Donald Trump continues his grand journey in 2026. With the anniversary of his first year in the White House approaching, he has prepared several changes that will affect ordinary Americans.

Probably the biggest news was the announcement of a 10 percent cap on credit card interest rates. This statement caused panic among service providers and credit card operators. The most affected stocks were those of Capital One Financial, Synchrony Financial, and the well-known American Express.

However, the day after the announcement, it became clear that the US president would have to get this measure through Congress. This will almost certainly not happen before January 20. In addition, the banking lobby is extremely powerful, so it will be very difficult to obtain a majority in Congress.

We can expect at least a significant delay. It is unclear exactly how Trump intends to push this through. Perhaps he will find some non-standard way. However, this would once again confirm that the White House chief has usurped more and more power, which poses a risk to both American society and the American economy.

Pressure on Powell and the Fed's independence

This risk became clear at the beginning of this week. The US Department of Justice has begun to take an interest in Federal Reserve Chairman Jerome Powell. The subject of interest is the overpriced renovation of the Fed's headquarters.

The authorities suspect Powell of overpricing the construction work by more than $700 million. This is not a new issue. President Trump personally addressed these allegations to Powell during a visit to the Fed. Powell responded very quickly and refuted the allegations relatively convincingly. However, this was apparently not enough for the authorities.

After the announcement that Powell was being investigated by the Justice Department, panic swept through the markets. This is a clear signal that Trump is influencing an institution that should remain independent. Trump blames Powell for not lowering interest rates quickly enough.

However, the governor of the central bank should not lower rates at the president's request, but based on macroeconomic data such as inflation and unemployment rates. Undermining confidence in the Fed at a time when US debt is reaching record levels is not exactly the best idea.

Powell, who is otherwise extremely unemotional, decided to respond this time. He denied all accusations and, for the first time, openly pointed the finger at President Trump, whom he considers to be the source of pressure on him. The situation frightened not only the markets but also some Republican congressmen. Undermining confidence in the Fed is a very risky move indeed. Even Treasury Secretary Scott Bessent has expressed strong displeasure at the possibility of legal action against Jerome Powell.

Moreover, the whole accusation does not make much sense. Powell's term ends in May 2026. By the time any trial began and reached a conclusion, Powell would long since have left office. So it can be seen more as a message to the future Fed governor. And that really threatens the independence of the central bank. Trump, as usual, when there is too strong a negative reaction, backtracked. He denied that he was behind the US Justice Department's investigation.

Trump's mistake about Powell's omnipotence

However, this statement does not change the fact that Trump has been bullying Powell for a long time. Just remember his derogatory nickname, Mr. Too Late. Trump is harming himself with this approach, because his criticism of the Fed regarding interest rates only reveals his ignorance of the issue.

The claim that if Powell lowered rates by one percentage point, it would save America a billion dollars a day in debt servicing is exaggerated, if not absurd. The bond market does not respond only to changes in short-term rates. For long-term bonds, investors also factor inflation expectations into the yield.

And if the Fed were to aggressively loosen monetary policy, inflation would likely rise in the coming years, leading to higher interest rates in the future. Add to this the unsustainability of US debt, and it is logical that creditors will demand higher yields from the US.

