The general illegibility of the markets continues. They resemble chaotic movement in which it is impossible to find a single direction. It is not that the situation is crazy, but that the indicators used to measure it are dysfunctional. One such reliable indicator of investment sentiment was the price of gold.

However, if we look at its last five days of movement, we see that it has fluctuated by as much as 4.29 percent. This is less than at the end of January, when gold volatility reached 20 percent.

So where is the problem? Has gold calmed down? We must answer this question in the negative, because the movement of this commodity occurred without any news. On the contrary, it seems that the fundamental environment has remained unchanged.

And that is precisely the point. Markets today are not responding to new information, but to their own uncertainty. The price of gold is not moving because investors have received a new impulse, but because they are looking for a reference point in an environment where traditional relationships between inflation, interest rates, and risk are failing.

Gold is no longer just a safe haven, but is becoming a litmus test of confidence in the system itself. So when we see sharp movements without any apparent cause, it is not a sign of calm, but rather an absence of an anchor. The market is not calm. The market is disoriented.

And a disoriented market is much more vulnerable than a market that reacts to bad news. Because where there is no narrative, volatility takes over.

The American puzzle: growth without inflation?

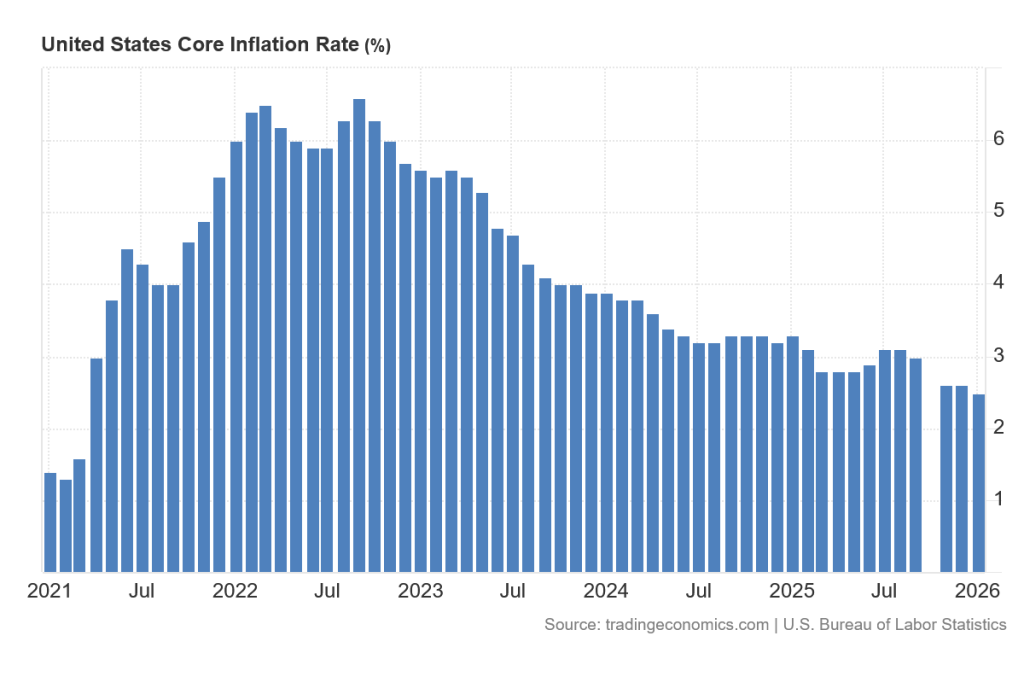

The absence of a narrative was confirmed by US inflation data for January 2026, which we learned about at the end of the week. Headline inflation fell to 2.4 percent in January. The 2 percent inflation target is within reach. Core inflation, excluding food and energy, fell to 2.5 percent, the lowest level since April 2021, when inflation problems caused by the economic slowdown during Covid began.

Finally, inflation in the United States has also taken a turn for the better. It would seem that the markets can breathe a sigh of relief, but the opposite was true.

