Every empire believes that its currency is eternal until the world begins to appreciate alternatives. America is not only a country with the most modern army and technological giants that dominate the world; the US dollar is also an important pillar of power.

Its advantage over other indicators, such as the military, whose real strength can only be measured in combat, is that the strength of the US dollar can be assessed almost immediately in several ways. The easiest is the dollar's representation as a reserve currency in central banks around the world.

However, it is not just a matter of measuring the strength of the US dollar and rejoicing or mourning the collapse of the American empire. Currency has become a battleground.

For many, the process of the world's de-dollarization has become a key issue, heralding the almost certain fall of the American empire. However, this view is highly ideological and prevents a rational understanding of the whole process.

The decline of the dollar is causing problems for the American economy, which, of course, increases tension in American society. However, this is a gradual process. The US dollar will not disappear overnight.

It may lose a significant amount of its value, but this will enable the US to solve its debt problem. So, paradoxically, the much-heralded end of the dollar may be beneficial. No one today doubts that a weak dollar is Donald Trump's wish and goal. The goal is to weaken it so that America can become strong again. Understanding and interpreting this process is far from easy.

The rise and transformation of the American currency

The rise of the US dollar was not the result of monetary innovation, but of a geopolitical shift. After World War I, the United States became the world's main creditor and accumulated most of the global gold reserves, while Europe dealt with debt and reconstruction.

The key moment came in 1944 at Bretton Woods, where the dollar was established as the anchor of the post-war monetary system. The US dollar was pegged to the gold standard at a fixed rate of $35 per ounce.

A monetary earthquake came in 1971 when the US unilaterally abolished the gold standard. The dominance of the US dollar was transformed into the petrodollar. Demand for the dollar was guaranteed by the fact that anyone who wanted to buy oil, which all economies need, had to have a large supply of dollars in their central bank reserves.

The dominance of the dollar did not disappear with the departure from the gold standard. It simply ceased to be a currency backed by gold and became the infrastructure of the global economy. As a result, the dollar became even more susceptible to the fate of globalization. And that is in short supply in today's world.

The first signs that the dollar was losing its power came with the financial crisis of 2008. The banking crisis undermined confidence in the globalization model based on free capital and cheap supply chains. The real turning point came with Brexit and the first election of Donald Trump. The COVID-19 pandemic accelerated the whole process. The war in Ukraine in 2022 triggered deglobalization. World trade did not collapse, but it created geopolitical blocs that trade among themselves in their own currencies. They no longer need the dollar. However, it should be reiterated that this is only a weakening of the dollar, not its demise.

A victim of its own success

The US dollar can also be seen as a victim of its own success. The US financial system remains robust precisely because the world continues to show interest in the dollar. Even during periods of rapidly growing debt, the United States had no problem financing its deficits. Demand for US bonds remained high and interest rates relatively low.

It is often argued that this makes the US dependent on its creditors. In reality, however, the opposite paradox applies. The larger and more systemically important US debt is, the more sensitive its holders are to its stability. US debt is therefore not only a manifestation of fiscal weakness, but also a consequence of the global role of the dollar.

This is where the dilemma of the US economy lies. The dollar is a national currency, but also a global currency. If it remains the world's reserve currency, it will generate sustained foreign demand and with it structural debt. However, if it were to lose this role, the United States would lose a key source of financial and geopolitical power. The US debt is therefore not just an economic problem, but a symptom of a system that works precisely because the world has so far taken it for granted.

The approach to this problem does not divide the United States according to economic schools of thought, but according to political courage. Democrats have come to terms with the fact that the global role of the dollar allows the debt to be ignored. The Biden administration has let the system run its course, quietly assuming that collapse is a long way off and that the world cannot afford to question US debt. Debt has thus ceased to be a problem to be solved and has become a variable that can be postponed indefinitely.

Donald Trump, on the other hand, tried to disrupt this comfort. Not because he had a well-thought-out solution to the debt, but because he understood its political essence. Trade wars, pressure to weaken the dollar, and open questioning of US commitments were attempts to reduce the costs of the global currency before the bill got out of hand. The result is the same for now: the debt continues to grow. The difference lies elsewhere. While the Democrats are betting that the problem will explode outside their term of office, Trump is trying to provoke it before it becomes unmanageable.

Where is the dominance of the dollar headed?

