Investors typically use the end of the year for tax optimization and quietly closing out positions to improve their annual performance. Year-end trading volumes have typically been very low. Hopefully, investors have cleaned up their portfolios so they can start the year with a clean slate.

The entry into the new year 2026 was sharp. The kidnapping of the Venezuelan president will take its toll on the markets. Before we look at this event in more detail, let's recall two events that should not be overlooked.

Tesla no longer sells the most electric cars in the world

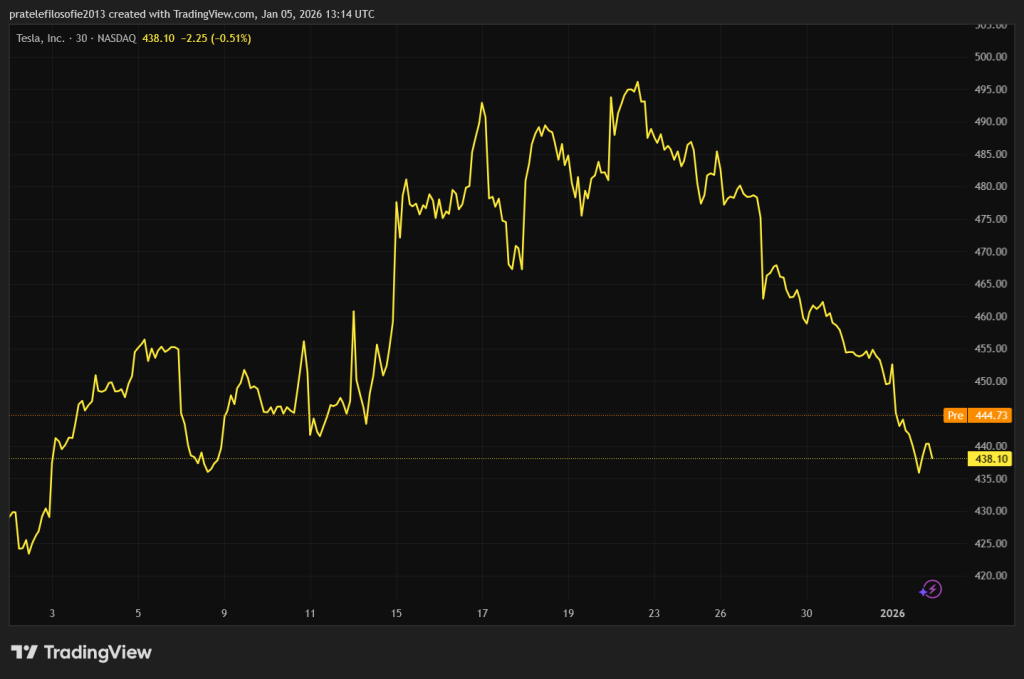

This year hasn't started well for Elon Musk fans either. Right off the edge of the year, we learned how many cars Tesla has sold. In the fourth quarter of 2025, Tesla delivered 418,227 cars. Year-over-year, the number of cars sold in that quarter fell 16 percent.

Total sales for 2025 reached 1.64 million cars. In terms of annual statistics, Tesla's sales are down for the second year in a row, down nine percent year-over-year. Tesla's stock responded to the announcement by falling 2.59 percent.

