Aside from the sell-off caused by Donald Trump on April 2, when he declared a "day of liberation," this was the worst session caused solely by market factors. The AI boom is becoming increasingly fragile.

Investors are questioning whether massive investments in AI infrastructure will pay off in the future, as these investments have so far yielded relatively low returns. It is also pointed out that these astronomical investments are financed by debt.

This is also true for large technology companies that generate sufficient cash flow. Smaller companies do not want to be left behind and are also going into debt. Investment in artificial intelligence is growing in all companies because they are all afraid of falling behind the competition.

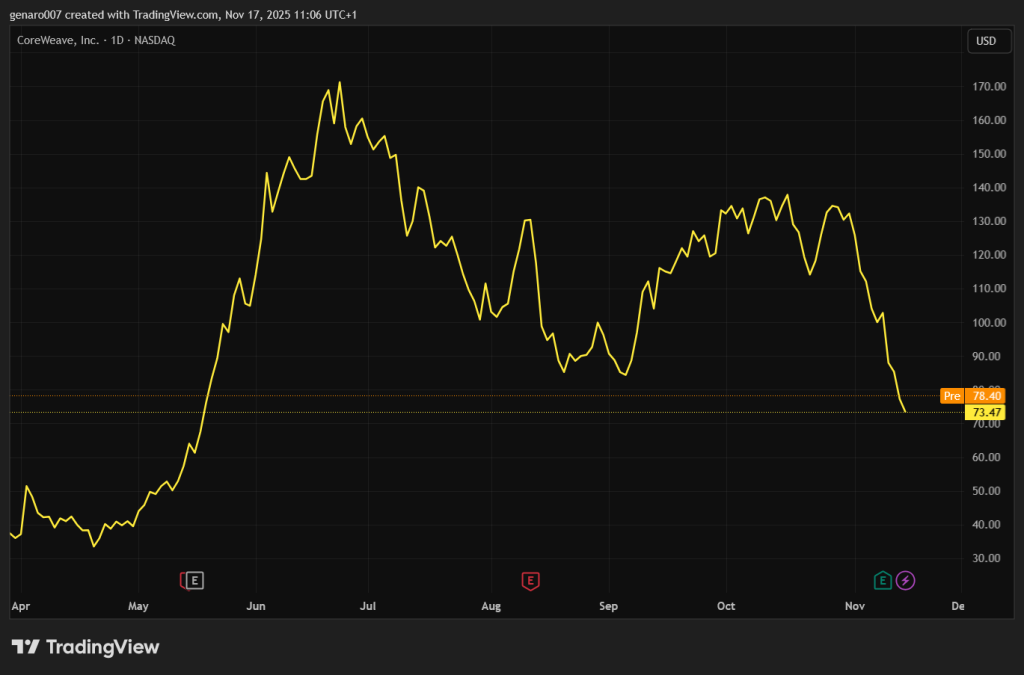

The latest very interesting factor that raised significant questions was a report by CoreWeave. This company went public recently - in March this year. It was one of the most interesting primary share issues in recent times.

CoreWeave specializes in cloud services and high-performance computing - in other words, it's a company that is in tune with the zeitgeist. It has soared to 180 since launching at a price of $40. Now, with tech stocks under pressure, its value has fallen to 77.

The company's management reported that it now faces a big problem in building new data centers. It wasn't a shortage of chips from Nvidia or AMD or a shortage of skilled labor, but concrete.

The construction of data centers that expand the boundaries of the virtual world ran up against physical boundaries. Lack of concrete or power sources could significantly slow AI development.

Fewer data centers being built will have a negative impact on revenue. Profitability projections may be pushed back a year or two. Investors may soon lose patience and start selling their shares. Investors are increasingly skeptical.

New versus old world

The decline in the Nasdaq and S&P 500 technology indices came at a rather unexpected time. In the US, the government shutdown has ended. This act has always had a very positive effect on the US stock markets. Government employees do not have to worry about their paychecks.

American consumers can now spend freely. However, this strong consumer spending power is not primarily reflected in the purchase of the latest chips. Americans will start spending on consumer goods and restaurants.

Thus, the end of the shutdown will mainly benefit the stocks of defensive companies such as McDonald's, Coca-Cola, Johnson & Johnson and many others. These 'old world' stocks are represented by the Dow Jones index. The latter, on the other hand, did well last week.

With the decline in technology stocks, talk of sector rotation immediately began. We are very sceptical about this. The timing is not right for these defensive stocks. Of course, in the event of a crisis or sell-off in the technology market, the stocks in question can serve as a safe haven.

But for defensive stocks to perform well, investors need to hold them for several years. They are designed primarily for long-term players. Long-term investments simply don't work in our fast-paced times. So this was just a short-term phenomenon.

Tesla shares were among those that were punished harshly last week. Their price dropped into negative numbers in terms of share performance since the beginning of the year. Tesla investors should listen more to CEO Elon Musk, who has basically kept saying that the coming months are going to be very difficult for his company. Of course, he adds in the same breath that Tesla will eventually prevail.

By the way, investor Cathie Wood sold some of her Tesla shares last week, even though she has trusted Musk for years.

But the situation in the technology sector is not clear-cut. Although many stars have fallen, it hasn't prevented AMD stock, for example, from having a very positive week. The company's CEO believes that sales will continue to grow strongly over the next five years.

The markets are increasingly confirming that it will be important to learn to pick the right stocks. Buying ETFs that track indices may not be the best way to invest if there is a correction in the Magnificent Seven.

Bitcoin below the $100 thousand mark

However, it's not just tech stocks that won't remember the end of the shutdown fondly. Cryptocurrency holders had to put up with the price drop. Over the weekend, the price of bitcoin fell to 93 thousand dollars. The drop in cryptocurrencies is most likely due to the confirmation that according to the halving cycles, we have already crossed the peak for 2025.

Investors were hoping that this peak was postponed due to the ongoing shutdown. Government employees have had to dip into their reserves or cut their spending to an absolute minimum. As a result, less has been invested in cryptocurrencies.

This halt in investment inflows was supposed to postpone the peak of the halving cycle. However, the theory has not been confirmed at all. On the contrary, the end of the shutdown accelerated bitcoin's decline.

The second possible explanation is the deteriorating outlook for interest rate cuts in December 2025. According to the FedWatch Tool, most of the market now believes that rates will remain unchanged. This is mainly due to persistent inflation.

This outlook is not good for cryptocurrencies. Despite bitcoin's price dropping below $100 thousand, most of the big players are still buying. This can be interpreted as a good sign. On the other hand, these large bitcoin holders are buying in order to hold bitcoin for the long term.

Therefore, it is not possible to simply conclude that a trend change is imminent. A turnaround in bitcoin will eventually come, but it is not very realistic to think that it will happen in the near future.

What to focus on in the next week?

In the coming week, identifying the main event in the markets is a relatively simple matter. As early as 19 November, the latest company in the prestigious Magnificent Seven group will present its financial results. It will be Nvidia, a company that has been the subject of more and more talk lately.

The cards are on the table. Investors expect the results to be weak - they need to be impressive to calm the markets. And that's going to be very difficult. Investors will focus primarily on the company's margins. If a nasty surprise comes in the form of falling margins, then the sell-off of November 13 will be little more than a prelude.