The end of the year is not exactly easy for investors. Markets are at a crossroads. However, it is not just a simple crossroads, but a straightforward, complex traffic junction where the high valuations of technology companies and the uncertain interest rate trajectory of most of the world's central banks intersect.

Add to this the not very legible developments in the commodities market, finding the right direction for one's portfolio is a tough nut to crack indeed.

Gold and silver are at all-time highs. These records indicate that investors want to hedge against risk by investing in precious metals. Add to that the fact that the price of US oil is at five-year lows, and it does not give much reason to be happy. The low oil price may please drivers, but it is also a reflection of the low demand for black gold in particular.

However, there is no indication that the coming year will offer a change in themes or resolve any of them. The opposite could be true. These themes will become increasingly complicated.

Oracle and Micron: contrasting signals from the AI sector

For the past week, investors have asked themselves several times in a row whether the time has come to take rich profits from technology companies. The reason for this move was the news that financial group Blue Owl Capital had not reached an agreement with Oracle to fund a new data centre project.

It was supposed to be a $10 billion investment. The two companies denied the information, but the markets decided to trade on the news and Oracle shares fell five per cent.

In fact, in recent weeks, Oracle shares have served as a barometer of how scared investors are of investing in artificial intelligence. The IT firm is plagued by large debts despite its considerable potential and a significant number of contracted projects. The company's debt is thus destroying the tech star's high margins.

The firm is at risk of being caught in a negative spiral as lenders lend to the firm at ever-higher interest rates. And in doing so, they will further chip away at the already low margins that Oracle achieves compared to other technology firms.

Oracle's net profit margin as of November 30, 2025 is 25.28 percent. As recently as five years ago, it was around 80 percent. For technology companies, margins of roughly 70 percent are common.

No wonder the situation around Oracle is getting investors' attention. An even bigger drop in the firm's margins could cause a correction in the entire sector, as the company would certainly pull out a number of other firms whose margins are declining because of high debt.

However, owners of Oracle shares might not be too bothered by the long-term gloomy outlook, as the stock rose again a day later as the IT giant acquired a five percent stake in TikTok US.

But it's just not easy to decide whether to see the sell-off in tech titles as an opportunity to buy cheap or to dump those investments. This story has been complicated by Micron's results.

Readers will know this company primarily as a maker of memory cards. But memory chips not only play a role in personal devices, they also have a key place in the data centers powering artificial intelligence.

Micron's track record matches this. Revenues climbed to $13.64 billion, beating analysts' expectations of $12.8 billion to $12.9 billion by a wide margin. Even more compelling was the profitability picture. Adjusted earnings per share came in at $4.78, while the market was only counting on $3.94.

The company announced that it has virtually sold out its entire production of data center chips for 2026. Demand for chips and upgrades is still strong. Micron's results clearly illustrate this.

The key question for AI investors, however, is not whether demand is strong or weak, but whether companies that invest massively in AI infrastructure will be able to finance these purchases over the long term. And Micron's results fail to give us a clear answer to that question.

Monetary policy: the ECB and the Bank of Japan

After the US Fed, two other important central banks also had meetings. The first was the ECB. No big surprises came here. The bank kept interest rates unchanged at two percent for the fourth time in a row.

Inflation may be below the inflation target, but there is no need to further stifle the European economy. In addition, the ECB has revised its outlook for European GDP this year to 1.4 percent instead of the 1.2 percent originally estimated.

These figures show that the ECB is now on rates that are close to neutral rates.

European central bankers are mostly very skeptical of further rate cuts. Officially, the ECB remains primarily dependent on macroeconomic data, and this has been the reason why speculation has begun to emerge that rates are more likely to rise rather than fall next year. We shall see.

This speculation is very premature for now. Given the high debt levels of most euro area Member States, it is unlikely that there will be a strong will for higher interest rates in Europe.

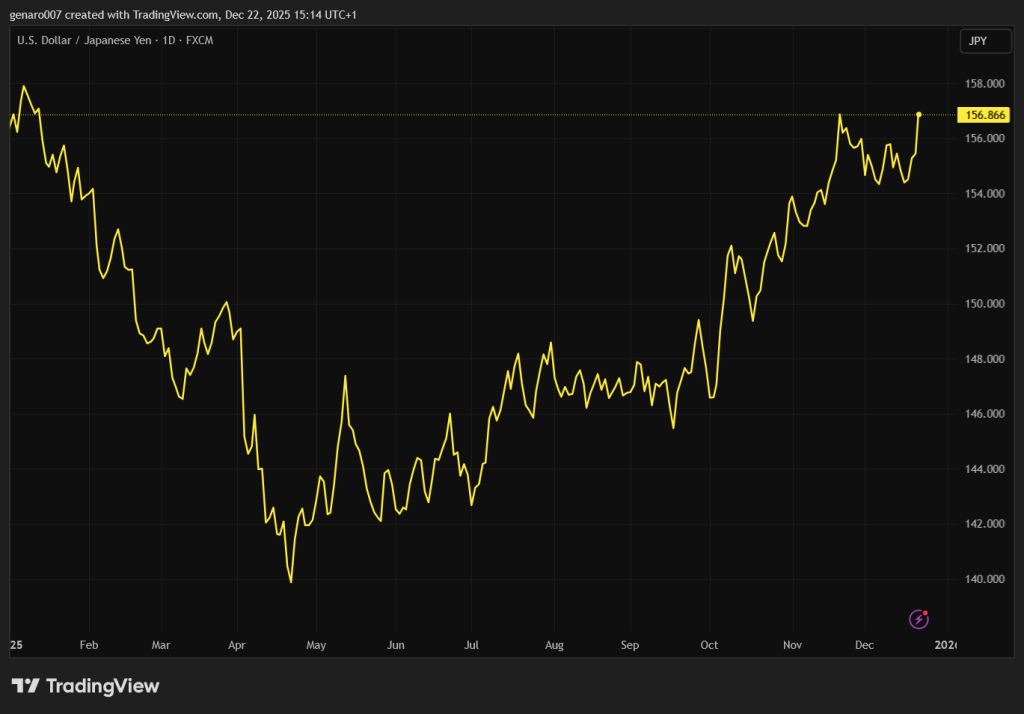

The situation is much more complex in Japan. The central bank there has raised interest rates to 0.75 per cent, as expected. The last time Japan experienced such high rates was in the summer of 1995. However, despite the rate hike, the Japanese yen continued to weaken. This is an unusual phenomenon, as a rate hike is usually accompanied by the opposite effect.

This reaction is mainly due to the Bank of Japan, which has chosen a not very happy communication strategy. In fact, Japanese central bankers admitted that it is not clear to them where the normative level of Japanese rates lies.

Despite the rate hike, Japanese monetary policy is loose. Markets like predictability, and in Japan's case, that is not very great.

Inflation remains very strong at around 2.9 per cent. Yields on Japanese ten-year bonds are at an unprecedented two per cent. It follows that even this huge yield on Japanese bonds will not cover inflation. A return to normality is therefore still a long way off in Japan.

At the same time, however, the central bank has not given a clear road map for further rate rises. Everyone agrees that rates should be raised, but when and by how much is in the stars. The Japanese have adopted a wait-and-see strategy and are hoping that the world and the financial markets will sort out the situation for them.