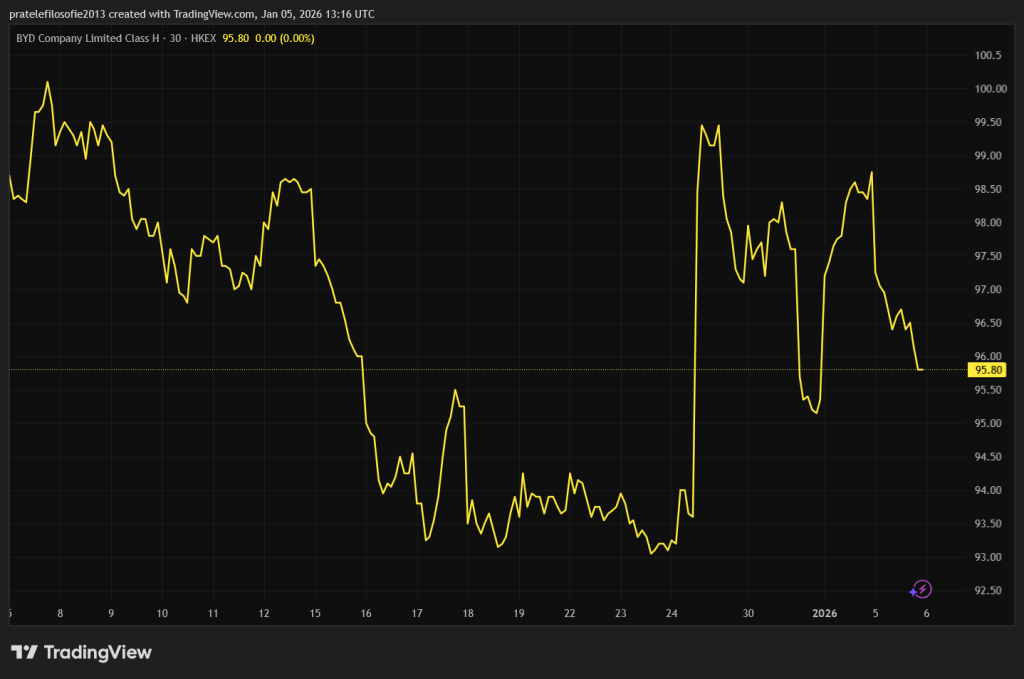

To make matters worse, Tesla's biggest Chinese competitor also released its numbers. BYD sold 2.26 million cars last year. While Tesla's sales volume is down year-over-year, its Chinese competitor's numbers continue to rise. Specifically, volume is up 28 percent.

On the other hand, BYD's shares jumped 3.6 percent on the Hong Kong stock exchange.

In addition, these figures need to be put into an overall context. While Tesla cars are selling in the Chinese market, we would look in vain for BYD electric cars in the US market. High tariffs and a possible deterioration in US-China relations are discouraging Chinese automakers from entering this market.

BYD wants to conquer Europe in the near future. The Szeged factory is expected to start full production in the second quarter of 2026. With Tesla's sales in Europe in long-term decline, BYD's situation is much easier.

Tesla will still have to come to terms with the fact that in the US it is no longer possible to claim a tax write-off on the purchase of an electric car. The end of the tax credit helped sales especially during the summer holidays. In 2026, Tesla can no longer count on improved demand from this source and will be forced to compete solely on price and product.

The pressure on Tesla will be enormous in 2026. Sales of electric cars will not grow, leaving Musk with only one option: to finally launch the long-awaited Robotaxi.

These are being deployed in a test facility in Austin, still with a safety monitor in the passenger seat. Musk, who is a master of communication and keeping investors interested, has hinted that these supervisors could soon be removed. However, he did not give an exact date.

It remains to be seen how long these vague promises to investors will last. On the other hand, Musk has always been able to wriggle out of all his problems, so there is no reason why he can't do it again this time.

Warren Buffett in retirement

The year 2025 is when legendary investor Warren Buffett's career will come to an end. At the age of 95, he is retiring as an investor just as he planned during the year.

Of course, no one is assuming that Buffett will stop caring about the markets altogether. Habits are hard to change at such an advanced age. Buffett will continue to share some insights from time to time.

One of the great strengths of this seasoned investor has been restraint. He did not lack patience or a certain skepticism towards the euphoria in the markets. Buffett never tried to surf the fashionable waves, but was always interested in the business model of a given company.

If a company's business model is sound, it is only a matter of time before that success is reflected in the financial markets. Look for undervalued stocks and sell them at the right time. It's a simple recipe, but a difficult one to follow.

Buffett remained true to himself in the last year of his active career. Even though the markets were rising thanks to artificial intelligence, he did not change his view of the situation. In his view, the markets have been overvalued for a very long time. There were no buying opportunities. Nothing influenced him in this belief.

And so he left his successor $358 billion in accounts.

The Fed is expected to continue cutting rates in 2026, so holding cash in the form of short-term U.S. Treasury bonds will not be as profitable. So Abel's successor will have to figure out where to park this large chunk of cash.

But if he is a faithful disciple of his mentor, it will be a gradual investment, not a hasty move or a one-horse bet, but a slow entry into a variety of stock titles.

The gradual market reaction to events in Venezuela

The only thing that can be said with certainty about what is happening in Venezuela is that it has been a very precise and successful operation on the part of the US. Part of the plan was to carry out this operation over the weekend in order to minimise panic on the world markets. That, too, was successful. Rather, the markets are waiting. The price of oil has even risen slightly. Brent crude was trading at 60.95 US dollars.

As late as Sunday evening, analysts expected the oil price to fall at the opening of the markets due to the increase in the supply of Venezuelan oil on the world markets. However, it soon became apparent that although Venezuela has the largest oil reserves in the world, its immediate impact on the oil market is very limited.

Venezuela's daily production is estimated at between one and 1.1 million barrels of oil per day. This is less than one percent of the world's daily production. The Maduro regime has failed to provide a technical solution to maximise the potential of Venezuelan oil.

Moreover, this oil is specific in that it is so-called heavy oil. It is suitable for the production of diesel and high-quality asphalt, but it needs special refineries. Its processing and sale will therefore be slow.

In the short to medium term, Venezuela will present new opportunities, particularly for US oil companies such as Exxon, Chevron and Occidental Petroleum, which will be able to invest massively in renewing production capacity. That is, if the US military can ensure political stability.