If you feel like Trump is everywhere, you might want to avoid the financial markets section. Donald Trump's actions completely overshadowed the CES consumer electronics show in Las Vegas, as well as the release of macroeconomic figures from the US labor market.

Despite the US president's constant reassurances, there are no signs of a major boom in the labor market yet. December's NonFarm Payrolls figures showed that only 50,000 new jobs were created in the US outside of agriculture. Analysts had expected at least 60,000. Even these figures do not correspond to the expected significant growth in US GDP.

Incidentally, the US foreign trade balance was also published. This statistic is key for the Trump administration. According to many, the long-term trade imbalance was one of the main causes of the relative impoverishment of the United States.

The economic content of the MAGA slogan basically boils down to the US exporting more than it imports. Trump wants to achieve this through two main tools: high trade tariffs and massive investments by foreign companies directly on American soil.

October's data brought great hope. The trade deficit fell to just $29.4 billion, the lowest level since 2009. The result significantly exceeded analysts' expectations, who had predicted a deficit of around $58 billion. These figures suggest that US GDP should accelerate its growth, as more is actually being produced in the US. Trump immediately hailed this as clear confirmation of the genius of his plan.

However, the question remains whether this exceptionally good result was a one-off – for example, due to extraordinary exports of precious metals. The decline in imports can also be interpreted as a sign of weaker domestic demand, which would be a rather negative sign. However, these macroeconomic considerations are not of much concern to anyone today, as Trump has captured all the attention. Last week, he launched three major battles on the financial markets.

First battle: Venezuelan oil

At the end of the week, Trump summoned all the heads of the American oil industry to his office. He explained to them that they would have to invest more than $100 billion in rebuilding Venezuela's oil infrastructure. However, this plan has not been met with much enthusiasm.

The head of ConocoPhillips pointed out that Venezuela still owes $12 billion for damages caused by nationalization. The head of Exxon described the country as uninvestable given the current security conditions.

Trump dismissed all objections. The White House will reportedly guarantee security itself, as it will be provided by the US military. This statement may have far-reaching consequences, as it suggests that the White House is counting on a direct military presence in the country. Exactly how the US plans to control Venezuela remotely while ensuring the safety of American engineers remains a mystery. In any case, the biggest winners in the whole Venezuelan business will be energy service companies such as Schlumberger and Halliburton, which will not have to invest their own capital but will supply technology, machinery, and services.

Second battle: the arms industry

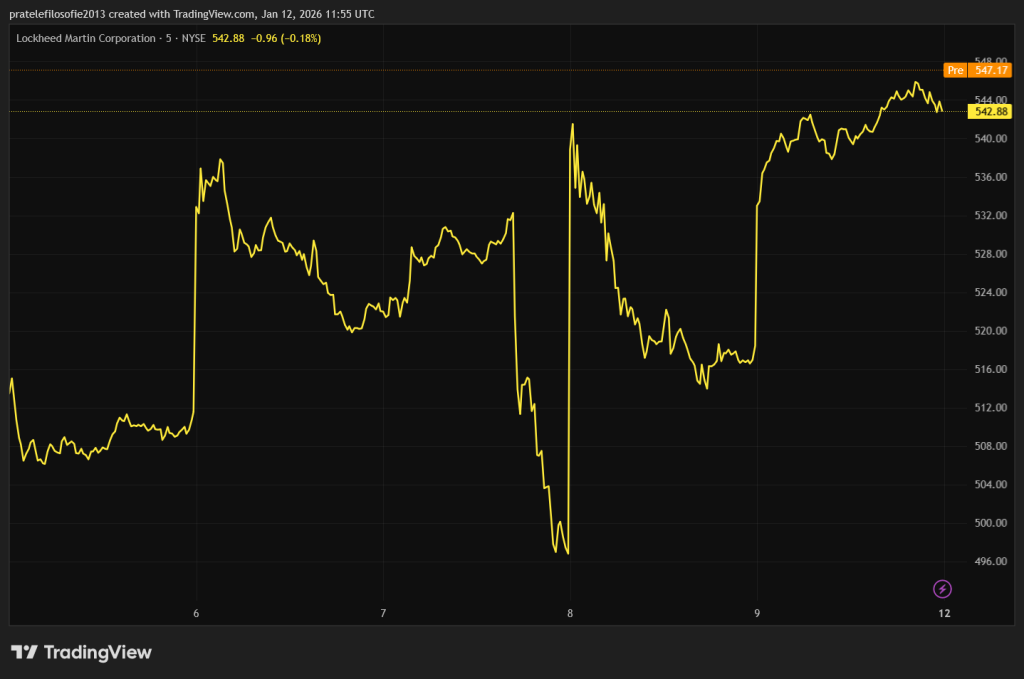

At the beginning of last week, Trump harshly criticized American arms companies. Instead of investing in new production capacity in the US, he said, they are paying out fat dividends, conducting massive share buybacks, and paying outrageous bonuses to their CEOs. Trump threatened strict regulations if the situation does not improve. These words caused panic among shareholders, and the shares of key players fell sharply.

However, the next day brought a reversal. Trump asked Congress to increase the defense budget for 2027 to $1.5 trillion—approximately 50 percent more than this year's record $901 billion. This will supposedly ensure America's absolute military dominance, at least in terms of military spending. Arms manufacturers' shares, of course, immediately headed upwards.

No one seems to mind that it is unclear where the US will get the money for such an increase. The item for servicing the national debt is already almost on par with defense spending, and another massive increase in the Pentagon's budget will only reinforce this trend.

Third match: the standard of living of ordinary Americans

The consequences of Trump's foreign and economic policies will prolong the period of instability , which is never good for the general population. As in the rest of the Western world, the rising cost of living remains a major problem in the US. Trump has decided to take action here as well.

First, he ordered government agencies to buy back more than $200 billion in mortgage debt in order to lower mortgage interest rates, which are currently around 6 percent. Critics have questioned this move, saying that the costs are high and the effect limited—interest rates are expected to fall by only a quarter of a percentage point.

However, the US president did not stop at mortgages. Credit cards with interest rates of 20 to 30 percent are a major problem in the American lifestyle. For many Americans, it is common to have several cards and to pay off debts with new debts.

Trump came up with the idea of limiting credit card interest rates to 10 percent. While this would significantly help many people, it would also greatly complicate the lives of the least creditworthy customers. With 10 percent interest rates, banks would have to assess creditworthiness much more strictly, so many ordinary Americans would not be able to obtain credit at all.

This gesture is surprising because it strongly contradicts the traditional Republican view of the free market and restricts market freedom. It seems to be more of a populist move ahead of the upcoming elections.

In any case, this week marks the start of the earnings season for the fourth quarter of 2025 in the US. As usual, it will be opened by the financial sector, led by giants such as JPMorgan, Goldman Sachs, and BlackRock. Let's hope that the figures and press conferences will be interesting, at least for a while, and allow us to focus on something other than the US president's constant ideas.