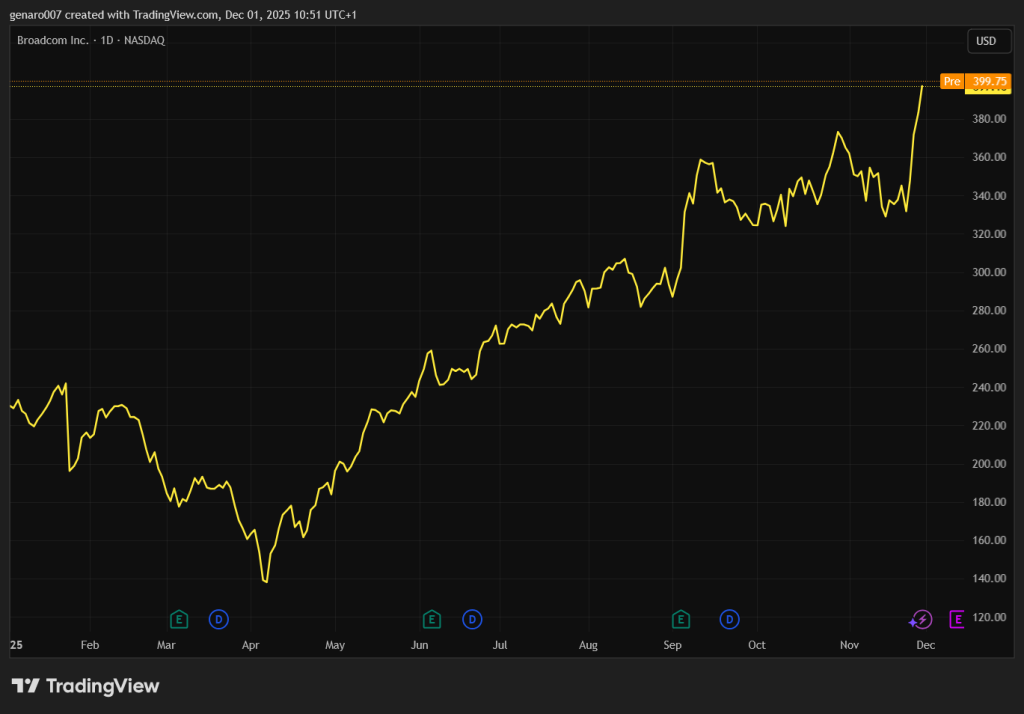

After the successful introduction of Gemini 3 by Alphabet came another bombshell - new Trillium chips and especially the TPU Ironwood designed to train Gemini 3 Pro. Shares of Broadcom, which is involved in production, immediately reacted to the news, adding more than 18 percent.

Meta, which has already announced that it will order these chips, was also happy. The only one who didn't look excited was, of course, Nvidia. The latter did issue a statement that it remains the technology leader despite Alphabet's progress, but the reality is different. The field of competition is getting tougher.

Nvidia may still have more than $150 billion in future contracts, and new ones are coming in, but soon it won't be the only choice. The big players will be able to choose between Nvidia, AMD, Intel, and most recently Alphabet. And when you add in potential Chinese competition, there could be a glut of supply in the market.

It's important to note one thing. Owning the best chips may be nice, but it doesn't generate wealth on its own. Chips are just quality shovels in a gold rush. Having the best shovels is a great foundation, but it still says nothing about how much gold is actually under the mountain. Technological maturity is one thing, return on a giant investment quite another.

Who will be the new head of the Fed?

Donald Trump already knows who he wants as Fed chief. But we'll have to wait and see. Treasury Secretary Scott Bessent handed the president a shortlist of five candidates. Kevin Hassett, Kevin Warsh, Chris Waller, Michelle Bowman and Rick Rieder.

It was Kevin Hassett who was added at the last minute and is currently considered the front-runner. He's one of Trump's staunchest allies who has been harshly critical of Jerome Powell all year, claiming that the Fed is deliberately not cutting rates because of the anti-Trumpism of its members. The markets have embraced his name with enthusiasm. Not because he's Trump's guy, but because he's likely to push rates as low and as fast as possible.

But Hassett's candidacy is not without risks. First and foremost, a Fed governor has to unite divergent views within the bank, and Hassett has made a lot of enemies over the past year just among the current central bankers.

The second problem is purely economic. As long as inflation remains above the two per cent target, no governor - not even the most loyal to Trump - will be able to just send rates to zero. Economic reality simply won't trump Trump loyalty. We should know the name of the new boss by Christmas.

Has the bear cycle in bitcoin really started yet?

The theory of halving cycles got confirmation in October 2025. Bitcoin reached a new ATH at 126 thousand dollars. However, many investors thought this was not enough and hoped for an even higher peak to come thanks to the US shutdown and other factors.

Those hopes proved to be false. Instead, a hard crash came. On November sixteenth, 2025, the proverbial death cross appeared on the chart. The fifty-day moving average crossed the two-hundred-day moving average to the downside. It was clear at that point that we would not see a new record any time soon.

It doesn't automatically spell disaster, but statistically it is very likely that the price will go lower until some really strong positive news comes along.

Bitcoin then indeed headed sharply lower. Catastrophe predictions and scare stories pushed the price even lower, but in the end the key support at $85k proved to hold. The price bounced back and returned above 90 thousand dollars.

Two things helped. The growing likelihood of a December rate cut by the Fed and speculation that Kevin Hassett would be the new governor, who would be friendly to risk assets like bitcoin.

However, the euphoria only lasted for a while. Since Monday morning, the price has been falling again and is currently hovering around $86,600. The most common explanation is speculation about a possible US military intervention in Venezuela. Any geopolitical uncertainty has a negative impact on bitcoin in the short term.

Whether the support at 85 thousand dollars will hold will be crucial for the future development. If it does, we could see consolidation. If not, the technical picture will deteriorate rapidly. In any case, according to halving cycles, we have about ten more months of relatively weaker performance ahead of us, so jumping on every growth bandwagon with the fear of missing the train is not exactly the best strategy.

On the contrary, more pronounced declines will attract long-term buyers, who see bitcoin primarily as an insurance policy against a dysfunctional fiat system and the endless indebtedness of advanced economies. Indeed, none of them have yet come up with a plan to ever pay off their debts. In this view, bitcoin and precious metals remain an attractive alternative.