At the end of last week and over the weekend, there was much speculation that market uncertainty stemmed from Kevin Warsh's nomination as Fed governor. Yes, it was surprising, but so far we know practically nothing about what monetary policy he will actually pursue.

The first meeting under his leadership is not scheduled until June. That is an unimaginably long time for today's markets. All possible opinions on what monetary policy Kevin Warsh will pursue are pure speculation, because we do not know the essentials.

We do not know how the future governor will behave when Trump pressures him to cut rates, even though macroeconomic data will not provide sufficient reason for such a move. Warsh's personality will only be tested by real experience. It therefore makes no sense to blame everything that happens on the markets on Warsh. He is just one piece of the puzzle.

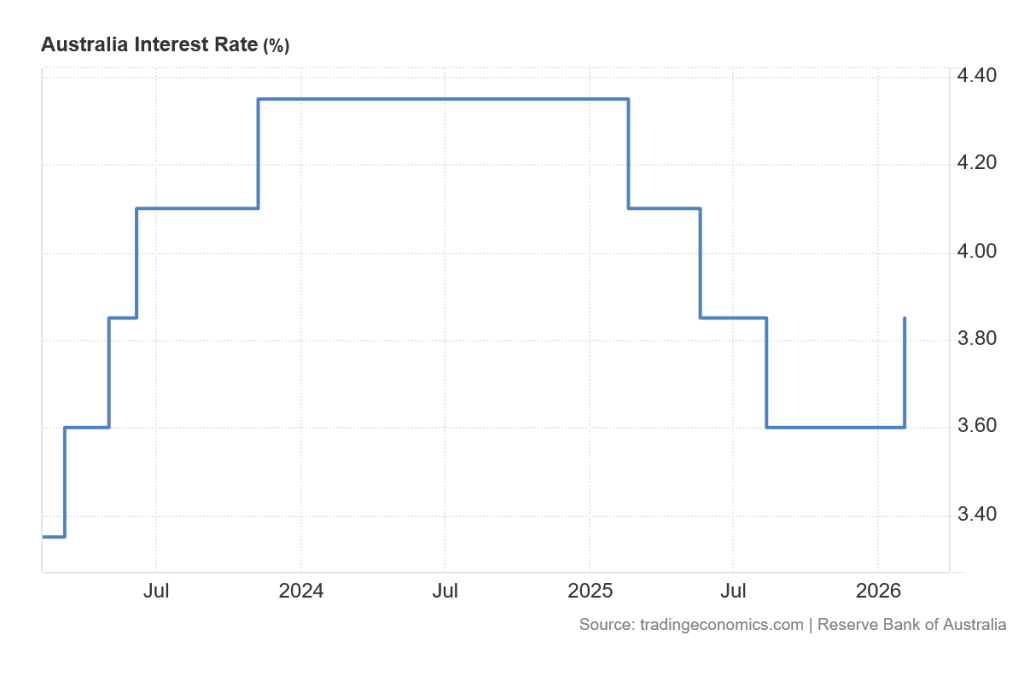

Unexpected rate cut in Australia

Let's stay with monetary policy for a moment. We are witnessing an unexpected phenomenon, which some investors have been speculating about for a long time, namely a rate cut by the Australian central bank.

For practically the entire last year and a half, markets have been growing thanks to hopes that the Fed would cut rates. As it is the most important central bank, the attitudes of other central banks around the world are derived from its stance.

We are now in a cycle of rate cuts that was supposed to send rates very low. Today, we know that zero rates hurt the economy and fuel another wave of inflation, but Trump's current vision for rates is around one percentage point.

However, the Australian central bank raised rates by 25 basis points to 3.85 percent. The reason was persistently high inflation, which reached 3.8 percent in December 2025. The dogma that rates must fall in 2026 was broken in the second month of this year.