The first hesitation arises in the question of what will actually happen next. At first glance, it seems unbelievable. Jerome Powell managed to land softly, even though US President Donald Trump threw a spanner in the works by introducing tariffs.

These did not cause any economic disaster. However, not long ago, Nobel Prize winners Paul Krugman and Joseph Stiglitz warned that Trump's tariffs would lead to an inflationary spiral and economic disruption; the reality so far looks much less apocalyptic.

Those who followed their predictions may now regret it. The fact that nothing of the sort has actually happened only increases tension in the markets, as it becomes increasingly clear that no one knows anything.

The second complication is the overall view of the economic reality in the US. Donald Trump predicts that US GDP will grow by 15 percent. However, he did not specify the time frame, whether this year or by the end of his term in office.

In any case, this means that if the US president is right, the US is in for unprecedented growth. However, GDP growth is usually accompanied by inflationary pressures and a reduction in unemployment. So far, however, we are seeing inflation falling and unemployment falling.

Similarly, the current GDP growth amid high interest rates raises the question of how it is possible for the US economy to grow so much while on a diet. Lowering rates could lead to the US economy overheating.

These questions only lead to the realization that no one knows anything. Except that Powell is unlikely to cut rates before the end of his term. Kevin Warsh will first and foremost have to provide the markets with a new vision of monetary policy. And given the conflicting macroeconomic data mentioned above, that will not be an easy task.

Democratization and the threat of artificial intelligence

However, uncertainty stems not only from macroeconomic and commodity developments, but also from artificial intelligence. For the second week in a row, panic has continued in the markets over software services. Following the AI model offering legal services, it is now the turn of financial services.

The main trigger was the introduction of the new Hazel AI tool from the Altruist technology platform. This tool focuses on automating complex tax planning, optimizing tax losses, and analyzing financial documents, activities for which traditional advisors charge high fees.

Language models will also change the approach to investing in general, especially to the benefit of retail investors.

Of course, the largest financial institutions have had their own AI-like tools for decades to analyze companies' financial results, press conferences, and other reports. Now, however, any investor can process this huge amount of data themselves in literally seconds. And they don't even need to know a word of English.

Investing is thus becoming significantly more democratic. The entire field of financial analysis will change. This does not mean that these companies will disappear tomorrow, but there will be significant pressure on margins and on acquiring and retaining clients. And since markets look primarily to the future, some companies have already been hit by sell-offs.

One example among many: Charles Schwab's stock has fallen by more than seven percent. This company is not a small one; before the price decline, it was among the 100 largest companies in the world by market capitalization. The company is currently valued at over $170 billion.

Artificial intelligence does not only affect small or medium-sized enterprises, but also threatens the large pillars of the global economy. However, its rise has also spread to another sector where we would expect it less. Investors have begun to flock to REITs, or real estate investment trusts, as if office buildings, data centers, and logistics parks were suddenly a thing of the past.

It seems that the market has begun to ask an uncomfortable question: if artificial intelligence increases productivity and changes the way we work, how much less physical space will actually be needed?

It therefore seems that the advent of AI is inevitable. So what is the problem if we accept this investment thesis? The problem today is that, logically, the advent of AI should lead to the victory of the "magnificent seven" companies, led by Nvidia, which were the engine of growth in the previous year.

However, when we look at the market, we see that these "magnificent seven" stocks are currently the worst investment for 2026. Microsoft is clearly in a bearish trend. This is unprecedented in recent years. If Amazon's stock sell-off continues this week, Amazon will also be in a bearish trend.

Traders know very well that the trend is an investor's best friend. Now, for the first time, we are seeing a negative price outlook for these companies.

The long-term bearish trend has been confirmed at Microsoft. The main support is at $350 per share.

Last week, Amazon and Microsoft shares were joined by a 5% decline in Apple shares. The main reason is technical problems in the development of the new generation of Siri with artificial intelligence.

The revolution that was supposed to confirm the unshakeable dominance of the tech giants is turning into a test of their vulnerability, and for the first time in years, the market is suggesting that even the winners of the artificial intelligence era do not have a guaranteed future.