Europeans who follow the financial markets mostly belong to a small group of financially literate people. Although the performance of European stock markets is an important indicator of the health of the economy, it rarely becomes a broad political issue.

In the United States, the relationship between politics and stock markets is much more direct, and the numbers clearly show this. More than 55 percent of Americans own stocks, either directly or through pension funds. In France, it is roughly 15 percent of the population. American stock markets are therefore not only a barometer of the economy, but also a political indicator that affects the majority of voters.

The stock market as a mirror of retirement security

In a somewhat exaggerated sense, it can be said that the curve of US stock market indices – whether the technology-heavy Nasdaq or the industrial Dow Jones – shows how successful pension reform has been in the United States.

Most Americans own shares as a form of security in old age. Wall Street is no longer just a matter for wealthy investment groups, but also a barometer of what pensions nurses, firefighters, or power plant employees will receive.

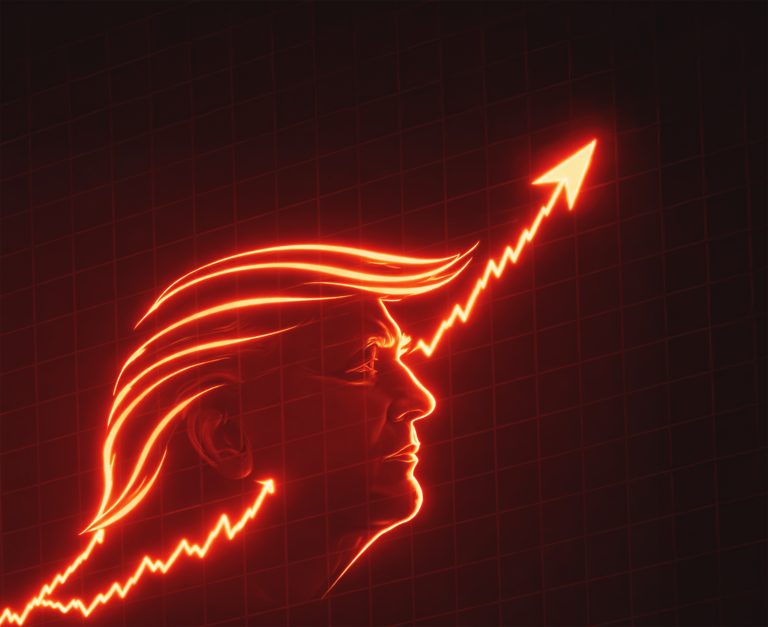

The US president is thus in the grip of Wall Street and now also Main Street. Everyone expects him to ensure that American markets grow. Trump, who wants to be remembered fondly and have historians praise his economic contribution to the development of the US, must necessarily take investors' interests into account. Trump's slogan, "Make America Great Again," must necessarily include "Make Wall Street Great Again."

The contradiction between the globalized market and economic nationalism

However, this is where a fundamental contradiction in the entire system arises. The success of Wall Street and the Make America Great Again agenda are proving to be difficult to reconcile in practice. The policy of economic nationalism clashes with the reality of the US stock market, where the biggest winners are deeply globalized.

A good example is Apple, one of the world's most valuable companies and a key pillar of US stock indices. Approximately 90 percent of iPhones are still manufactured in China, mainly by suppliers such as Foxconn.

The United States remains Apple's most important market, accounting for roughly 40 percent of its total sales. Apple's margins are huge. Markets are pushing for the entire supply chain to continue functioning.

However, there is a catch. America is gradually getting rid of its own industry and becoming dependent on Chinese manufacturers. Of course, over time, these manufacturers are pushing for a larger share of the profits. This model is proving unsustainable. In the short term, it has calmed the markets and pushed the shares of companies such as Apple to new highs, but in the long term, it reinforces the United States' dependence on manufacturing capacities beyond its control.

A bet on the long term and a subsequent turnaround

The White House chief has decided to at least try to solve this problem, which is to his credit. He took an unexpected step for today's politician by prioritizing the long-term perspective over the short-term one. Continuing in the same vein, i.e., with a very negative foreign trade balance, would only lead to further impoverishment of the US.

He therefore decided on a radical solution in the form of Liberation Day, which introduced tariffs on imported goods. This was an attack on the main idol of the global world – free trade. And that is why, on April 2, 2025, a sell-off began on the stock markets. At first, it seemed that Trump had declared war on Wall Street on behalf of ordinary Americans who wanted to buy primarily American products.

In the early days, Trump made the situation worse by downplaying the slump in the American financial markets. The hard core of MAGA rejoiced that they finally had a president who was capable of standing up to the "almighty" Wall Street. American indices lost more than 20 percent since Donald Trump entered the White House.

It was only when the bond market—which is several times larger than the stock market—began to collapse that Trump reversed course and announced a pause in his tariff policy on April 9. He then decided to negotiate with each country individually.

At the same time, he urged Americans that now was the time to buy stocks. Those who listened to President Trump reaped fabulous rewards. The S&P 500 index gained a very respectable 40 percent from its low on April 9 to the end of last year. From this perspective, most investors are very satisfied. The S&P 500 index posted a 16.4 percent gain for the year, which can be considered a very good year in terms of long-term statistics.

However, the question remains as to how to evaluate Trump's turnaround on April 9. At first, it was a disappointment for many of his staunch supporters. With hindsight, however, we must admit that he managed to solve a seemingly unsolvable equation. He introduced tariffs and the markets ultimately rose.

Presidential cycles and outlook for the rest of his term

Trump need not be sad that, after just 100 days, he did not look like a successful president from Wall Street's perspective. On the contrary, at that moment, he was the third worst American president in history, as the markets had fallen by eight percent. Despite this poor result, however, he did not give up. His tenacity is a trait that many political opponents and commentators continue to overlook.

American stock traders have their theories about everything. Presidential cycles are no exception. The theory was developed in the Stock Trader's Almanac. It works with statistical figures that show that the second presidential year tends to be weak for the stock markets.

Since 1940, the S&P 500 index has gained an average of 4.2 percent during the second year of a presidential term. Its long-term average annual return is around nine percent.

After the first year, when the new administration benefits from optimism or expectations of better times, the second year arrives, which gives room for unpopular decisions. It is important to make them at the beginning of the year so that their impact is as small as possible before the upcoming midterm elections. After the elections, the presidential term enters its second half, which is usually a time of abundance.

The cards have been dealt. In Trump's case, he has two years left, during which he can focus primarily on his legacy and image for future generations. From a historical statistics perspective, we can therefore expect more prosperous times on the US markets with Trump.

Paradoxically, the first year of Trump's term proved successful for the markets precisely because of his U-turn. It cannot be said that he is guided by the stock market, but when market reality became too strong, he could not ignore it. This experience may reassure investors: in the event of a significant correction, a political response can be expected, but not automatic support for every decline.