A roller coaster ride

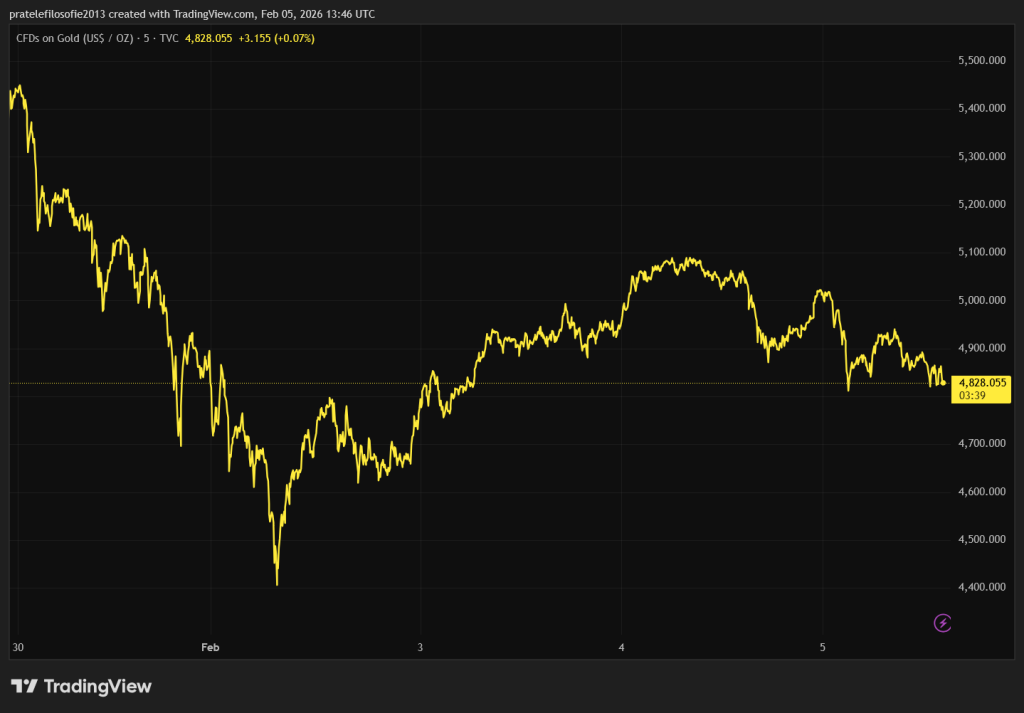

Monetary policy is closely related to both gold and bitcoin. Gold is an insurance policy against poor monetary policy by central banks, especially the US Fed. Bitcoin, on the other hand, is a financial asset that responds positively to loose monetary policy.

However, anyone who wants to draw conclusions about monetary policy or the macroeconomic outlook based on the performance of these assets will learn absolutely nothing. The behavior of gold and silver now resembles meme stocks. Gold is not a safe haven today, but rather a place where the biggest storm is taking place. Volatility is extreme, and no one knows exactly why.

Silver is following gold in this regard, but with one significant difference. Such high volatility in silver will have an unpleasant impact on the real economy. Silver remains an industrial metal, and extreme fluctuations will complicate production planning.

A slowdown in production would translate into an economic slowdown. And that is the last thing we need in the current situation. All this is happening without any obvious news or change in the fundamental trend. The markets are driven by pure emotion.

This trend is even more visible with cryptocurrencies. The price of bitcoin broke through the important psychological level of $70,000. The last time bitcoin could be bought at this price was in November 2024.

The decline is even more pronounced for the popular cryptocurrency Solana. It is trading below $90, at levels last seen in January 2024. As with gold, there is no particular reason that would surprise the markets, except that the developments of recent days confirm that Bitcoin and cryptocurrencies have entered a bearish phase.

This is nothing new for long-term investors. Moreover, data show that most bitcoins are now being sold primarily by speculators, i.e., those who held them for a short period of time. Whales remain calm for now. There is no other possible explanation, which is very general but at the same time explains everything. Behind the events on the financial markets is primarily fear. It is a purely emotional movement that cannot be stopped by rational arguments.

Unexpected developments in the field of artificial intelligence

This fear and general panic are slowly but surely spilling over into the stock market. The South Korean Kospi index serves as proof of this. At the beginning of the week, it fell by five percent due to doubts about the entire artificial intelligence sector and, in addition, concerns about a lack of operating memory for new data centers.

After this brutal one-day slump, the South Korean stock exchange opened the next day on the same, this time positive, wave, and the index jumped five percent. Paradoxically, for the same reason.

This time, however, the prices of memory chip manufacturers soared, pulling the entire semiconductor sector with them. Don't look for logic behind this.

Similarly, economic results and reports do not have a uniform direction that would allow for a clear interpretation of the situation. The markets were pleased with Palantir's excellent results. Profits are growing and management remains very optimistic. After all, artificial intelligence is the future.

However, the effect of this positive news was offset by another. Oracle, currently considered the weakest link in the chain of companies involved in the artificial intelligence phenomenon due to its debts, borrowed another $50 billion. This is not a sign of healthy growth.

Finally, let's add that artificial intelligence continues to redraw the economic map of the world and, later, the stock market. Anthropic has introduced its Cowork assistant, which focuses on understanding, searching, and editing legal texts.

While the assistant cannot replace a lawyer, it significantly increases their productivity. This tool is a disaster for companies developing software for law firms. LegalZoom.com paid for this news with a drop of one-fifth. However, it is not just services for lawyers that are at risk. All possible software services are at risk. Incidentally, the same fear is pushing down the shares of Adobe and Duolingo.

Artificial intelligence is no longer just an engine of growth, with companies simply talking about AI implementation at press conferences. The artificial intelligence revolution has entered a phase where it is beginning to claim its first victims, surprisingly in the field of software companies, where few expected it.

The crunch time in artificial intelligence is further increasing tension in markets that are currently dominated more by emotions than by cold assessment of reality. However, the best protection against these emotions is to resist them and stick to your own investment plan.