Neither the US nor other markets have a clear direction. One day they are euphoric, the next they are depressed. Their behavior is schizophrenic. In such a situation, it is not advantageous for investors to focus on daily movements, but rather to try to distance themselves from this confused behavior. So what is the market actually telling us?

High volatility in the technology sector

Recently, we have seen high volatility in the Nasdaq technology index. Investors are no longer convinced that investments in data centers, exceeding $700 billion this year alone, are really worth it.

The construction of such centers is also threatened by a shortage of memory modules, which has two consequences. The prices of memory modules are now rising to dizzying heights, increasing investment costs. At the same time, delays are lengthening.

This could mean that 2027 will also be a year of high investment in data centers. Previously, it was expected that these massive investments would end next year and large companies would finally start to make money.

The only exception that investors have taken kindly to is Meta's stock. The reason is simple. This company already uses artificial intelligence to tailor the content in its feed precisely to the user's profile, allowing it to sell more advertising.

This is the paradox of the whole situation surrounding artificial intelligence. Investors most appreciate the old business model, in which artificial intelligence is not used to develop and surpass human capabilities, but to make people spend more time watching low-information content.

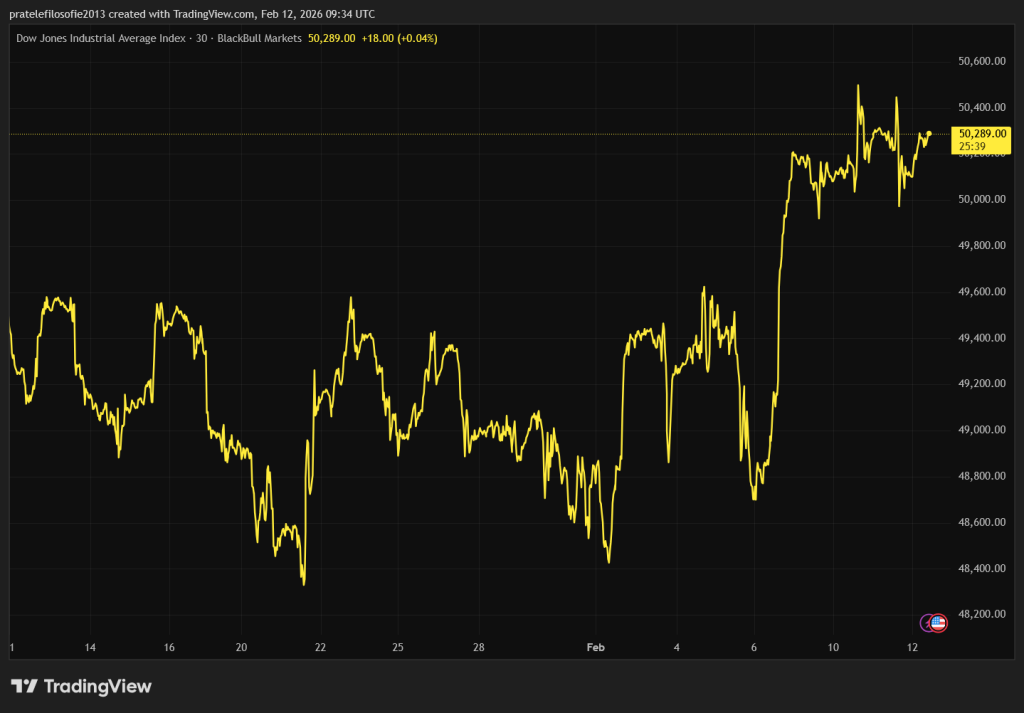

It is precisely these doubts that are causing the technology index to stagnate and tread water. However, we must not overlook the fact that the Dow Jones index is growing. It is composed of large companies with a defensive character. Investors are thus moving away from risky assets and seeking certainty.

When defensive stocks start to rise, it is most likely a sign of the end of a strong bullish trend. If this movement continues in the coming weeks, it will mean that investors have become very cautious. This thesis is also confirmed by the fall in the price of bitcoin. In addition to confirming the entry into a bearish cycle, this can also be interpreted as a loss of appetite for risk.

