Last week may go down in stock market history. During Friday's session, silver weakened by as much as 38 percent at one point and ultimately closed the trading day with a loss of 26 percent.

Silver thus recorded a sharper decline than during its most famous crisis in 1980. Gold ultimately lost only nine percent, but fell by 13 percent during the session. This is something you don't see every day. Moreover, there was no clear catalyst for this event.

Of course, as always, there were far more sellers than buyers on the market. The markets panicked. It's the same as when a fire breaks out in a full movie theater. The likelihood of being trampled by the crowd is enormous. And this also applies to the stock market. When everyone decides to press the sell button at the same time, we witness exactly such trading sessions. It is important to understand what happened.

Fed meetings and Powell's truth

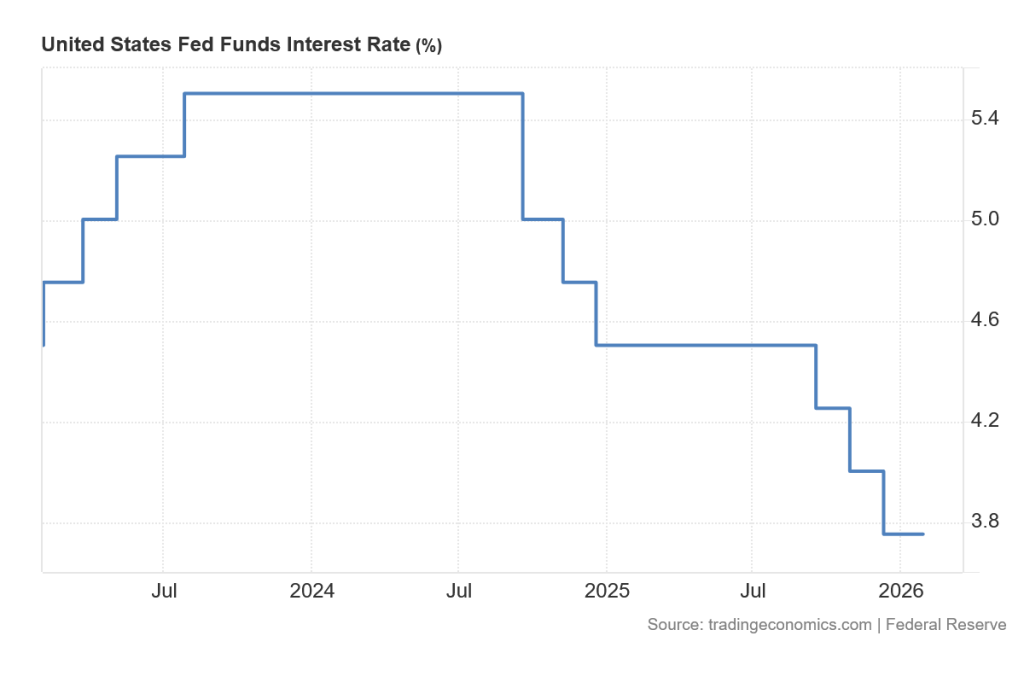

Let's start with the Fed meeting. Unsurprisingly, it left rates unchanged. Looking at the huge 4.4 percent growth in US GDP at the end of the year and inflation that is still not heading towards the 2 percent target, Powell and most of the central bank's board could not cut rates.

There were exceptions, with two members voting for lower rates in line with the US president's wishes. This is more a political order than a real reason to cut rates. Moreover, if this Friday's January unemployment figures confirm the downward trend, Jerome Powell may not have to cut rates at all before the end of his term as Fed chairman [mid-May, ed.].

Since it was known in advance that rates would remain at the same level and the Fed did not publish an update to its macroeconomic projection at this meeting, investors only had the press conference to go on.

On Polymarket, it was even possible to bet on what Powell would say. That's how closely his every word is scrutinized. The outgoing Fed chief did not disappoint the press conference participants, as he bluntly stated that US debt is unsustainable. It's not that everyone didn't know this, but it's an unpleasant truth that no one wants to hear.

Powell's statement was a symbolic jab at Donald Trump. Despite his efforts and the introduction of tariffs, the debt problem remains and will not be solved easily. More radical steps will be needed.

The market reacted to this news with further increases in the prices of gold and silver. Problems with government debt are the main driver of growth. The problem of large debt, especially when it is not adequately addressed, will more or less always end in currency devaluation. And precious metals remain a safeguard against currency weakening. Gold thus peaked on Thursday.

An unpleasant surprise from Microsoft

Until now, buying Microsoft shares was a safe bet in the field of artificial intelligence (AI). Thanks to its robust business model, this technology giant can afford to invest astronomical sums in its development.

Thanks to the extreme diversification of its services and broad user base, it can leverage AI elements for better profitability. Even if the development of artificial intelligence stagnates, a company like Microsoft is very well equipped to absorb shocks. At least it has been until now.

