From an economic perspective, Europe is in the worst situation compared to China and the United States. The country of the dragon still has cheap labor and is catching up with the US in terms of technological progress.

The US economy is driven primarily by technology companies and large corporations across all sectors. Europe has very few companies and sectors in which it truly dominates.

This week, two important European companies published their results: luxury giant LVMH (Louis Vuitton Moët Hennessy) and Dutch company ASML. Both have a significant impact on the economic health of Europe.

LVMH as a benchmark

France's LVMH is primarily the strongest player in the luxury goods sector. That is why, according to Forbes, the company's owner, Bernard Arnault, is the fifth richest person on the planet, with his family's private assets totaling €178 billion last year.

This sector was the last to resist the influence of globalization for a long time. Luxury is based on quality, and expensive European labor is still worthwhile here. LVMH's results as the sector leader therefore serve as a key indicator of the health of the entire industry.

Unfortunately for Europe, this sector is not going through an easy period. Trump's tariffs were a blow to the industry. Moreover, there is a shadow of doubt hanging over it that tariffs may increase significantly.

We have already seen this in the case of Greenland, where Donald Trump's first response was to increase tariffs on countries that did not approve of his plan. LVMH shares reacted negatively to this news. Investors wondered whether the decline would continue after the results were published.

Unfortunately for the luxury industry, the answer is yes. LVMH shares fell by more than 7.8 percent in response to the economic results. The group's full-year sales reached €80.8 billion, which was €300 million more than analysts had expected. However, year-on-year sales fell by five percent.

The results on paper do not look disastrous, especially as the last quarter of the year showed a solid improvement. So how can such a sharp drop in shares be explained?

Given the problems with tariffs and weak demand from Chinese customers, this decline was expected. The combination of falling sales and rising costs also affected operating profit, which fell by nine percent year-on-year to €17.8 billion.

Perhaps this statement by Europe's richest man, Bernard Arnault, is to blame: "One thing I am sure of: the desire for high-quality products goes hand in hand with rising living standards around the world."

Given the tense geopolitical and economic situation, the high government deficits of virtually all Western governments, and the absence of prospects for a major economic boom in 2026, investors were primarily overcome by concerns and fears that Donald Trump is prepared to impose tariffs on this very important sector for Europe.

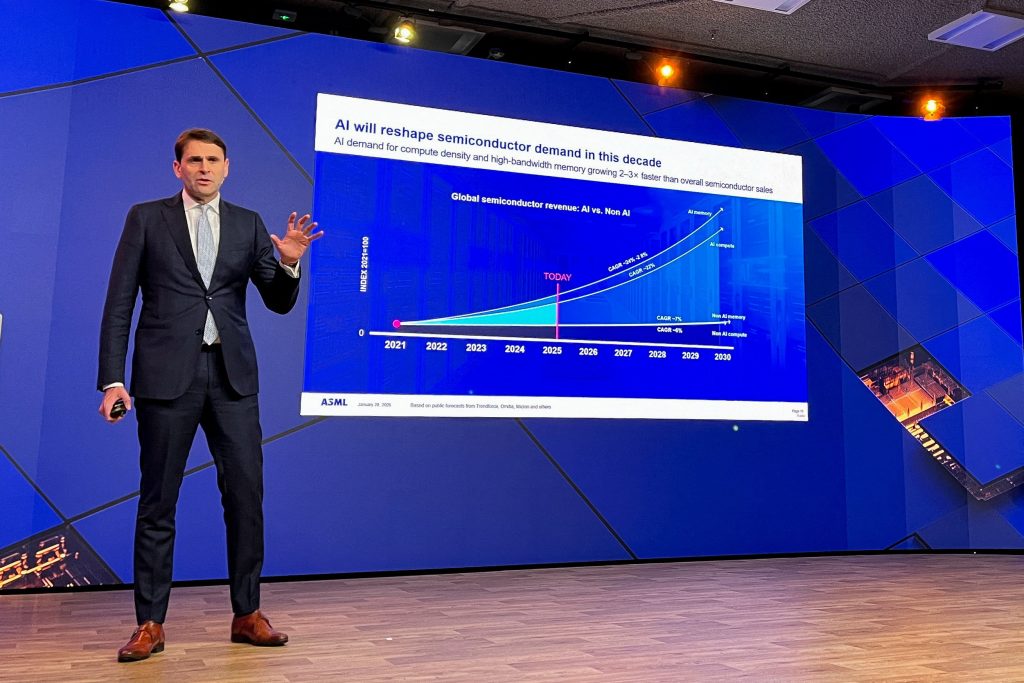

ASML – an important link in the artificial intelligence chain

ASML's position is completely different. It is not that this company determines what happens in the entire sector, but it is irreplaceable in the chip production chain. As a manufacturer of lithography machines, it represents the only bottleneck in the production of chips for artificial intelligence. The importance of ASML will therefore continue to grow in the future.

The company ended the last quarter of 2025 in style. Sales were record-breaking, and new orders significantly exceeded analysts' expectations. The development of new orders is crucial for ASML because it allows the company to plan far into the future, which is an unprecedented luxury in the artificial intelligence sector. Orders reached €13.16 billion.

The publication of Taiwan Semiconductor Manufacturing Company (TSMC)'s financial results also foreshadowed good results. The Taiwanese company announced record investments in production capacity in the coming years, including the opening of several plants in the US. These factories will necessarily be equipped with ASML equipment. The company's management remains very optimistic about 2026, with revenues expected to reach €34 to €39 billion, compared to €32.67 billion in 2025.

Despite a record year, ASML will not be able to avoid layoffs. The company plans to cut approximately 1,700 jobs, mainly in the technology and IT departments, primarily in the Netherlands and partly in the US. This news is, of course, bad for employees and for the European economy in general, but it will please shareholders.

The second reason for joy is a massive share buyback program, on which the company's management plans to spend up to €12 billion by 2028. No wonder ASML shares have gained 21.1 percent since the beginning of the year.

US insurance sector under fire

This market overview would not be complete without mentioning Donald Trump. The US president has decided to open another front and fight for more efficient use of public funds. In addition to reducing the national debt, he plans to significantly increase defense spending next year. Many have asked where Washington will get the money for this. The answer came quickly.

On Monday evening, the Centers for Medicare and Medicaid Services proposed an average increase of only 0.09 percent in payments to private Medicare Advantage plans for next year. Payments typically increased by four to six percent annually.

The entire health insurance sector experienced a sharp decline. Shares of companies such as Elevance, CVS, and Humana fell to annual lows. The biggest drop—by as much as a fifth—was recorded by UnitedHealth, which had the misfortune of publishing its results on that very day. And they were not so favorable.

Health insurance is one of the most defensive sectors. Such an unprecedented shock will force many investors to reevaluate its role in their portfolios. UnitedHealth Group has long symbolized this stability. However, last year, its shares fell sharply after the resignation of CEO Andrew Witty. At that time, they became so cheap that they attracted even Warren Buffett. Now they are on sale again.

Investors are therefore asking themselves whether now is the time to buy. Those who answer in the affirmative are assuming that this is a classic Trump tactic: first cause maximum shock with a small increase in payments and then negotiate. The length of the negotiations will be key.

If both sides agree quickly, we can expect an early turnaround in the share prices of US health insurers. If not, there is a risk of a bitter war between the White House and the industry. Trump has a good chance of scoring political points in such a clash; all he has to do is put pressure on the link between the federal budget and ordinary people.