Surprising figures from the US labor market

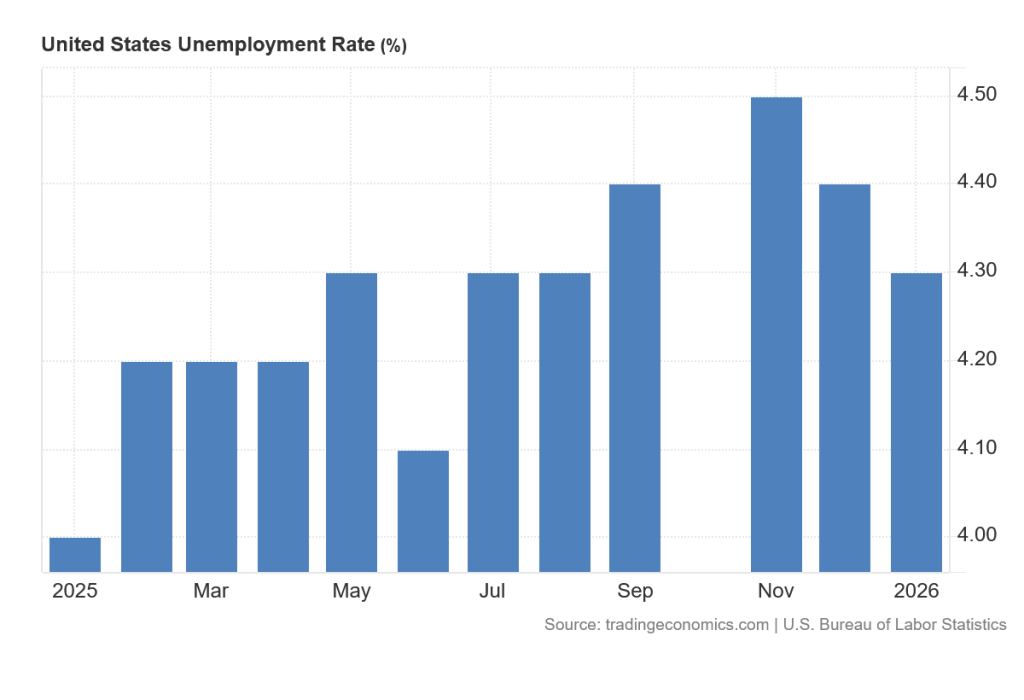

The release of unemployment data was postponed by a week due to the shutdown. The result surprised everyone. Unemployment in the US fell from 4.4 to 4.3 percent in January 2026. The worst-case scenarios of a massive influx of artificial intelligence into the labor market have not yet been confirmed.

On the contrary, it appears that, in addition to GDP growth, the unemployment rate will also create a further difference between the US and Europe. The latest figures show that unemployment in Europe is beginning to rise uncomfortably. In France, it rose from 7.7 to 7.9 percent in the last quarter of 2025. In the Czech Republic, unemployment exceeded 5 percent in January, reaching 5.1 percent. The last time it was this high was nine years ago. The question remains whether this is just a seasonal fluctuation or a change in trend.

Donald Trump once again did not forget to boast about how successfully he is fighting unemployment. However, the market has recently been operating on the logic that good economic news is bad for stocks because it means that the US central bank does not have to cut rates.

Inflation is still above the 2% target, so markets were hoping for higher unemployment figures that would allow the Fed to cut rates. Now those are falling too.

From a purely macroeconomic point of view, there is no reason to cut rates. Trump, however, sees it completely differently. The US economy is booming and, according to him, it deserves to pay the lowest interest on its debt, i.e., to have low rates.

Kevin Warsh's mission at the helm of the Fed will be very interesting. If he remains, as he himself claims, primarily dependent on data, he faces a very difficult situation.

Two different stories from the automotive industry

In recent days, the stock market has offered us two completely different stories. One of the largest car manufacturers, Stellantis, announced a write-off of more than €22 billion in its latest results.

The write-down is mainly related to investments in the production of electric cars. This direction has proven to be a dead end and, moreover, very expensive. Management now promises that 2026 will see a return of customer preference to the entire process.

This confirms one of the basic theses of electric car critics, namely that customer demand is not high enough. Perhaps it would be, but electric cars are very expensive, and therefore customers are not interested in them.

Stellantis customers want affordable, reliable, and durable cars above all else. However, Stellantis' change of direction will take a long time. One year is definitely not enough. In any case, the company suspended dividend payments and ended 2025 with a loss. The carmaker's shares even fell by another 24 percent in a single day.

Like most of the automotive industry, luxury car manufacturer Ferrari is under pressure. However, the main reason is concern about the impact of US tariffs and their possible further increase in the future.

The second reason for the weakening of the carmaker's shares in 2026 is the decision to launch an electric car under this brand. We will see if Ferrari succeeds in a field that is currently experiencing a crisis.

Moreover, wealthy customers bought Ferraris primarily for the roaring sound of the combustion engine. This is missing in electric cars. The electric car will be called the Ferrari Luce. The interior was designed by the creative studio LoveFrom, founded by former Apple chief designer Jony Ive. The interior will certainly be outstanding, but the question remains whether the Ferrari Luce will also be a commercial success.

In any case, Ferrari's figures confirm the stability of the business. The company reported adjusted earnings of €2.14 per share for the fourth quarter, with year-on-year revenue growth of 4 percent to €1.8 billion. These results easily exceeded analysts' estimates. For this year, Ferrari expects revenues of €7.5 billion and an adjusted operating margin of over 29.5 percent.

The luxury car market is thus showing surprising stability in turbulent times. Perhaps in the era of artificial intelligence and technological upheaval, it will become apparent that there are segments, such as true luxury and strong brands, that no revolution, whether electric or digital, will affect as easily as the mass market.