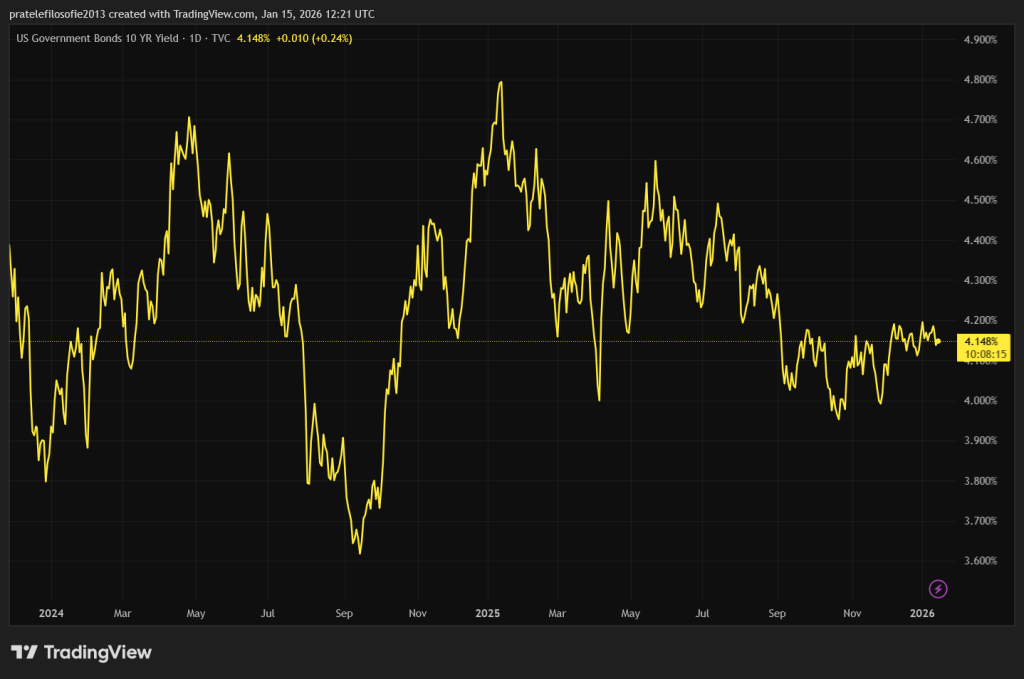

This phenomenon can already be seen today. US bond yields are roughly at the same level as in October 2024, despite the Fed cutting rates by around 1.25 percentage points. The aggressive rate cuts demanded by the president could therefore have the opposite effect.

However, the markets have once again demonstrated their proven strategy of buying the dip. For many, the decline is an opportunity to buy more. So far, this strategy has always paid off. And in the case of the Trump versus Powell clash, it was no different.

Markets will become increasingly immune to the president's statements. It appears that many of them have no real basis. The question of whether there is a well-thought-out strategy behind this is becoming increasingly urgent. So far, it looks like Trump is creating artificial chaos. As its creator, he understands it better than others and is taking advantage of it. However, this style of governance cannot be sustained in the long term.

Gold, silver, and market reactions

The price of gold and silver has benefited from the confusion surrounding Powell, geopolitical uncertainty about a possible attack on Iran, and the absence of a concrete solution in Venezuela. It even shot above $93 per ounce. The silver market is thus in full swing.

Since the beginning of this year, silver has strengthened by an incredible 30 percent. That is really a lot. Holders of this metal are enthusiastic, but such rapid growth signals either the emergence of another speculative bubble or a significant imbalance in the market for this commodity. Neither option is healthy for the market.

Alphabet surpassed the $4 trillion mark

Fortunately, the financial markets offer other news besides what is happening around President Trump. Alphabet (Facebook) has managed to break through the psychological barrier of $4 trillion in market capitalization.

The tech giant is now in second place, just behind Nvidia. Paradoxically, it has overtaken Apple. The impetus for Alphabet's stock growth came after the announcement that Apple will use a model and infrastructure based on Gemini for the new generation of its AI agent Siri.

This could be a classic win-win situation. Apple is trying to convince investors that its lag in artificial intelligence is a thing of the past. At the same time, this is very good news for Google, confirming the technical sophistication of the Gemini model.

The differences between ChatGPT and Gemini are now minimal. Google has a real chance to dethrone OpenAI. Developments in the field of artificial intelligence show that maintaining a significant technological lead is extremely difficult at present.

Events have taken a very rapid turn in the world and on the stock market. We are only halfway through the first month of the new year, and a lot has already happened. That is why it is important to remember that in the long run, it is those who keep a cool head and stick to their plan who win on the stock market.