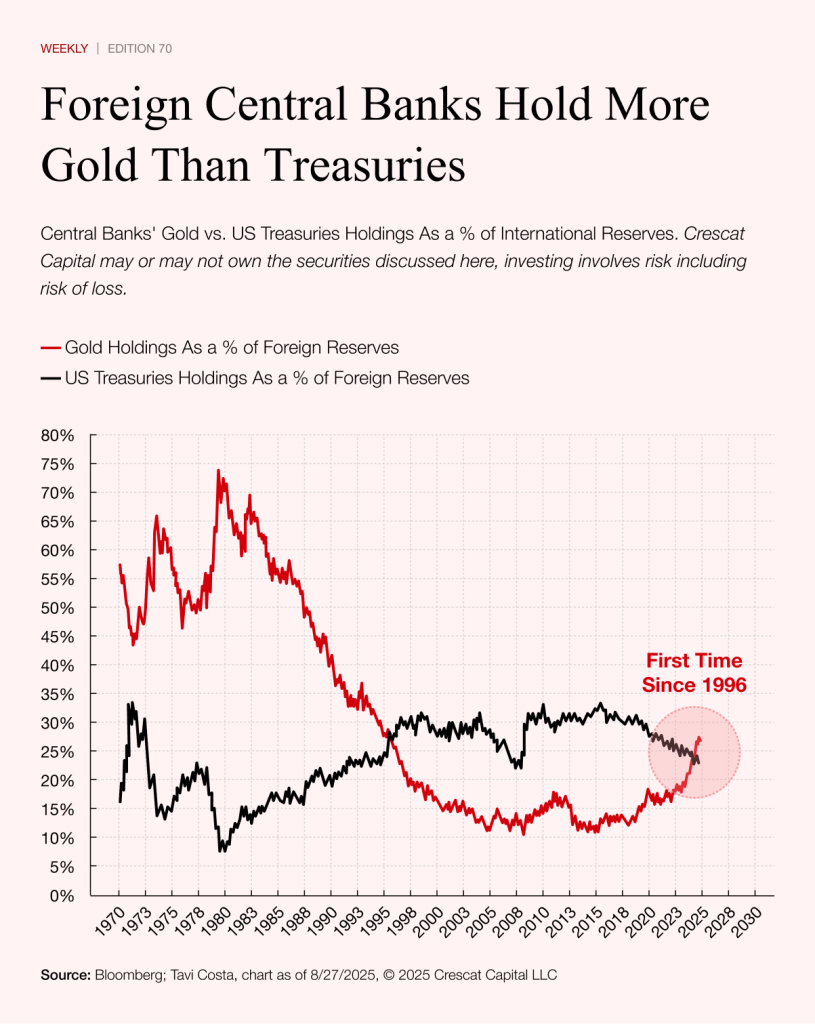

So what is the current situation on the currency battlefield? The first year of Trump's term ended with foreign central banks now officially holding more gold than US government bonds. This situation has not occurred since 1996.

This development is the result of several events. The first is, of course, that the US dollar has become a political weapon. After the freezing of Russian dollar assets, it is a reminder to many governments that relying on US dollar reserves may one day prove to be a big mistake.

The second reason, and a logical consequence, is that more and more countries are choosing currencies other than the dollar for international trade. The position of the US currency in international trade is also not helped by US tariffs, which dampen foreign trade and thus demand for dollars.

The third reason, which relativizes the development of central banks' foreign exchange reserves, is the sharp rise in the price of gold. This automatically increases its weight in portfolios without central banks having to actively sell dollar assets.

In addition, gold has a long-term negative correlation with the US dollar, and a weaker dollar pushes its price up. At first glance, it might seem that the dollar is losing strength. This is true in the short term, but in the long term it may herald its return to full strength.

The problem runs deeper. Trump's strategy for tackling US debt and reviving domestic industry is based on a weaker dollar. Holding the US currency at this point means consciously accepting its devaluation. This is where the fate of the dollar as a global currency will be decided.

If central banks accept this strategy and maintain the dollar, the United States will gain time. However, if they conclude that the costs of a weak dollar are too high, a quiet but systemic retreat will begin.

And that is a scenario Donald Trump cannot afford. A massive shift away from the dollar would not only weaken the US currency, but would undermine the very logic of his economic strategy. De-dollarization would thus go from being a side effect of global changes to a direct political challenge for the White House. In that case, it would no longer be enough for Trump to communicate via social media. The American response would have to be tough and based on pressure, force, and the open enforcement of its own interests against anyone who tried to leave the system.