Virtually nothing has happened on the markets since the beginning of the week. The US markets did set a new all-time high, but that is not unusual this year.

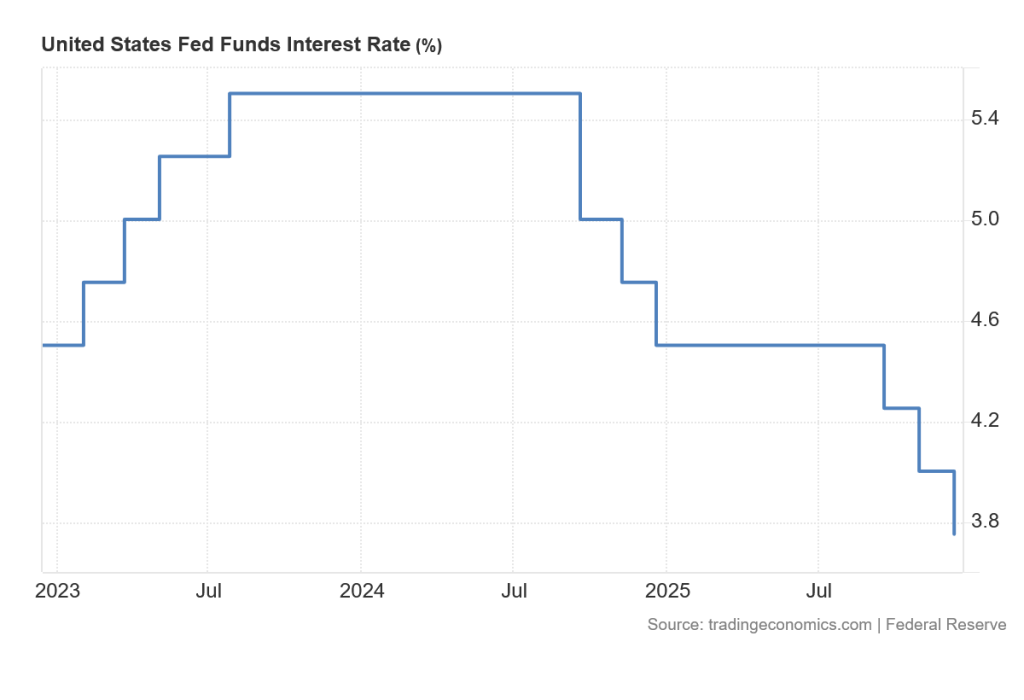

The reason for the calm was the anticipation of what the last meeting of the US Federal Reserve this year will bring. No one doubted that the Fed would cut rates by 25 basis points this time as well. This expectation was confirmed and no one was surprised. However, investors were waiting for the details, for the new economic projection and for news on whether the Fed would start buying US bonds again.

By its Wednesday meeting, the markets were virtually immobilized. For economic commentators, this situation is not at all easy, because there is a constant waiting game and nothing of substance is happening in the markets. The constant speculation about the Fed also makes no sense because the main question of whether rates will be cut was answered long ago.

So there is nothing to do but rely on studying the details. But even here there is a risk that their real impact on the stock or bond market will be minimal, even if they are quite strong.

The split in the banking board

As expected, the Fed cut rates. There was really nothing new here. What was new, however, was the cacophony among central bankers. They have two days to get their notes straight.

It has been a long-standing custom that the Bank Board voted unanimously after discussion. With the arrival of Stephen Miran in September, that changed forever. Once again, Trump's man on the board did not disappoint, voting to cut rates by a straight 50 basis points.

However, there were also a couple of central bankers who raised their hand in favour of leaving the Fed rates at their current level.

The Fed's banking board is increasingly divided. Even when a new boss arrives in May next year, it will have to resolve this divergence. The Fed chief has no veto power. He has only one vote like the others, but he should persuade the others rationally what is best for the Fed to do.

For ambiguity itself sends the signal that the situation is unreadable. And who better to understand the economic situation than central bankers? If even they don't know whether it is better to cut rates or leave them at current levels, then no one does.

A favourable macroeconomic projection

In addition to the outcome of the rate vote, the Fed's macroeconomic projection was released. And it is more than favourable. Anyone who thought that America was heading for a recession under Trump's leadership and the imposition of tariffs must be disappointed.

The Fed raised its estimate of GDP growth for the US economy next year from 1.8 per cent to 2.3 per cent. That's a big shift forward. Likewise, anyone who feared that artificial intelligence would start destroying jobs is, according to the Fed, worrying unjustifiably. U.S. unemployment is set to fall from 4.5 percent to 4.4 percent next year and then to a steady 4.2 percent in the years after that.

And as for the last figure to be monitored - inflation: it is to fall from the current 3 per cent to 2.5 per cent next year, and only in 2028 is it to fall to the long-awaited two per cent target. This is where the dog is buried. Even according to the Fed's projections, there is not much room for further rate cuts.

Even though US President Trump said on television the day before the US central bank meeting that when the institution's new governor arrives in May next year, it will cut rates. The projection for 2026, though, hints that rates could fall at some point during that year. So Powell may leave that one rate cut to his successor.

Here we come to the most important message of the Fed's December meeting. Even though macroeconomic indicators are not glowing red and do not require this bank's intervention, the Fed cut rates. In doing so, it merely confirmed that it stands behind the US market, the US President and supports the US economy, even though it does not have to.

When we add to this the fact that, following the end of quantitative tightening, the central bank has announced new purchases of USD 40 billion of US Treasuries per month in order to support the liquidity of the US banking sector, it is hard to imagine what more it could have done.

The Fed did not spoil Christmas for investors. Therefore, if nothing unexpected happens, the US S&P 500 index could surpass the psychological threshold of 7 thousand points before the end of the year.

The streaming saga to continue

When Donald Trump is involved in something, we can be sure that a story full of twists and turns awaits us. The White House boss warned last week that he had a bid from Netflix to take over some of the assets of Warner Bros. Discovery doesn't like it - mainly because it would create too powerful a player in the market.

Trump's sudden concern for competition in the streaming services field is almost touching. As always, however, the boundaries between politics and business are proving to be quite flexible with this American president.

Indeed, Paramount has come forward with a $108.4 billion bid to take over the entire company. The offer is thus 36 billion higher than the one offered by Netflix. The management of Warner Bros. Discovery thanked them for the offer and announced that they would study it, but for the time being nothing changes in their decision to go ahead with the merger with Netflix.

Paramount isn't just about the money, though. The company is backed by Trump's son-in-law Jared Kushner, funds from Saudi Arabia and Qatar, and the Ellison family. All of these bidders have one thing in common: an open door to the White House.

Having Trump in the pocket in the form of the US president could be a strong card in this duel. The problem is that the President is now arguing that a merger between Netflix and Warner Bros. would create too dominant a player and therefore the deal should not happen. However, if Warner Bros. absorbed Paramount, there would again be one very strong player.

According to the markets, Warner Bros. has emerged as the clear winner from the whole saga so far. The stock is close to the $30 price that corresponds to Paramount's offer, and has appreciated 177 percent since the beginning of the year. This is sure to please many Czech investors as well, as Warner Bros. shares are among the most frequently discussed investments among Czech users on the X network.

Shares of Paramount jumped a tenth after the announcement, while Netflix shares lost more than 3 percent. Wall Street thus assumes that having President Trump on its side will be crucial in the whole deal. So far, this story doesn't have an exactly scripted scenario. What is certain, however, is that there are many episodes to come before the final takeover of Warner Bros.