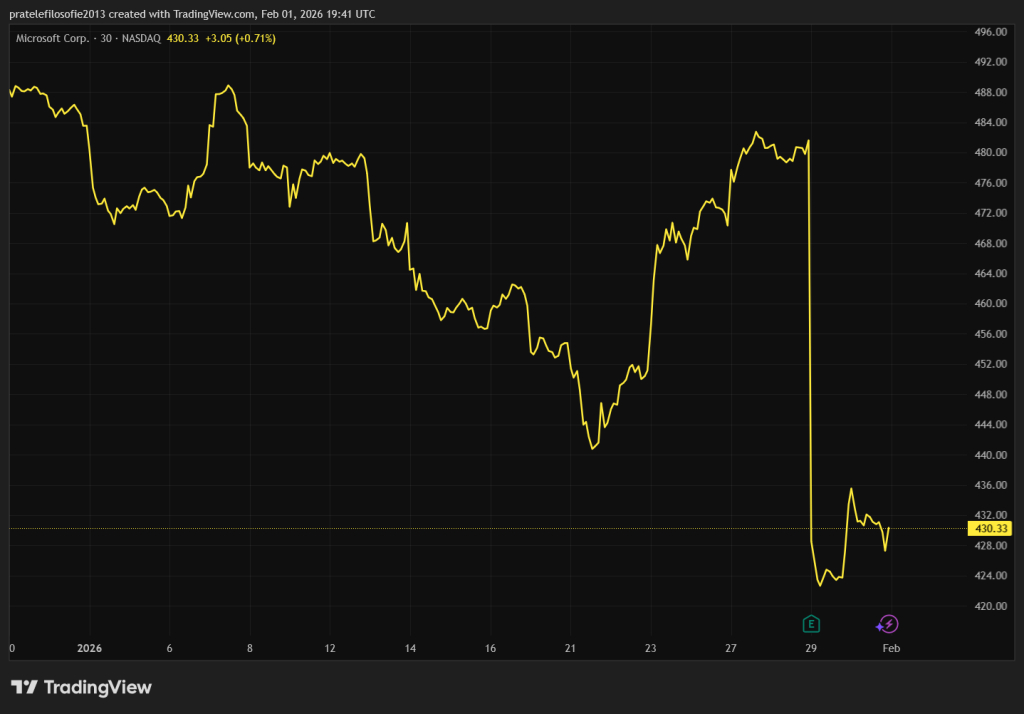

The numbers themselves were great. The company reported adjusted earnings of $4.14, which was more than the expected $3.91. Revenue reached $81.3 billion, compared to expectations of $80.3 billion. Despite the great numbers, Microsoft shares lost 6.7 percent in premarket trading immediately after the results were announced.

This unexpected decline can be explained by the fact that revenue from the Azure division, i.e., cloud services, the segment most closely linked to artificial intelligence, grew by only 39 percent. The markets had expected 40 percent. This seems, of course, like an exaggerated reaction, but it must be considered in the context of Meta's results, which were published at the same time.

Meta's financial results were much worse than expected. Despite this, Meta's shares recorded strong growth. The reason for this was artificial intelligence, because thanks to it, Facebook offers people more personalized content, which increases the amount of time they spend on the social network.

And the more time users spend viewing their feed, the more money Meta makes. According to its own data, the use of artificial intelligence has helped the company achieve an 18 percent increase in the number of ad impressions.

Tech giant Meta, like Microsoft, is investing huge sums in AI, but in Meta's case, the results are already coming in. Despite all its efforts and invested resources, Microsoft has not significantly accelerated the growth of its cloud services.

Investors now expect the money spent to bear fruit as early as this quarter. At Microsoft, profits can be expected in the future, but investors are no longer willing to wait. How is Microsoft's price slump related to gold and silver?

A chain reaction of panic

Microsoft's unexpected sharp decline forced all investors to close their bets on the company's stock growth. In order to cover these loss-making leveraged trades, investors decided to take profits on gold. It was this unexpected move that sent the gold and silver markets into a state of panic. Emotions then took over the sell-off. When everyone wants to flee, we can witness such large sales.

It is humanly understandable that those who bought gold for the first time this week with the expectation that this investment would grow at the same pace as in 2025, and then saw a huge drop in price, decided to throw in the towel and get rid of their gold and silver.

The final blow to gold and silver was Trump's nomination of Kevin Warsh to head the Fed. His appointment still has to be approved by the Senate. This came as a surprise to the markets, as Warsh was one of the most hawkish candidates [preferring to fight inflation over supporting economic growth, ed.

It was expected that the White House would reach for more loyal candidates. However, despite his previously declared hawkish position, a radical change of opinion could have been a condition for his nomination. It was this uncertainty that convinced the markets that everything could be even more complicated than it seems at first glance. However, if Warsh remains more hawkish, this is bad news for gold.

Fundamentals remain unchanged

On the other hand, the fundamental reasons for the rise in the price of gold, i.e., the US national debt problem, remain unchanged. Gold remains in a long-term growth channel. For the trend to change, the price of gold would have to fall below $4,200 per troy ounce. We are still a long way from this threshold.

Tension and fear in the market are palpable. As a result, investors may very quickly take gold into their favor. The increase in tension is also illustrated by the strengthening of the Swiss franc, which investors also choose as a safe haven. If this trend continues, we may see the Swiss central bank dust off the concept of negative interest rates.

To make matters worse, Bitcoin weakened significantly over the weekend. Its price stopped at $77,000. The fall of Bitcoin dragged down all other cryptocurrencies. Warsh's name was again mentioned as the reason for the declines.

This is a somewhat absurd reason, if we disregard the element of surprise and the prospect of a slightly more hawkish policy than expected. Warsh has spoken positively about Bitcoin in the past and viewed it as the "policeman" of monetary policy before politicians. This is true to a certain extent.

The decline in the price of bitcoin thus remains something of a mystery. Perhaps it is just a confirmation of halving cycles and the fact that we have entered a bear market. Or more precisely, we have been in it since the fall of 2025.

The biggest question is whether the sell-off will spill over from the commodity market and cryptocurrencies to the stock market. This week could therefore be very busy on the markets.