of stock options that Musk will receive upon meeting specific goals. The first reward he will receive is when Tesla's market capitalization increases from the current $1.5 trillion to $2 trillion. The next if sales of 11.5 million vehicles a year are achieved. These rewards are still relatively achievable.

However, Musk will only achieve the full reward when Tesla's market capitalization reaches $8.5 trillion. To give you an idea: the most expensive company today is Nvidia. The latter was recently worth five trillion dollars for a while, but did not hold it for long. It is now worth $4.5 trillion. So Tesla will have to work very hard.

Another mythical goal is to surpass the sale of one million humanoid robots. It should be noted here that Musk is a great visionary and has many ideas, but his main problem has been meeting the timeframe of his projects. For example, it was the Optimus programme that was supposed to produce five thousand robots in 2025. That target is unlikely to materialise.

As a result, the whole project will be very late. Even according to the billionaire's most optimistic plans, one could talk about the mass diffusion of robots only in 2030. Staying down to earth, even 2035 would be a big achievement for Musk. The businessman will be 64 years old by then.

Not everyone was thrilled about such a big reward. Among the biggest detractors in shareholder circles was the Norwegian Investment Fund, which called the reward astronomical and poorly designed. However, the majority of shareholders voted in favor of the reward because Musk has talked about quitting Tesla if he doesn't get it.

Everyone knows that the shares of this car company are realistically overvalued. And it is Elon Musk who is to blame for this enormous overvaluation. So far, however, he has always been a winner. That is, unless you count a brief political episode that didn't go very well for him.

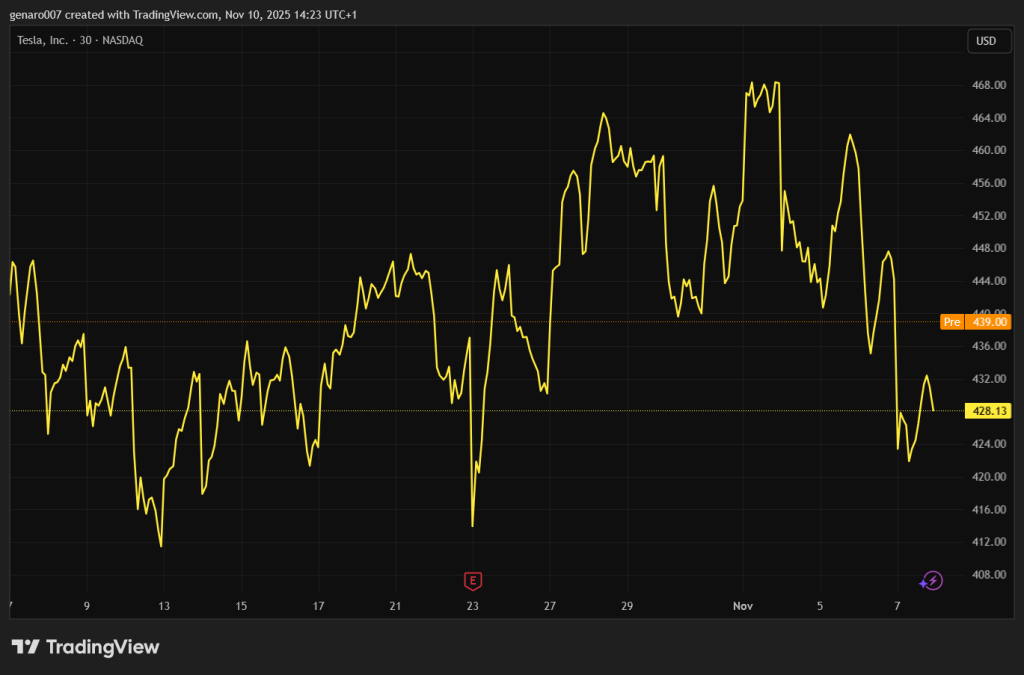

Shareholders will just be happy to see Musk leave politics on the sidelines and focus on Tesla. That's what this huge incentive award is supposed to do. If the billionaire receives this reward, it will be seven times the one-year GDP of the entire country. For the sake of completeness, let us add that the markets have not priced this deal particularly well, as Tesla shares have lost five per cent in the last week.

What to watch next week

The main topic in the coming days will probably be whether the ongoing government shutdown can be ended. If it were to continue, the economic damage would continue to deepen. Already, more than five thousand flights are cancelled every day in the United States.

Despite the fact that part of the government's agenda is virtually halted, inflation data for October will have to be published on 13 November, because pension benefit calculations are linked to it.

However, other macroeconomic figures may be delayed, which again gives room for political interpretations, including Donald Trump, who knows how to take advantage of such information windows.

Meanwhile, earnings season continues. This week it's the turn of companies like Occidental Petroleum, a recent Buffett favorite, followed by Porsche, Cisco, E.ON, Walt Disney, Allianz and Siemens Energy.